Get a Quote

Get a Quote and Find Services to Fit Your Needs 50000+ Satisfied Clients

5000+ Licenses & Registration

15 Branches across India

75 Years + Combined experience

Satisfied Clients

Services

Years Combined Experience

Get Started!

FCRA Registration Process

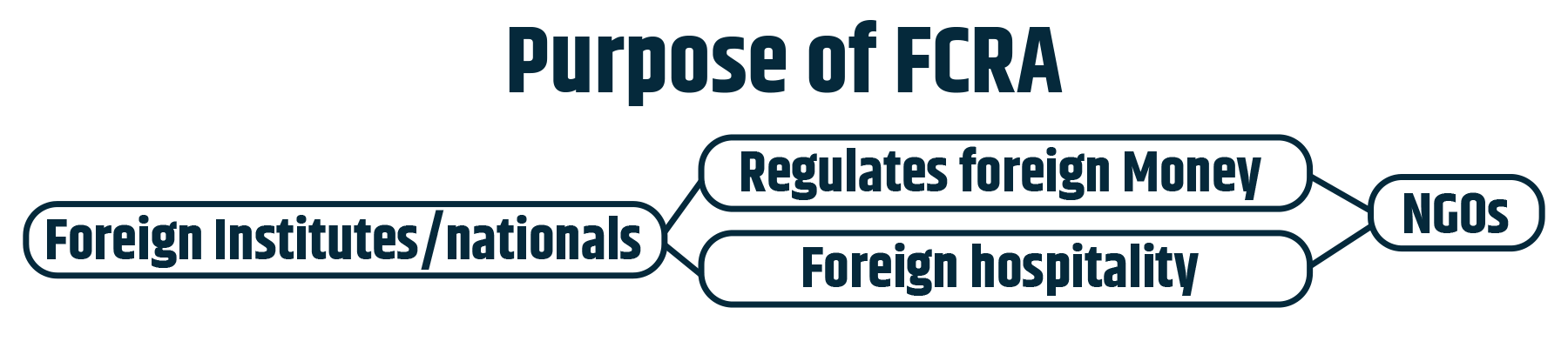

Foreign Contribution Regulation Act, in short, FCRA is the mandatory registration that makes any Trust, NGO or Section 8 Company eligible to get donations from foreign entities. The FCRA registration is done under the FCRA Act 2010. It ensures that foreign donations will be used for social causes. The FCRA registration needs to be done through the FCRA online services portal. By getting the FCRA registration certificate the following things can be done:

These days the world is well-connected and it takes place on a day to day basis between people and country. The inflow and outflow of foreign currency is on a very high level and to regulate this, there is a need for the Foreign Contribution Regulation Act, 2010.

An FCRA Online Services is a web portal of the Ministry of Home Affairs. In this portal, you can apply, track your application and can also verify the validity of the FCRA certificate. There are some other advantages of FCRA online services:

1. Get Permission to Receive Foreign Contributions – The organisations have to receive the permission from Ministry of Home Affairs to receive foreign contributions. This license is required for a person or NGO.

2. Submit Annual Return – Every FCRA-NGO has to submit an Annual Return to the Ministry of Home Affairs (MHA) before 31st December online. It is filled to mention the foreign fund received for the previous financial year. If FCRA-NGO does not receive the foreign contribution then filing a NIL return is mandatory.

3. Check Status of FCRA Application – To check the status of the FCRA application, the applicants have the option to check the status on the portal. You can check whether the application got approved or rejected.

4. File Complaint – Individuals and organisations have a right to file a complaint about the malpractices related to FCRA. Different emails are available to file complaints and there’s a complaint box placed near the MHA reception in Major Dhyan Chand National Stadium (MDCNS), Near India Gate, New Delhi.

The following are the ways in which foreign contribution can be receive:

Direct/Indirect Transfer: Any donation or transfer of any articles, currency or foreign security by any person from a foreign source, directly or indirectly, will be termed as a foreign contribution.

Donations: Even donations in Indian rupee currency received from foreign sources, including foreign nationals of Indian origin, are also considered foreign funds.

Second-hand Contribution: Funds transferred by a recipient of foreign contribution to other organization/s within the country will be considered foreign contributions under the FCRA

Foreign Deposit Interest: Interest earned from deposits from foreign contributions is also foreign contributions.

The FCRA Act has several benefits for Indian society as well as the Nation. Some of the key benefits of the FCRA includes the following:

1. An FCRA regulates the utilization of foreign contributions from individuals, political parties and organizations ensuring the contributions are not used for any illegal purposes.

