Get a Quote

Get a Quote and Find Services to Fit Your Needs 50000+ Satisfied Clients

5000+ Licenses & Registration

15 Branches across India

75 Years + Combined experience

Satisfied Clients

Services

Years Combined Experience

Get Started!

MSME Registration Process

MSME stands for Micro, Small, and Medium Enterprises. These enterprises are the backbone of the country's economy, especially for developing countries like India. This will help to grow the business mindset and push forward the nation's economic growth.

As the MSME industry includes small and medium-sized businesses, the number of labour is higher than in any other industry. So, this also helps in the employment generation. The MSME Act came into effect on October 2nd, 2006 to provide incentives and facilities to MSMEs across the country. After its launch, it became popular among businesses as it provides a complete Udyog Aadhar Registration online application process, includes no government fees, minimal documentation and self-declared information.

Only service providers and product manufacturers can obtain MSME Registration. Following is the classification of Micro, Small, and Medium Enterprises:

(1).png)

Micro Enterprises: Investment in plant and machinery up to INR 1 crore and turnover up to INR 5 Crore.

Small Enterprises: Investment in plant and machinery up to INR 10 crore and turnover up to INR 50 Crore.

Medium Enterprises: Investment in plant and machinery up to INR 50 crore and turnover upto INR 250 Crore.

