Get a Quote

Get a Quote and Find Services to Fit Your Needs 50000+ Satisfied Clients

5000+ Licenses & Registration

15 Branches across India

75 Years + Combined experience

Satisfied Clients

Services

Years Combined Experience

Get Started!

Process of Company Registration in Germany

Germany is the economic powerhouse of the Jutland peninsula. It is the largest and most powerful nation in the European Union. The German Government has always taken the initiative for SMEs, i.e., Small and Medium Enterprises, to mark up considerable developments in the Deutsch mainland. In Germany, these SMEs are also termed the Mittlestand. The benefits and incentives the German Government offers aid these SME enterprises to function effortlessly in their respective ministries.

Furthermore, the German Government is supportive of providing the required training to all its registered businesses for carrying out varied commercial activities. Germany considers its SMEs to be the backbone of its highly developed nation. They understand the language of Business and its importance in the process of nation-building. Therefore, the Germany Authorities have enabled the Company Registration procedure to be very easy and business-friendly for budding entrepreneurs as well as investors.

If someone is about to start a business in Germany, It is necessary to complying with various legal requirements and Germany Commercial Registry is one of them. This kind of registry plays a vital role in providing transparency and legal certainty for any business.

The Germany Local courts maintain a public register which is the germany commercial register. It is identified as central repository of business related information,such as their legal structure, ownership, financial statements, and other relevant details. The Federal Ministry of Justice and Consumer Protection operates the German commercial registry and ensure the accuracy and integrity of the information and details which contained in commercial register.

Since we have mentioned much about Germany and its corporate environment, let us look at some of the benefits of registering a company in Germany in detail.

Germany offers the most transparent legal procedures of all the western Europe countries when it comes to running businesses. For foreign investors, the process of company registration is quite straightforward in Germany. In addition, the German Government offers a lot of support to business enterprises in terms of incentives and subsidies.

The Deutsh Land offers world-class infrastructural facilities to budding businesses. Businesses run effectively if commercial productions are conducted in a seamless manner. This can be enabled with a well-built and well-supplied infrastructure. The state-of-the-art telecommunications system of Germany enables business enterprises to run themselves effectively in the Deutsch environment. The German Infrastructure also offers high-speed transport facilities, such as railways, cargo, road networks, trams, etc., along with other multitudes of infrastructure facilities.

Germany consistently ranks as one of the least corrupt nations around the globe. As per the Transparency Index Report of 2018, Germany is in the eighth position in the world for the least amount of corruption in official proceedings and government-working.

Germany does not exercise any form of exchange control for foreign investment opportunities. Therefore, any number of foreign organizations can invest in businesses registered in Germany.

Before you start with the company registration procedure, you must know the eligible business structures that can be incorporated with the Corporate Authority of Germany.

It is crucial for you to choose the type of business structure appropriate for company registration in Germany. Therefore, we have detailed the eligibility for every recognized business structure in Germany.

