Get a Quote

Get a Quote and Find Services to Fit Your Needs 50000+ Satisfied Clients

5000+ Licenses & Registration

15 Branches across India

75 Years + Combined experience

An insurance broker is a person or a business entity who implements their knowledge of insurance to act as an intermediary between customers and insurance companies. Consult with our experts for insurance broker license.

Satisfied Clients

Services

Years Combined Experience

Get Started!

Insurance Broker License process

The Insurance Broker license is an authorized license issued by the Insurance Regulatory and Development Authority of India (IRDAI). IRDAI has formulated laws for any entity looking to become an insurance broker in India. An applicant entity becomes bound by those rules once it obtains the broker license for insurance solicitation and procurement.

As per the Insurance Regulatory and Development Authority of India (Insurance Brokers) Regulations, 2018, an insurance broker is referred to as a business entity that implements their knowledge about the insurance industry to act as an intermediary between those who are seeking insurance policies and those who are selling it.

Insurance acts as a safety net, providing protection from major financial setbacks. When you regularly pay a small amount known as a premium to an insurance company, they promise to support you financially if something unexpected happens — such as a car accident, a medical emergency, or damage to your home.

People choose to buy insurance because life is unpredictable and not all surprises are pleasant. One of the main reasons is peace of mind. It feels reassuring to know you're covered if things go wrong. Insurance also offers financial protection, helping you handle high expenses like hospital bills, vehicle repairs, or property damage without facing a financial crisis. In many places, certain types of insurance, such as car insurance, are legally required. Moreover, life insurance plays a crucial role in supporting your loved ones financially if you're no longer there to take care of them.

The insurance industry is expanding rapidly, especially in countries like India. A major reason for this growth is increased awareness, as more people are paying attention to financial planning. The rise of digital technology has also played a key role, making it easier than ever to purchase insurance through websites and mobile apps. Government initiatives, like universal health coverage, are further encouraging people to invest in insurance. Additionally, the changing world has brought about new needs — from cyber insurance to travel coverage — reflecting how people now seek protection across various areas of life.

However, to become an insurance broker, one must obtain an Insurance Broker license.

To become a licensed insurance broker, you need to know about the types of insurance brokers that are present. Categorically, one can split them into three types to select insurance broker specialization.

♦ Direct insurance brokers act as intermediaries between reinsurers and customers after obtaining an insurance broker license.

♦ They assist clients in risk management, claim consultancy, insurance coverage, and remuneration or fees.

♦ They provide insurance advisory services due to their detailed and updated market knowledge.

♦ Brokers help clients obtain e-insurance policies and claims.

♦ They gather complete information about the client’s business and share it with the insurer.

♦ They assist clients in choosing the best policy and explaining different quotations.

♦ They help clients open their e-payment accounts and complete e-insurance policies.

♦ Direct brokers work on behalf of clients to provide insurance services.

Life Insurance Brokers are the most sought after among the brokers in India. They provide insurance and risk management services to clients that are seeking life insurance policies in India.

General life insurance broker license is issued to a property insurance broker. Licenses for auto insurance and health insurance are issued in this regard.

This insurance broker certificate is issued to those that engage with both life and general insurance policies.

♦ Reinsurance brokers act as intermediaries between reinsurers and insurers.

♦ They maintain a database of the reinsurance market.

♦ They advise insurance companies about international and reinsurance markets.

♦ They communicate the records of insurance companies to the reinsurance company.

♦ Their services include risk management, negotiating on behalf of reinsurers, and collecting and remitting premiums.

♦ They employ qualified brokers to solicit insurance policies.

♦ They select reinsurance companies to enhance the market capacity of insurers.

♦ They assist insurers with claim settlements.

♦ They comply with the laws and regulations of the regions.

♦ Composite Brokers are a combination of direct and reinsurance brokers.

♦ They provide direct insurance and reinsurance services in India.

♦ Offer advice to clients on the right insurance cover and policy terms and conditions.

♦ Provide services such as insurance consultancy and risk management.

♦ Maintain proper records for clients.

♦ Negotiate claims on behalf of clients.

