Get a Quote

Get a Quote and Find Services to Fit Your Needs 50000+ Satisfied Clients

5000+ Licenses & Registration

15 Branches across India

75 Years + Combined experience

Satisfied Clients

Services

Years Combined Experience

Get Started!

Startup Registration process

A company in its initial days is known as a Startup. By starting a company in India, you take your first step in the business world. After setting up a company, it comes under the category of startup for 10 years. To get the recognition, you must complete the online startup registration.

The Government of India has been offering assistance for making startup businesses grow through Startup India Scheme. This scheme has many benefits such as tax exemption, patent rebate, government funding, etc. and to avail these benefits, the startup needs to register under the Department of Industrial Policy and Promotion (DPIIT). The startup businesses must fulfill the eligibility requirements to obtain the certificate of a startup business.

A startup is a company that is in the early stages of development and creates some new creative ideas and products. In the starting, the startup is comprised of one or two entrepreneurs. Most small businesses tend to stay small but the startups aim to grow fast and make a place in the market.

These startups are based on a new idea and are created from the perspective of making the businesses more developed. So, the government helps them because of their innovative ideas. The government of India started a strong eco-system for nurturing innovation and startups in the country. It is for driving sustainable economic growth and generating large-scale employment opportunities that aim to empower startups to grow through innovation and design.

The objective of startup recognition is to reduce the regulatory burden on startups, and to allow them to focus on their core business, keep the compliance costs low and provide benefits.

When you start a company that is just a budding venture, it is called a Startup. When you start a company in India, you take your first steps towards the business world. A Startup doesn't have access to a lot of finance. However, it has all the necessary ingredients of a recipe that can create a successful business:

And based on these three factors, it can grow. However, the government has noted the potential of such budding companies. Therefore, you can now register a Startup in India under the many schemes of the government.

Registering your Startup in India makes your business receptive to the many benefits of Startup business registration. Some of them include the following points.

Unlike the business registration process in India, where the road is long, and the roadblocks are many, the Startup registration process is simple. It doesn't involve many steps; all you need to do is take your innovative approach towards your business and take the reins of the procedure. So, this intuitive registration of Startup in India makes it optimal for your business to get much-needed Assistance when you are just starting up.

Once you register a Startup company in India, certain IPR registration fees like patent and trademark registration are reduced. Conventionally, that means a reduction of the price of intellectual property registration services like copyright, design, patent or trademark registration by half. It will help you not only start your business but also protect your business identity after you are done registering a company in India.

Government funds are readily available for a company registered as a Startup. It is because, in the eyes of the government, every Startup incorporated is one with innovative business and customer solutions standing at the forefront. Thus, the government of India has no issues putting money behind such registrations in India.

After a Startup is registered for the first three years, they are exempted from paying any income taxes. It is beneficial for those entrepreneurs choosing registration in India to gain some support from the government when their business is just starting. This form of incorporation of a company is especially beneficial for those who are yet to find confidence in these business entities.

As the registration of a Startup in India helps an entrepreneur with several positive aspects, including fewer taxes and easy exit, venture capitalists aren't apprehensive about investing in a startup – especially if the business idea is innovative.

As the registration of a Startup in India helps an entrepreneur with several positive aspects, including fewer taxes and easy exit, venture capitalists aren't apprehensive about investing in a startup – especially if the business idea is innovative.

There are many other advantages once you obtain the Startup certificate registration. But to know about them, you first have to find out whether you are eligible for registration for a Startup in India.

