Get a Quote

Get a Quote and Find Services to Fit Your Needs 50000+ Satisfied Clients

5000+ Licenses & Registration

15 Branches across India

75 Years + Combined experience

If you want to promote non-profit goals and create meaningful change in society, starting a Section 8 Company is a great option. Contact Registrationwala for assistance in Section 8 Company Registration and experience the true spirit of altruism.

Satisfied Clients

Services

Years Combined Experience

Get Started!

Section 8 Company Registration

A Section 8 Company means a business entity associated with a Non-Profit organization. Unlike other business entities, the purpose of a company is not to generate profit. But rather, the purpose of this business entity is to promote charitable causes that involve science, culture, education, religion etc.

Basically, the Section 8 company is similar to an NGO Company. The profit earned by the company is used for the above mentioned purpose and not paid as a dividend among members. The business registration of the company is done under the Companies Act, 2013. The benefits of the section 8 company only came into picture when the registration got done.

These are NGOs under the guise of companies whose objectives it is to help as many people as possible. After Section 8 Company incorporation, its structure can feel similar to an NGO, a trust or a Society. The MCA is responsible for the formation of this type of company. Below are some of the popular company examples:

Federation of Indian Chambers of Commerce and Industry, and Confederation of Indian Industries, Give India are some of the names in the section 8 company list that make it worthwhile to acquire the certificate of section 8 registration. The corporations registered under Section 8 of Companies Act 2013 are often destined to assist India to move forward.

There are several functions associated in incorporating a section 8 company and they are as follows.