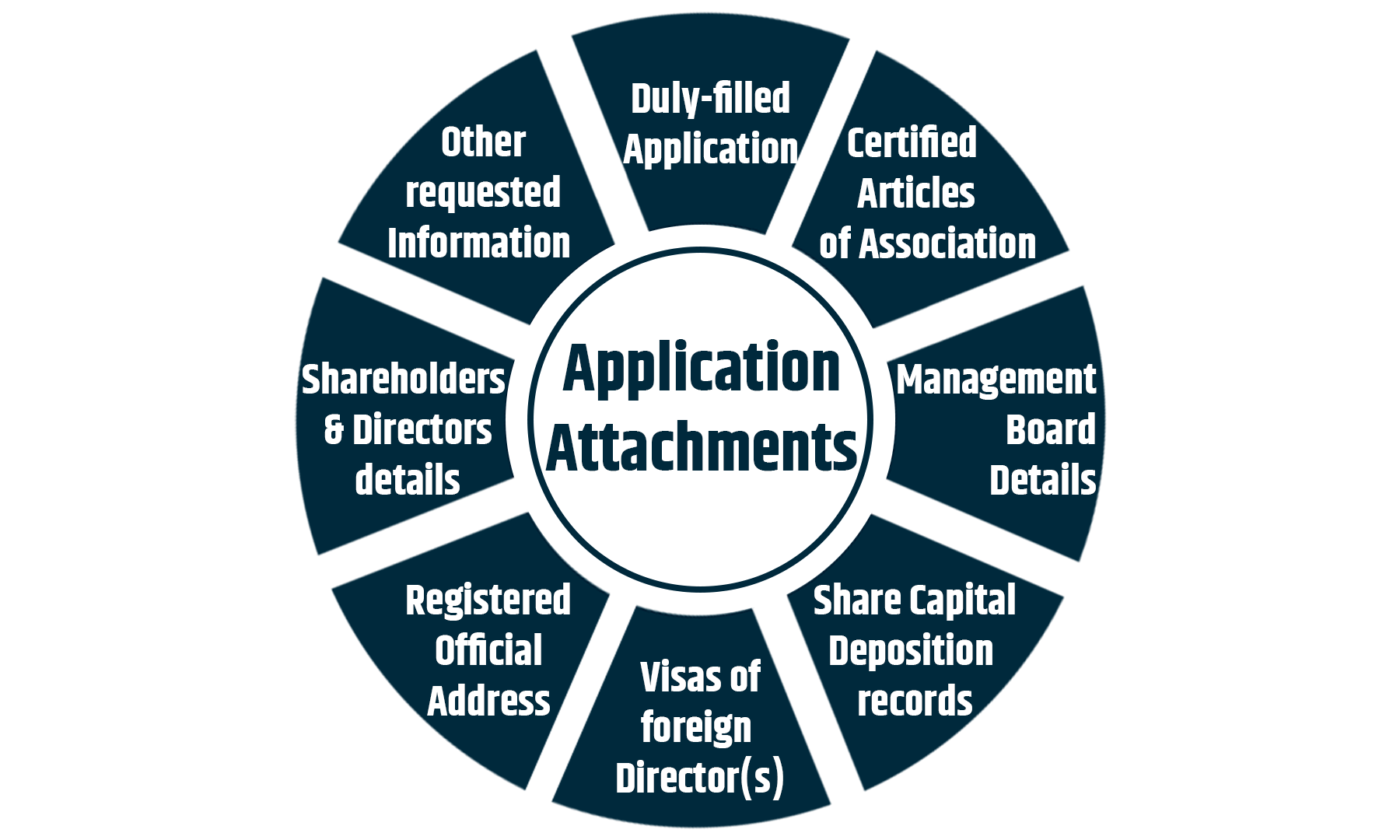

Every company incorporation aspirant must draft and compile the following documents that must be submitted along with the company registration application:

Document 1 : Duly-filled application for Company Registration

Document 2 : Certified or notarized Articles of Association of the proposed Company

Document 3 : Details of the management board structure of the Company

Document 4 : Certificate proofing the share capital deposition records

Document 5 : Visas of Director(s) in case he or she is a foreign resident

Document 6 : Registered Official Address of the proposed Company

Document 7 : Complete details of the Shareholders as well as Directors of the Company