2. Mandates that organizations receive foreign funds for proper accounts and records maintenance, thereby promoting transparency as well as accountability in the utilization of foreign funds.

3. Many organizations in India receive foreign funds for social as well as charitable work for providing education, healthcare and relief to the poor and needy. The Authority encourages organizations to continue their work within the legal framework for receiving foreign funds.

4. Foreign Contributions can be sought for supporting development projects such as building schools, hospitals and community centers. The FCRA provides a legal framework to receive such contributions to promote development in the Country.

5. The FCRA comes with its own set of legal frameworks for accepting foreign contributions and strengthening bilateral relationships between India and other Nations. In such cases, the FCRA contributes to increasing cooperation and collaboration on various issues of both countries.

The following are the eligibility requirements for getting an online FCRA Online Registration certificate in India:

1. Must be registered under the Section-8 of Companies Act.

2. Trust must be registered under the Indian Trust Act

3. Societies must be registered under the3 Indian Society Registration Act

4. Entity should not be prohibited by the provision of the FCRA

5. Must be operate for 3 years before opting for FCRA registration certificate

6. Foreign contribution should not risk the life or safety of any individual

7. Must have the objective to serve the society by promoting health, education, economic development, promotion of art, sports, etc.

The following documents provided in the given table, must be upload on the portal of FCRA online services to complete the FCRA registration process:

The below mentioned steps are required to complete the FCRA registration process through the portal of FCRA online services:

Note: The FCRA renewal process should be done after 5 years, as per the new FCRA 2010 rules and the FCRA renewal can be done online.

Registrationwala, the FCRA registration consultant, offers India's best FCRA online services. We can assist you in the FCRA registration process by providing you with the following services:

Therefore, get in touch with us if you want the FCRA Registration in minimum time and at minimum FCRA registration fees. You can also check your FCRA online registration status on their official website.

Q1. In which form must we file the application for FCRA registration?

A. Form FC-3

Q2. What are the benefits of NGO FCRA registration?

A. The benefit of FCRA registration is getting legal approval for gaining foreign money and hospitality for the NGO.

Q3. How to check the online FCRA registration status and number?

A. You can visit the official portal of the FCRA to check your application status.

Q4. How to apply for online renewal of FCRA registration?

A. You can apply for renewal only before the FCRA license expiry. The renewal application must be submitted one month before the license expiry.

Q5. What is the validity of the FCRA registration certificate?

A. Five Years

Q6. How to access the FCRA registration checklist?

A. You can visit the official FCRA portal and download the registration checklist. For the documents checklist, you can refer to the documentation section of this page.

Q9. What is an FCRA registration number?

A. It is the certificate number issued to an NGO post its FCRA registration.

Q11. Why is the FCRA registration required?

A. To get funds and donations from a foreign land with legal approval.

★ ★ ★ ★ ★

I very much appreciate the fact that you guys possess tremendous knowhow of private limited company incorporation. You have exhibited professional and respectful manner towards my query and I would seriously recommend you guys to all the folks looking for outstanding business services.

★ ★ ★ ★ ★

Thanks to their support, I got my trademark successfully. I highly recommend their services for anyone needing help with their intellectual property. The person assigned to me was very cooperative and helpful.

★ ★ ★ ★ ★

Thanks to their support ragistrationwala team, I got my IP-1 license successfully and special thanks to Miss.Kanishka for your great and timing support !!!!!! I have archived my goal one step forward... Thanks for the entire team....

★ ★ ★ ★ ★

Really helped a lot in getting my both VNO licenses. Great experience working with the team and very humble team, thanks for providing the vno license on time.

★ ★ ★ ★ ★

I had a good time working with Registrationwala. Good team. I would recommend their services to others.

★ ★ ★ ★ ★

It was extremely great service of Registrationwala consulting firm, and this firm is providing the best services and worry about the client's required services along the client's satisfaction.

★ ★ ★ ★ ★

Superb Experince! Within no time the trademark registration was on.Highly professional team. I am very much Impressed with the prompt response and efficiency.Thank you.

★ ★ ★ ★ ★

We had taken ISP license from registration wala and the supporting person is very helpful to taken that license his communication and his work is satisfactory and thanks for those services

★ ★ ★ ★ ★

I sincerely appreciate your prompt support in helping me get the access license so quickly. Your professionalism and efficiency are truly commendable. Thank you for going above and beyond to assist me. Keep up the great work!