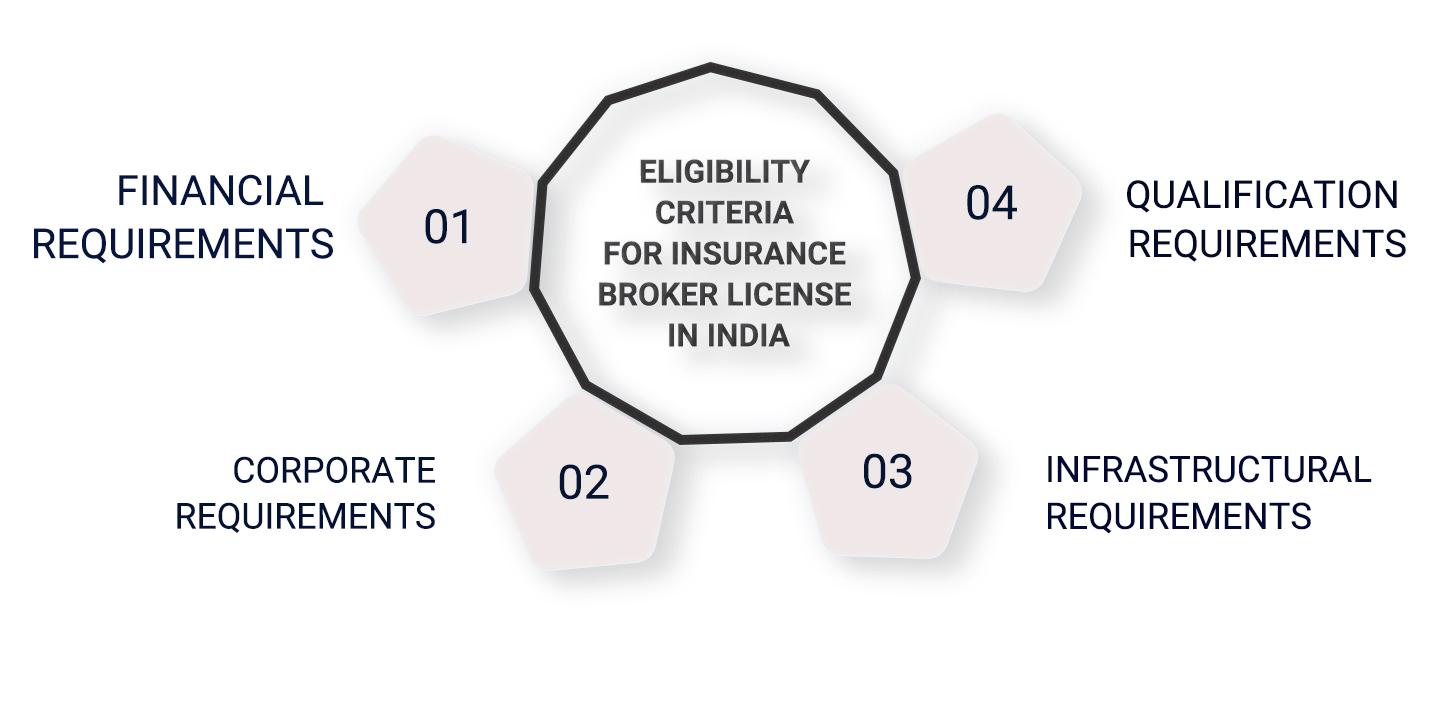

Here are the key registration requirements to consider before applying for an insurance broker license.

Following is the paid-up capital contribution required for each type of insurance broker:

| Broker Type | Minimum Requirement |

| Direct Brokers | ₹75 Lakh |

| Re-Insurance Brokers | ₹4 Crores |

| Composite Brokers | ₹5 Crores |

When the applicant is applying for an insurance broker license online, at the time he must adhere to the following net worth requirements:

Following are the deposit requirement criteria, which comes to the surface when the applicant has to submit an amount to the scheduled bank for the insurance broker license:

Once you meet the insurance broker license requirements, you can move ahead with the procedure to acquire the license.

In addition to these requirements, the licensees must be capable of adhering to the different codes of conduct formulated for Insurance brokers by the Insurance Regulatory and Development Authority of India.

Required documents for Insurance Broker Certificate Registration listed below.

Below is complete step by step process to get insurance broker license in India.

Before applying for an insurance broker license, it is essential to meet the qualifications mandated by the Insurance Regulatory and Development Authority of India (IRDAI).