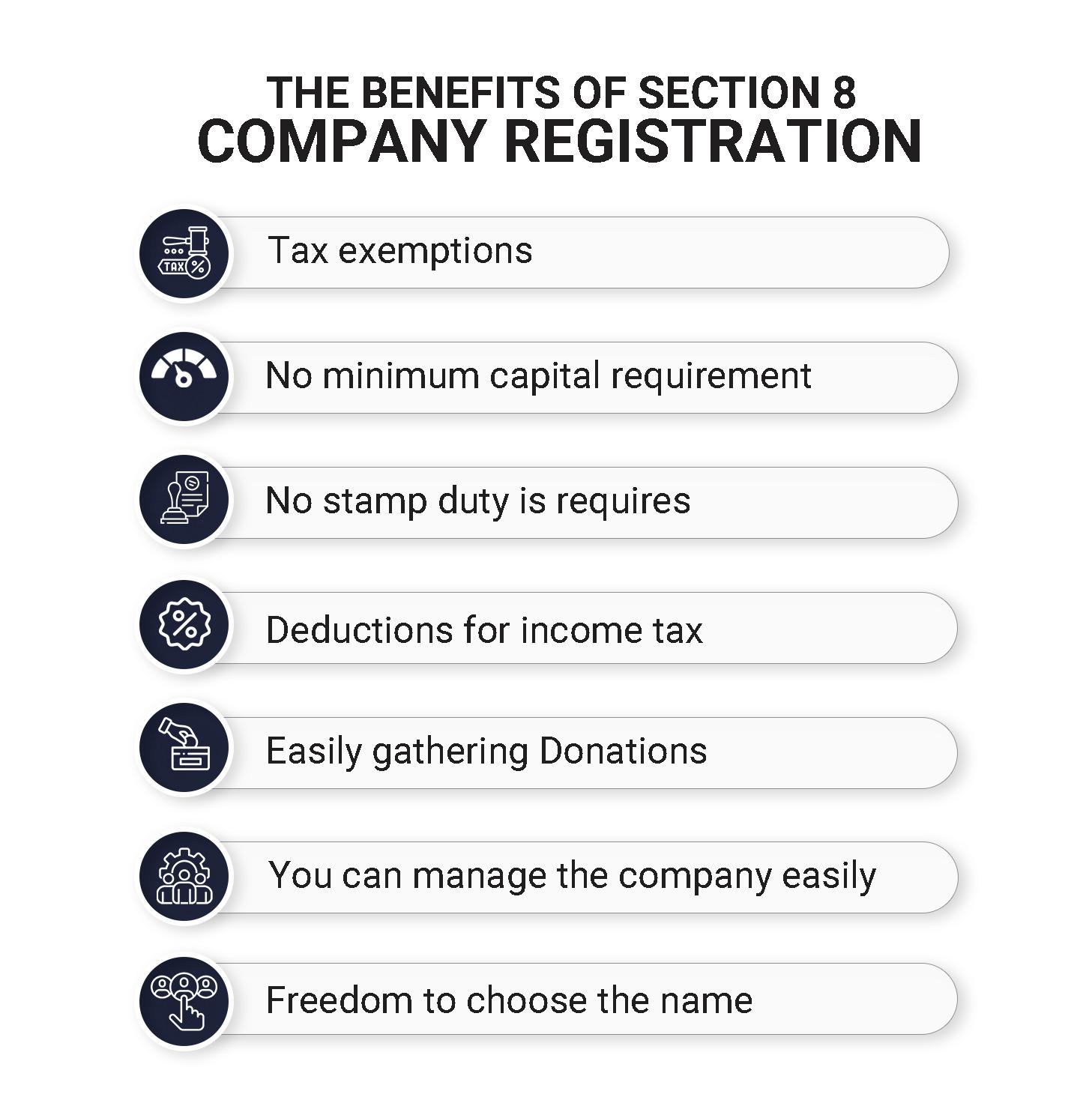

But what do these benefit even mean? Thankfully, our approach to Sec 8 Company registration relies on first making you aware of these perks.

Companies registered under section 8 company are different from the rest. Existing as business entities, their main purpose to promote social welfare – as aspect that has

Thus, let’s now take a deep dive into the these benefits of section 8 company:

The Company Act defines a business entity that is not to generate profits, but goodwill among the public. So, the government of India saw this as a fit to provide several tax exemptions in India. For these companies India has placed fourth specialized income tax deductions. However, to obtain them, you must acquire the 80G and 12A registration for section 8 companies in India.

To incorporate a sec 8 company, there is no limit on minimum capital and the reason behind this is simple. Its altruistic nature motivates the government of India to incentivize its registration by reducing the section 8 company registration fees and the way they do it is by removing any minimum capital requirement.

Since there is no net worth requirement, there is no need for a stamp paper to incorporate a section 8 company in India. It ensures that the directors can register a company without being encumbered by the stamp duty requirements.

Donations are the most viable form of earnings for section 8 companies. This means that the money acquired from donations is the only source of “income” for this business entity. However, that money can’t go into paying the members of the business entity, but to promote the company’s objectives.

This company is governed by the rules specified in the Memorandum of Association. Thus, as long as you follow the objectives you have specified in your MOA to the tee, management won’t be an issue for your company.

The name of section 8 companies in India need not have the words “Company” or “Limited” integrated with it. This business entity entails a term that emphasizes that the company is an organization – using words such as Foundation, Electoral Trust, Chambers, Federation etc.

These advantages of section8 companies can only be enjoyed by those who meet the eligibility criteria.

So, who can form a Section 8 Company in India? The answer is anyone. However, there are some regulatory criteria that you must first take care of. Thus, before you start the incorporation, you must meet the following eligibility criteria:

As soon as you take the mentioned eligibility criteria into account, and fulfill them, you can start gathering the documents for Section 8 Company Registration online.