Document 8 : Any other information as requested by the Authority

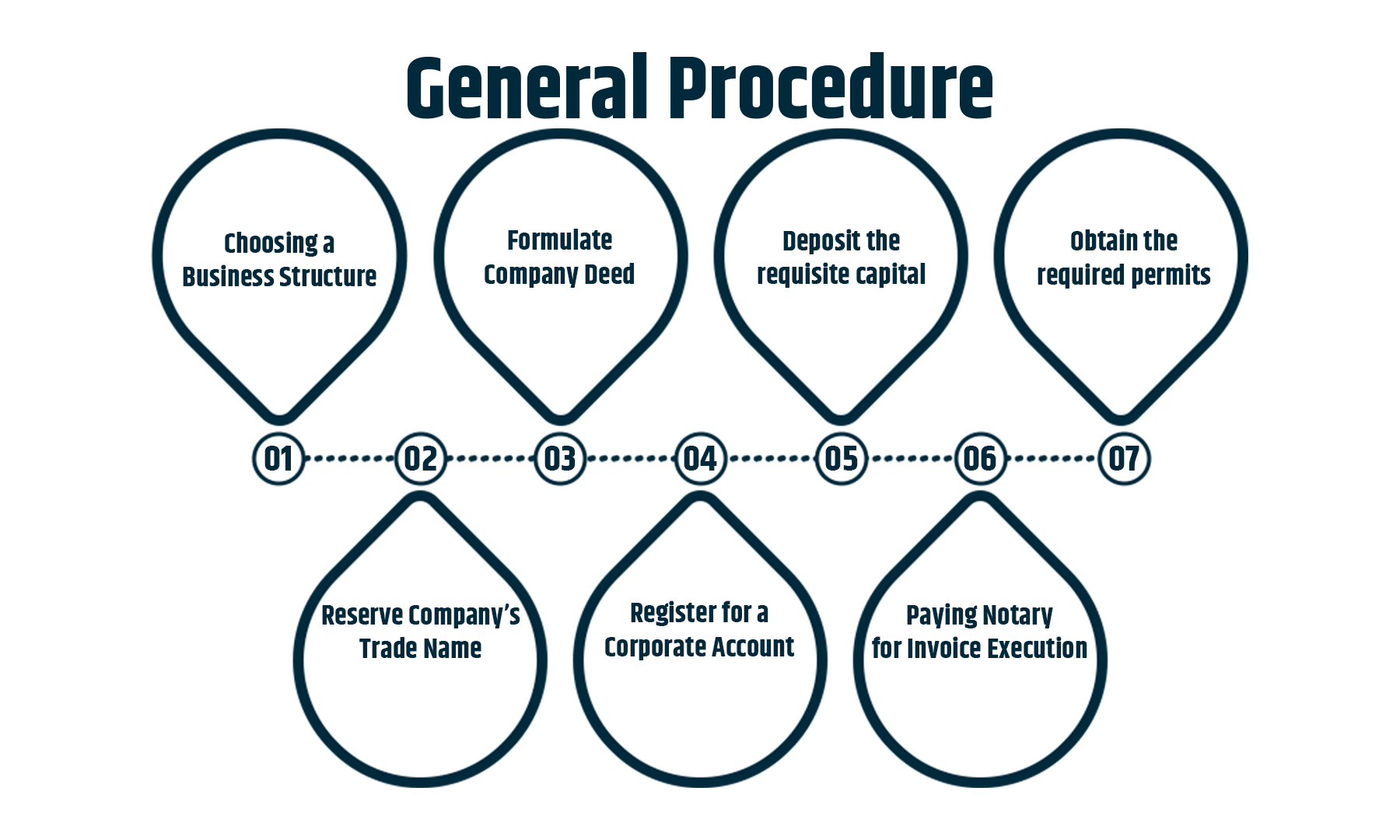

Every company incorporation applicant must conform to the following procedure to register its Business with the German Authority:

Let us look at steps in detail one by one.

As we have described the different business structures available in Germany, the applicant must choose the appropriate business structure to register with the Germany Corporate Authority. The most common business structure adopted by foreign investors is LLC or Limited Liability Company. But such a business requires a minimum of EUR 25,000 as its share capital requirement. Therefore, the applicant can accordingly adopt other business structures requiring lesser capital in Germany. Also, the applicant must choose a business structure as per the nature of the business activities it intends to undertake.