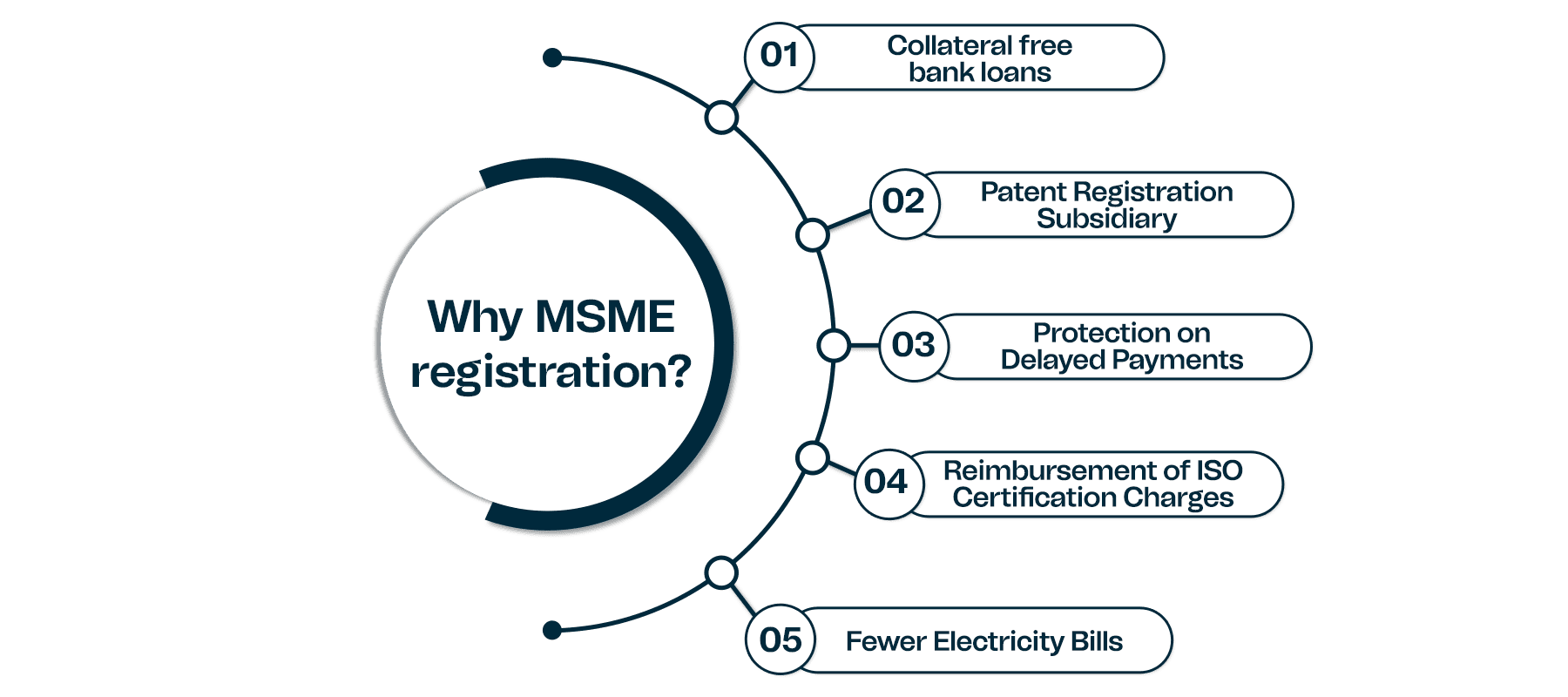

Some of the benefits of MSME registration under the provision of law are as follows:

The Indian Government has made collateral-free loans available to MSME businesses. This program offers financial security to small businesses. Any new or old business can claim the benefits and for extra benefit, the Government of India launched SIDBI and MSME registration online to ensure that the Credit Guarantee Scheme is implemented properly.

The MSMEs which are registered with the MSME ministry have the benefit of getting 50% subsidiary patent registration. This step encourages small businesses and firms to work on new projects and innovate new products and technology. Avail the benefit by submitting an application to the respective ministry.

The MSMEs are facing an issue of delayed payment and it disturbs the entire business because of a lack of payment. So, the Supreme Court has mandated that any buyer who purchases goods and services from the MSME should pay the complete payment within 15 days of purchasing the goods and services. If the buyer delays the payment by more than 45 days then they have to pay the interest as discussed with the MSME on the amount.

To obtain the ISO certification, all the expenses that are incurred by Micro, Small and Medium Enterprises will be reimbursed to the entrepreneur. So, this motivates the respective business to get ISO certification for their business and to export high-quality products abroad.

The registered MSMEs have the benefit of getting a concession on the electricity bills. This will help the businesses to increase production without worrying about the capital expenditure such as electricity bills, and other maintenance charges.

The following are the criteria for MSME registration as a Micro, Small and Medium Enterprise:

The manufacturing, service industries, wholesale, and retail trade which fulfils the revised MSME classification criteria of annual turnover and investment can apply for MSME registration online.

These entities are eligible for MSME license and these are Individuals, startups, business owners, entrepreneurs, Private and public limited companies, Sole proprietorships, Partnership firms, Limited Liability Partnerships (LLPs), Self Help Groups (SHGs), Cooperative societies, Trusts.

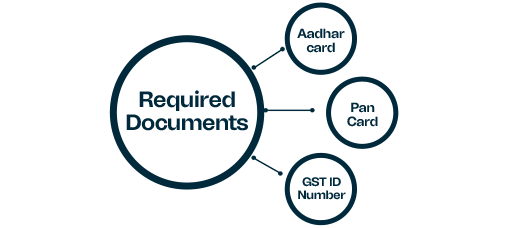

The following documents are required for MSME registration in India:

1. Aadhar Card.

2. PAN Card.

3. GST Identification Number (GSTIN).

The MSME registration process is completely online and it must be completed through the government Udyam Portal. On the portal, the MSME registration can be done in the following two ways:

New Registration

For new entrepreneurs who are not registered yet as MSMEs or those with EM-II.

Migrate to Udyam (Re-Register)

For those already having registration as UAM.

For those already having registration as UAM through Assisted filing.

The new entrepreneurs or those who have EM-II registration will register under this option. This option will be available on the home page.

After clicking on the link, a new page will appear. Here fill in the Aadhaar Number and name of the Entrepreneur.

Click on Validate & Generate OTP. You will receive the OTP by mail or mobile number linked with the Aadhaar Card.

Fill in the OTP and a PAN verification page opens. On this page, fill in the ‘Type of Organisation’ and enter the PAN number. Click on the ‘Validate PAN’ button.

Once the PAN verification is complete, a Udyam Registration Form will appear. The entrepreneurs have to fill in their personal and enterprise details.