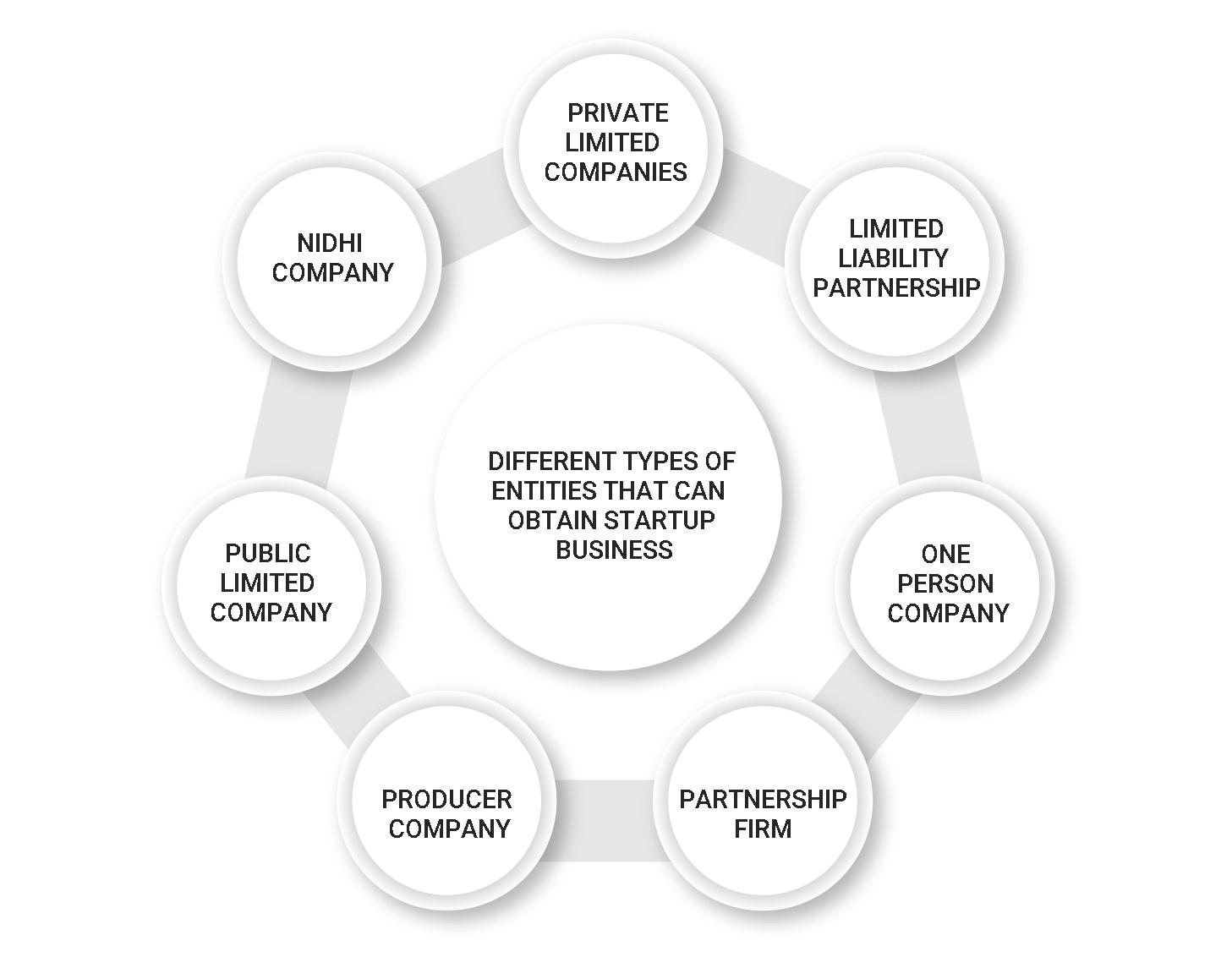

The government of India has not put any boundaries on which type of entities can register as a startup:

Startup India registration for a proprietorship is impossible because the entity is not registered under government regulation. Thus, if you have a sole proprietorship firm that you want to incorporate as a Startup, contact us to convert it into a one-person company.

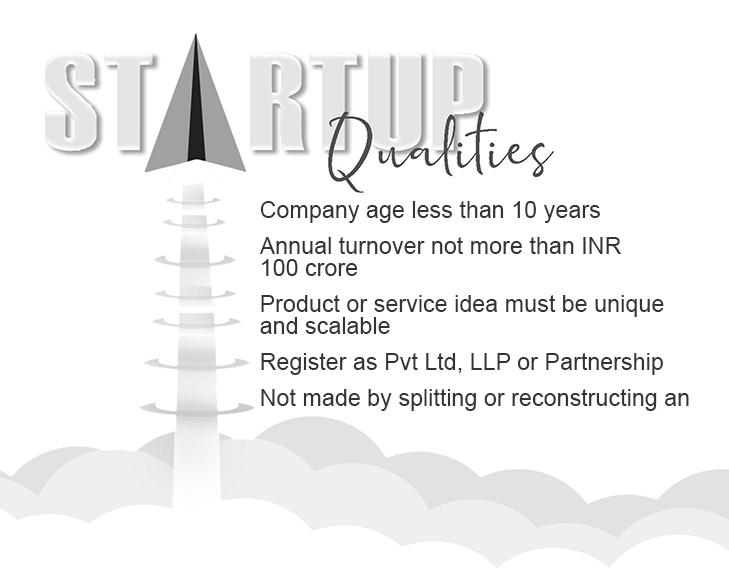

Below is the eligibility criteria that a business must fulfil to register as a startup in India.

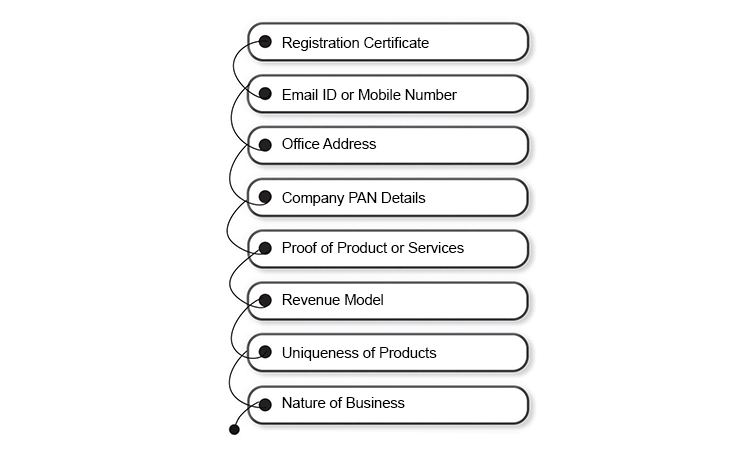

Documents required for Startup Registration in India

The following are the documents required for Startup India registration:

These documents will put you on track with the company Startup process.