Further, the applicant must formulate the Deed of the company formation. The Deed or agreement must be drafted as well as executed before a Notary. The Company founders must provide the following to the Authorities with their specimen signatures:

After opening the bank account, the applicant must deposit a certain amount of capital for the process of company formation. In this regard, the applicant can put the Stammkapital number for reference. Once the deposition takes place, the company registration applicant must also ensure that the deposit receipt is sent to the Notary to make it official.

The applicant must, As per the type of commercial activity undertaken, must arrange for or apply for specific licenses or permit from the German Authorities. Without the requisite permits, the Business cannot operate entirely in the German market.

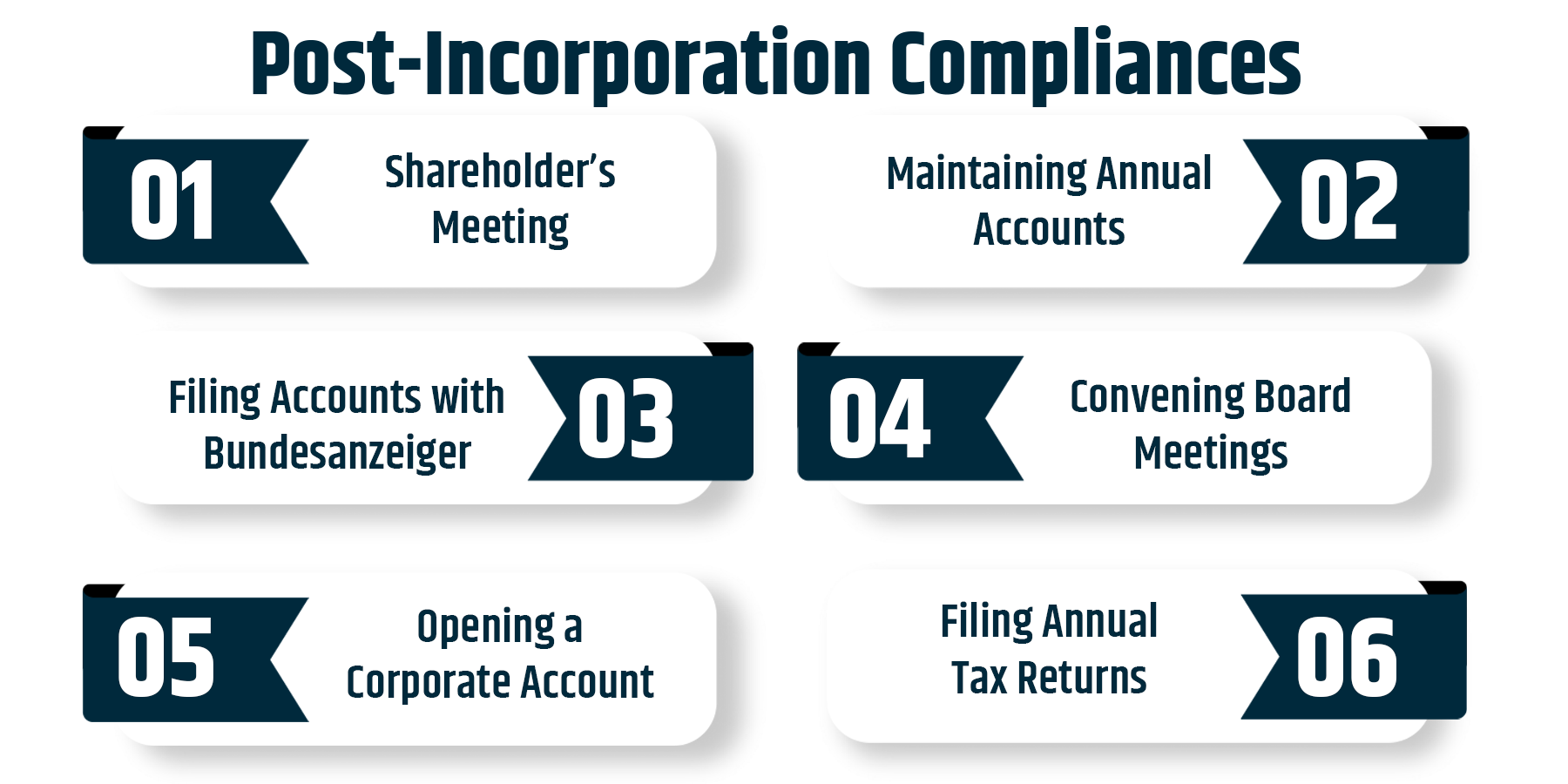

Setting up a business does not finish with its incorporation within the Commercial Register in Germany. Every newly registered Company in Germany must conform to the stipulated compliances as per the directions of the German Authority.

Heed the following compliances that must be conformed to after the due procedure of company registration in Germany.

The annual board meetings with the Company directors and shareholders must be held as per the Articles of Association of the Company.

Every registered business entity in Germany must undertake the task of opening a bank account in Germany after its registration with the Authority. Germany boasts of one of the best international banking facilities in the world.

Our Incorporation experts provide you end to end company incorporation services in Germany by assisting you in the following manner:

We ensure that your company incorporation services requirements for Germany are always on time. Our professionals understand the intricacies of company incorporation procedures in Germany. Thus, we have expedited the process – helping you incorporate your Company at an affordable price.

So, reach out to our Incorporation Experts and realize your dream of starting your own Company in Germany.

Q.1 What is the meaning of GmbH?

In German language, the GmbH is an abbreviation for “Gesellschaft mit beschränkter Haftung.” Its meaning is “company with limited liability.”

Q.2 What is HRB number in germany?

The HRB is for an incorporated company (Kapitalgesellschaft) and corporations are listed under HRB and other companies such as partnerships.