The next step in obtaining an insurance broker license involves filing the application through FORM B. This form is the official document used to apply for the license.

Along with FORM B, a set of supporting documents (mentioned above) must be submitted.

Once the initial application and documents are submitted, IRDAI will review the submission and may issue an intimation to the applicant. This could involve requests for additional information, clarifications, or compliance

The final step in the process involves the payment of the prescribed fee for the insurance broker license. This fee varies depending on the type of broker license and the duration for which it is sought.

The Insurance Regulatory and Development Authority of India (IRDAI) carefully reviews your application and all supporting documents. They thoroughly assess whether you meet the financial and technical criteria required to be an insurance broker. Only if everything checks out, will they issue the insurance broker certificate.

Once approved, the IRDAI grants you a commercial insurance broker license.

It's important to note that you won’t receive a separate license for each type of insurance you want to deal with. For example, there isn't a specific "car insurance broker license." Instead, you'll get a general insurance broker license that allows you to offer various types of insurance, including car insurance.

After receiving your license, it's crucial to follow all the rules, regulations, and codes of conduct set by the IRDAI to maintain your status as a licensed insurance broker.

Following are the rules associated with the IRDA broking license

If you want to start your journey as an insurance broker, connecting with insurance broker license consultants at Registrationwala can be helpful. Our consultants will make the entire Insurance Broker Registration process smooth and easy for you.

◻️ We’ll provide you with our end-to-end assistance and professional guidance throughout the entire process.

◻️ We’ll make sure you meet the eligibility requirements and ensure that your application is filled completely and without any errors.

◻️ In fact, we will fill out the application on your behalf.

◻️ Once the application has been filed with IRDAI, we will actively coordinate with the authority to learn about the application progress.

◻️ Simply put, we will guide you through each and every step of getting an Insurance Broker Certificate in India.

Q1. Who licenses the insurance broker?

An Insurance broker is licensed by the Insurance Regulatory and Development Authority of India.

Q2. How do I become an insurance broker?

To become an insurance broker, you need to:

Q3. How can I become a Health insurance broker?

To become an health insurance broker, you must obtain the Direct Insurance broker license in India.

Q4. What are the different Insurance brokerage license requirements?

Q5. What is a principal officer in an Insurance broker company?

The Principal officer of an Insurance broker company is the personnel that understand all the regulatory, technical and market aspects of the insurance broker business.

Q6. Who can become an Insurance broker?

Following entities have the permission of the IRDA to become an Insurance brokers:

Q7. What is the IRDA license renewal fees?

The government of IRDA license renewal is as follows:

It is, in many cases, same as the IRDA license fees.

Q.8 What are the conditions of Insurance broker license renewal?

Modified Date: 24-May-2025

★ ★ ★ ★ ★

I very much appreciate the fact that you guys possess tremendous knowhow of private limited company incorporation. You have exhibited professional and respectful manner towards my query and I would seriously recommend you guys to all the folks looking for outstanding business services.

★ ★ ★ ★ ★

Thanks to their support, I got my trademark successfully. I highly recommend their services for anyone needing help with their intellectual property. The person assigned to me was very cooperative and helpful.

★ ★ ★ ★ ★

Thanks to their support ragistrationwala team, I got my IP-1 license successfully and special thanks to Miss.Kanishka for your great and timing support !!!!!! I have archived my goal one step forward... Thanks for the entire team....

★ ★ ★ ★ ★

Really helped a lot in getting my both VNO licenses. Great experience working with the team and very humble team, thanks for providing the vno license on time.

★ ★ ★ ★ ★

I had a good time working with Registrationwala. Good team. I would recommend their services to others.

★ ★ ★ ★ ★

It was extremely great service of Registrationwala consulting firm, and this firm is providing the best services and worry about the client's required services along the client's satisfaction.

★ ★ ★ ★ ★

Superb Experince! Within no time the trademark registration was on.Highly professional team. I am very much Impressed with the prompt response and efficiency.Thank you.

★ ★ ★ ★ ★

We had taken ISP license from registration wala and the supporting person is very helpful to taken that license his communication and his work is satisfactory and thanks for those services

★ ★ ★ ★ ★

I sincerely appreciate your prompt support in helping me get the access license so quickly. Your professionalism and efficiency are truly commendable. Thank you for going above and beyond to assist me. Keep up the great work!