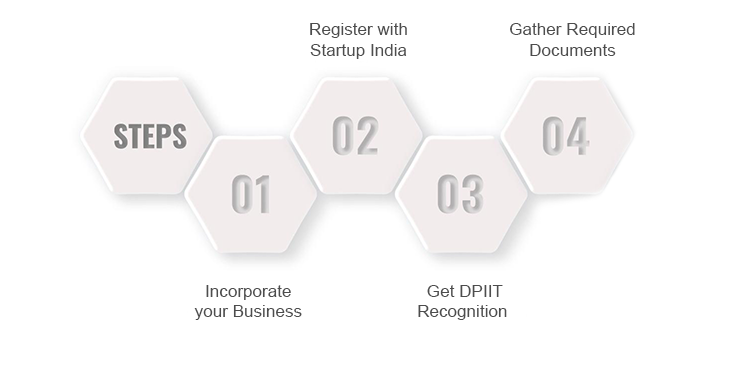

The procedure for startup registration process in India is as follows:

1. Incorporate your Business: To be recognized as a Startup, your business needs a structure. Therefore, first, you must incorporate your business as a Private Limited Company, Partnership Firm, or LLP. In the process, you can consult the experts as it is different from startup company registration. You can establish a company or LLP by applying to the authority (Registrar of Companies) and the Partnership Firm (Registrar of Firms).

2. Register with Startup India: The business must register as a startup, the process is simple and completely online. For registration, the startup must apply with documents and other necessary details.

3. Get DPIIT Recognition: The DPIIT recognition is important to get benefits such as self-certification, IPR application, tax exemption under 80IAC, and easy-winding up of company and public procurement norms.

4. Gather Required Documents: You need to submit all the above-stated documents with the application for new startup registration. Documents must be in the right format so that they will easily be submitted. After applying for the recognition, you will get the certificate of recognition online.

We at Registrationwala provide end-to-end solutions to establish your Startup business in India. Our services include:

If you want to be a part of the Startup India scheme, reach out to Registrationwala for startup India registration services. We will assist you with the entire process of online business registration for startup and make it cost-effective.

Q1. How long does it take to get recognition from DPIIT?

A. The certificate of recognition will be issued within 2 working days once the application is successfully submitted with the required documents.

Q2. What is the validity of DPIIT recognition?

A. The validity of the recognition is for 10 years from the Date of Incorporation.

Q3. Is there a fee for DPIIT recognition?

A. Ministry of Commerce and Industry does not charge any fee for the DPIIT Certificate of Recognition for Startups.

Q4. Can a foreign company register under the Startup India scheme?

A. Any entity that has at least one registered office in India can register the business under the Startup India scheme. The scheme is created for only Indian states but soon the government will enable international registration.

Q5. Can a One-Person Company (OPC) avail of the benefits of the Startup India initiative?

A. Yes, an OPC is eligible to avail of the benefits of the Startup India Initiative.

Q6. How to download the certificate of startup registration?

A. If your startup gets recognised then you will be able to download a system-generated verifiable certification of recognition.

★ ★ ★ ★ ★

I very much appreciate the fact that you guys possess tremendous knowhow of private limited company incorporation. You have exhibited professional and respectful manner towards my query and I would seriously recommend you guys to all the folks looking for outstanding business services.

★ ★ ★ ★ ★

Thanks to their support, I got my trademark successfully. I highly recommend their services for anyone needing help with their intellectual property. The person assigned to me was very cooperative and helpful.

★ ★ ★ ★ ★

Thanks to their support ragistrationwala team, I got my IP-1 license successfully and special thanks to Miss.Kanishka for your great and timing support !!!!!! I have archived my goal one step forward... Thanks for the entire team....

★ ★ ★ ★ ★

Really helped a lot in getting my both VNO licenses. Great experience working with the team and very humble team, thanks for providing the vno license on time.

★ ★ ★ ★ ★

I had a good time working with Registrationwala. Good team. I would recommend their services to others.

★ ★ ★ ★ ★

It was extremely great service of Registrationwala consulting firm, and this firm is providing the best services and worry about the client's required services along the client's satisfaction.

★ ★ ★ ★ ★

Superb Experince! Within no time the trademark registration was on.Highly professional team. I am very much Impressed with the prompt response and efficiency.Thank you.

★ ★ ★ ★ ★

We had taken ISP license from registration wala and the supporting person is very helpful to taken that license his communication and his work is satisfactory and thanks for those services

★ ★ ★ ★ ★

I sincerely appreciate your prompt support in helping me get the access license so quickly. Your professionalism and efficiency are truly commendable. Thank you for going above and beyond to assist me. Keep up the great work!