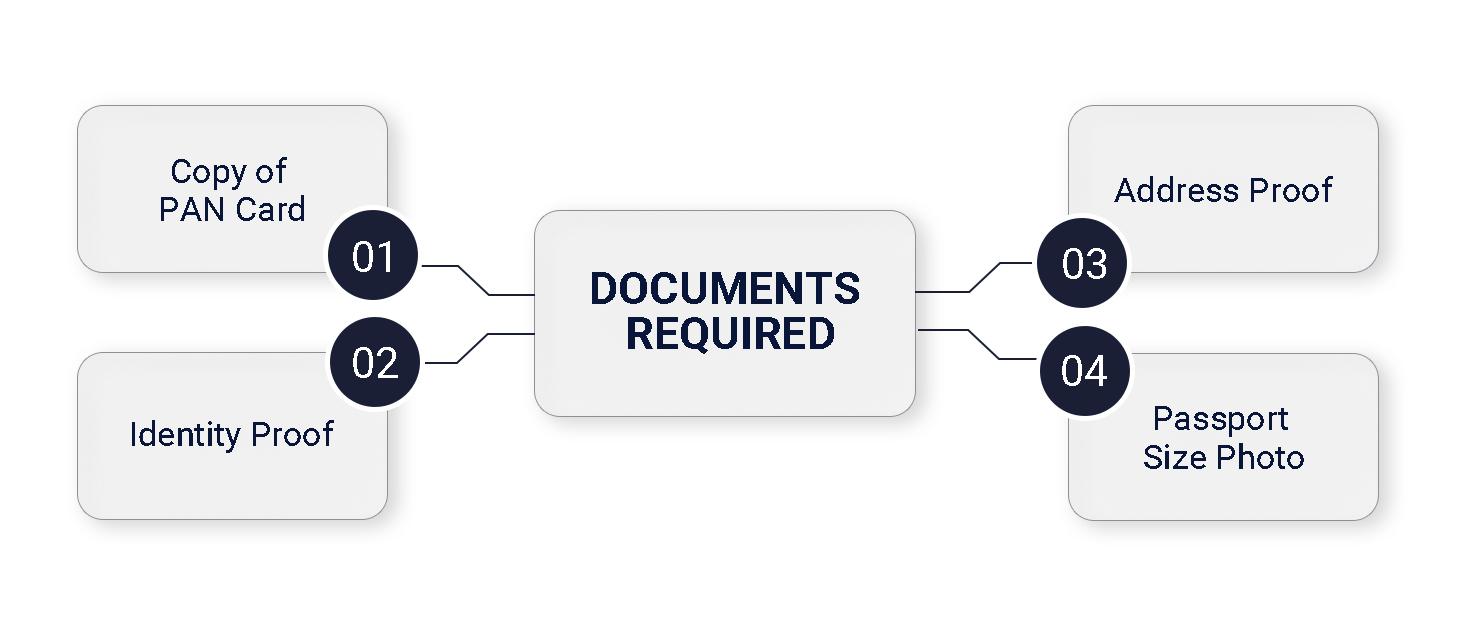

Following are the documents required for company incorporation for each director/ shareholder to proceed with company registration online.

For Directors/Shareholders, the company registration documents are as follows:

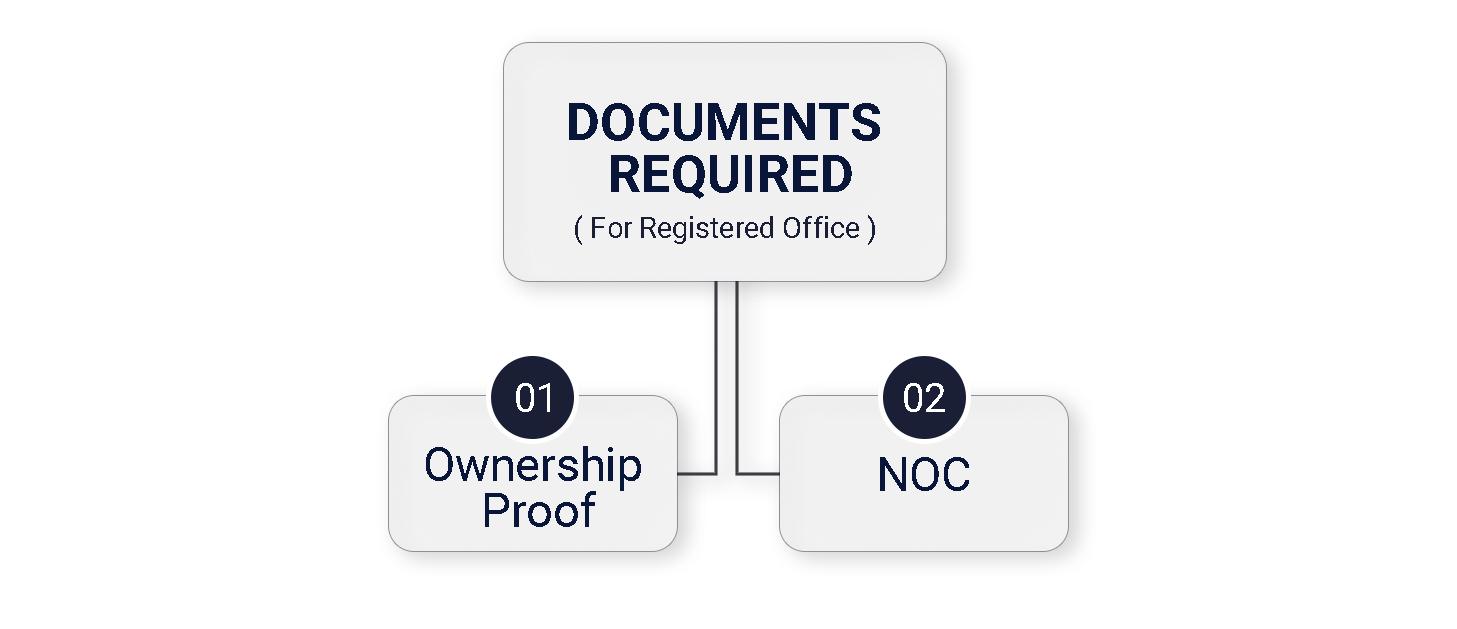

For registered office, the company documents are as follows

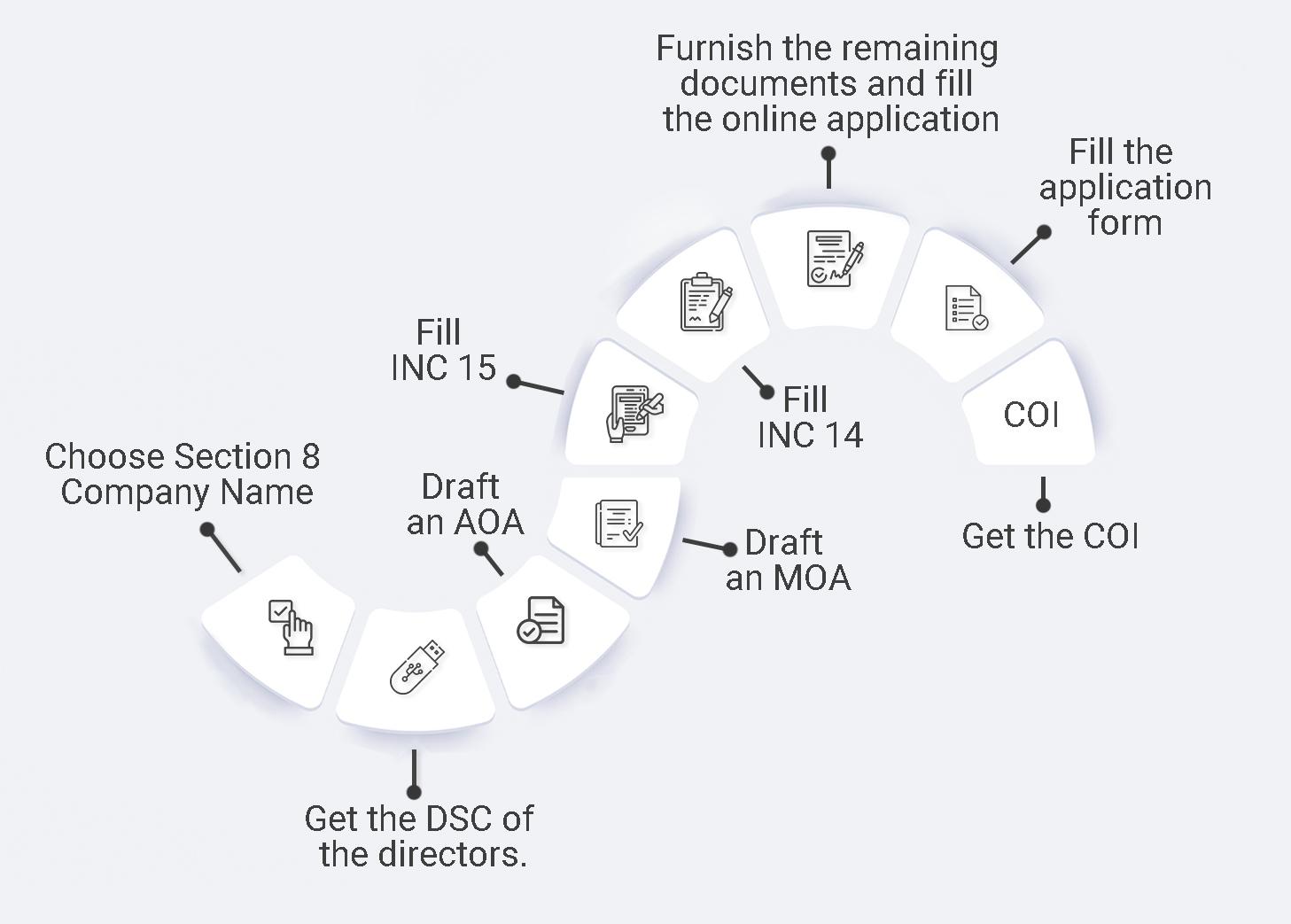

Once you have these documents, below is a process to incorporate a section 8 companies. However, the procedure for incorporation of Section 8 Company under spice involves the following steps, and none of them should be ignored at any time.

First step of the company registration procedure is this - you need to decide a good name for your company. And, the name rules are relaxed when you compare them to other limited business entities.