Q.3 Can I change the business structure after registration?

Yes, you can change the structure of your business after registration through a legal form. By changing a company's legal format, the legal identity of your company will not change. Previous shareholders will remain the same and also no shares or assets will be transferred from the company to another one.

Q.4 Do I need a physical office in Germany to register my company?

Yes, a local registered office address is required to register a company in Germany. While submitting the application, the owner must have an actual office address where the company is operated.

★ ★ ★ ★ ★

I very much appreciate the fact that you guys possess tremendous knowhow of private limited company incorporation. You have exhibited professional and respectful manner towards my query and I would seriously recommend you guys to all the folks looking for outstanding business services.

★ ★ ★ ★ ★

Thanks to their support, I got my trademark successfully. I highly recommend their services for anyone needing help with their intellectual property. The person assigned to me was very cooperative and helpful.

★ ★ ★ ★ ★

Thanks to their support ragistrationwala team, I got my IP-1 license successfully and special thanks to Miss.Kanishka for your great and timing support !!!!!! I have archived my goal one step forward... Thanks for the entire team....

★ ★ ★ ★ ★

Really helped a lot in getting my both VNO licenses. Great experience working with the team and very humble team, thanks for providing the vno license on time.

★ ★ ★ ★ ★

I had a good time working with Registrationwala. Good team. I would recommend their services to others.

★ ★ ★ ★ ★

It was extremely great service of Registrationwala consulting firm, and this firm is providing the best services and worry about the client's required services along the client's satisfaction.

★ ★ ★ ★ ★

Superb Experince! Within no time the trademark registration was on.Highly professional team. I am very much Impressed with the prompt response and efficiency.Thank you.

★ ★ ★ ★ ★

We had taken ISP license from registration wala and the supporting person is very helpful to taken that license his communication and his work is satisfactory and thanks for those services

★ ★ ★ ★ ★

I sincerely appreciate your prompt support in helping me get the access license so quickly. Your professionalism and efficiency are truly commendable. Thank you for going above and beyond to assist me. Keep up the great work!