For instance, you don’t need to use the name “Section” or “8” or “Company” anywhere in your name. But, it is always better to ensure the uniqueness of a name by checking the name availability. To get any help in choosing a name, reach out to Registrationwala. So, make sure that you follow the rules of section 8 company act. However, make sure that you choose the words federations, authority and others as the Section 8 Company Suffix.

The second step is to get the Digital Signature Certificate for your company’s Directors. An important step in the formation of the company, this is the process that will help with the authentication of the documents that you upload online.

MOA refers to Memorandum of Association and it is filed using INC 13 using. It is the document that details the information about the directors, the shareholders and the objectives of the section 8 company. For instance, if your purpose is to educate, the MOA should specify that your goal is to promote education. Also, it should adhere to specific rules and regulations. The document that details those is the Articles of Association.

File a joint declaration via Form INC 15 and in this, you will declare that all the points mentioned in the Section 8 company MOA are according to the provisions set by the MCA. All the directors must file individual declarations via FORM INC 14 for Section 8 Company. They have to individually declare that their roles are clearly defined in Memorandum of Association.

The final step of this process is to obtain the certificate of incorporation. And for that, you need to submit the application for registration online. The portal that facilitates the registration is hosted by the Ministry of Corporate Affairs.

Start filling up the application form for registration online. So, make sure that all the details you provide align with the ones mentioned in the rules. Also, ensure that you have completely assessed the MOA and AOA before entering their details to the application form. MCA section 8 company rules are pretty strict when it comes to the documents. So pay a thorough attention beforehand.

If the Registrar of Companies accepts your registration form, it will get your company licensed under Section 8 of the company registration act. As an NGO under section 8 of the companies, you will get access to many benefits from this point forward.

The company procedure, in the right hands, won’t take more than a week to complete. However, the operative words here are the right hands. Registering a section 8 company in India under Companies Act 2013 isn’t an easy task for everyone. That’s where our NGO registration consultant steps in to help you. We deliver end to end assistance to register section 8 Companies online in India.

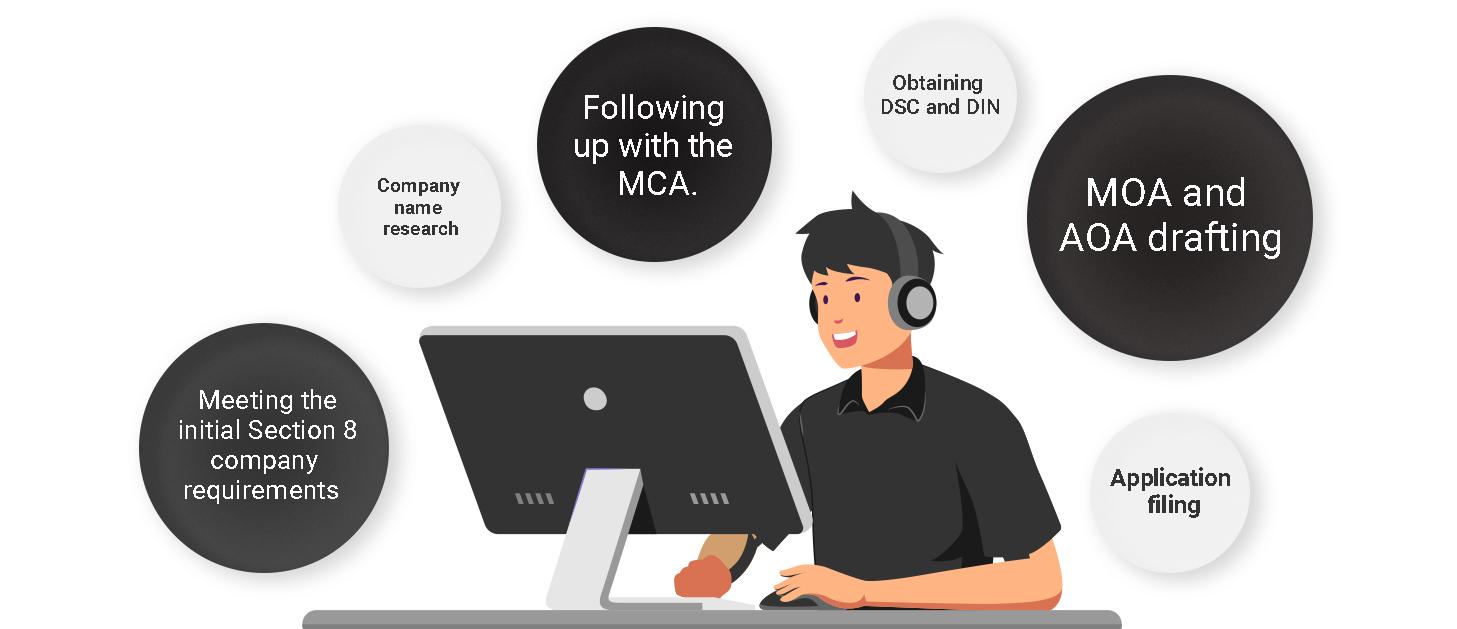

We, at Registrationwala provide end to end solutions for registration in Delhi and the rest of India. It is because we know all about section 8 company registration in India, down to the minute details. That knowledge helps us in providing you the following services:

If you want to help people and work for the betterment of society, you should choose Section 8 company registration. The process of its formation is not easy. However, through Registrationwala, it can be made easy. Our company registration experts make the prospect of incorporation easy for you. Reach out to Registrationwala to begin with section 8 incorporation.

Q1. Can a Section 8 Company be Listed?

A. No, a company cannot be listed since its purpose is to not to generate profit – an aspect a listed company has to adhere to.

Q2. What is the section 8 Company Directors Count?

A. There must be at least two directors in a section 8 company.

Q3. Which is better between society trust and section 8 company?

A. It all depends on your purpose. However, in most instances, a section 8 company is a much better choice.

Q4. Can a Section 8 Company do business?

A. A section 8 company only exists to conduct not for profit activities. Thus, a company can’t do business.

Q5. Can a Section 8 company receive donations?

A. Yes, a Section 8 company can receive donations in India.

Q6. Can a Section 8 company declare a dividend?

A. There is no concept of dividends in a Section 8 Company.

Q7. Can your firm help me with Section 8 Company Financial statements?

A. Yes, our firm can help you with Section 8 Company balance sheet format in excel. Furthermore, we can also help with auditing and other accounting requirements that you might have for your company.

Q8. Can Section 8 Company issue shares?

A. Since there is a restriction in a section 8 company regarding, the issuance of redeemable preference shares is an impossibility.

Q9. How can a Section 8 company file income tax returns?

A. Section 8 Company ITR form to file tax returns is ITR-7. This ITR form must be filled up and submitted to the Income Tax Department on an Annual basis.

Q10. Is Section 8 Company a Private Company?

A. Yes, Section 8 Companies are private limited companies registered under the Section 8 of the Companies Act, 2013.

Q11. Can Section 8 Company Invest in Shares?

A. There are no restrictions on investing in shares for the purpose of profit. However, that profit should still be used to undertake the tasks mentioned in the Section 8 Company MOA.

Q12. What are the Section 8 Company MCA Registration Charges?

A. The cost of obtaining the Section 8 company license depends upon the type of activity you want to partake in through your organization. However, the general cost is around INR 31,999/-.

Q13. What are the compliances required for a Section 8 company?

A. Following is the Section 8 Company Compliance Checklist:

★ ★ ★ ★ ★

I very much appreciate the fact that you guys possess tremendous knowhow of private limited company incorporation. You have exhibited professional and respectful manner towards my query and I would seriously recommend you guys to all the folks looking for outstanding business services.

★ ★ ★ ★ ★

Thanks to their support, I got my trademark successfully. I highly recommend their services for anyone needing help with their intellectual property. The person assigned to me was very cooperative and helpful.

★ ★ ★ ★ ★

Thanks to their support ragistrationwala team, I got my IP-1 license successfully and special thanks to Miss.Kanishka for your great and timing support !!!!!! I have archived my goal one step forward... Thanks for the entire team....

★ ★ ★ ★ ★

Really helped a lot in getting my both VNO licenses. Great experience working with the team and very humble team, thanks for providing the vno license on time.

★ ★ ★ ★ ★

I had a good time working with Registrationwala. Good team. I would recommend their services to others.

★ ★ ★ ★ ★

It was extremely great service of Registrationwala consulting firm, and this firm is providing the best services and worry about the client's required services along the client's satisfaction.

★ ★ ★ ★ ★

Superb Experince! Within no time the trademark registration was on.Highly professional team. I am very much Impressed with the prompt response and efficiency.Thank you.

★ ★ ★ ★ ★

We had taken ISP license from registration wala and the supporting person is very helpful to taken that license his communication and his work is satisfactory and thanks for those services

★ ★ ★ ★ ★

I sincerely appreciate your prompt support in helping me get the access license so quickly. Your professionalism and efficiency are truly commendable. Thank you for going above and beyond to assist me. Keep up the great work!