Lastly, fill in the investment and turnover details, select the declaration and click on the “Submit & Get Final OTP” button. The Udyam Registration Certificate will be shared on the email of the entrepreneur. Also, the entrepreneur can check the status of the MSME license registration through the Udyam Registration Portal.

The entrepreneurs who are already having UAM registration, have two options to choose from as stated above. Choose the option according to you, from the government portal.

A new page will appear, fill in the Udyog Aadhaar Number and an OTP option. There are two options for OTP, one is to fill the OTP received on mobile and the second received by email. After filling information, click on “Validate & Generate OTP”.

After entering the OTP and other details in the Udyam Registration Form, the registration will be complete.

At Registrationwala, we help entrepreneurs obtain an MSME registration online certificate in simple four steps:

Document collection

Filing the MSME Registration Form application

Obtaining the Registration

Delivering your MSMED registration certificate

Reach out to us to get your MSME business register online with the government. Our team will help you in the best possible way.

Q. What is the Validity of MSME Certificate?

For an entity, there is no validity of MSME certificate/ Udyam certificate. The certificate can be used as long as the entity is using ethical practices and is financially stable.

Q. How can I renew my MSME Udyam certificate?

The MSME Udyam Certificate can renew online by following these ways:

Visit the Udyam portal and you get an option ‘Update Details’ under which you can Cancel or Update Udyam Registration.

Click on the link and login to the portal. Once login is complete, your Udyam Registration Certificate will appear on the screen. There will be some active fields, which you can change, and there are some fields that cannot be changed.

Once done with all the changes, submit the form. Now you can download a renewed certificate by clicking on the ‘Print Certificate’ option.

Q. Is Udyam registration free of cost?

Yes, the Udyam Registration is free of cost and you don’t need to pay any registration fees. Also, there are no fees charged for updating, MSME renewal or any other service of Udyam.

Q. How to check MSME registration by name?

On the government portal, there is no such option to look for MSME registration by name. However, you can retrieve your MSME registration number by following these steps:

Visit the Udyam portal, and click on forgot Udyam/ UAM Number. This option is available under the print/ verify.

Choose the registration option; udyog Aadhaar Memorandum or Udyam Registration.

Choose the OTP Option; Mobile or Email.

Enter Mobile/ Email as per your selection. Click on Validate & Generate OTP.

Enter the OTP and the MSME number will display on the screen.

Q. What is the MSME SSI Registration?

A. SSI MSME Registration is the Small Scale Industry MSME Registration gaining which the business becomes eligible for schemes and subsidies by the Government.

Q. How to proceed with Trademark Registration for MSME?

A. Any registered MSME can apply for trademark registration. They can apply for the logo with the regional office of the Trademark Authority of India.

★ ★ ★ ★ ★

I very much appreciate the fact that you guys possess tremendous knowhow of private limited company incorporation. You have exhibited professional and respectful manner towards my query and I would seriously recommend you guys to all the folks looking for outstanding business services.

★ ★ ★ ★ ★

Thanks to their support, I got my trademark successfully. I highly recommend their services for anyone needing help with their intellectual property. The person assigned to me was very cooperative and helpful.

★ ★ ★ ★ ★

Thanks to their support ragistrationwala team, I got my IP-1 license successfully and special thanks to Miss.Kanishka for your great and timing support !!!!!! I have archived my goal one step forward... Thanks for the entire team....

★ ★ ★ ★ ★

Really helped a lot in getting my both VNO licenses. Great experience working with the team and very humble team, thanks for providing the vno license on time.

★ ★ ★ ★ ★

I had a good time working with Registrationwala. Good team. I would recommend their services to others.

★ ★ ★ ★ ★

It was extremely great service of Registrationwala consulting firm, and this firm is providing the best services and worry about the client's required services along the client's satisfaction.

★ ★ ★ ★ ★

Superb Experince! Within no time the trademark registration was on.Highly professional team. I am very much Impressed with the prompt response and efficiency.Thank you.

★ ★ ★ ★ ★

We had taken ISP license from registration wala and the supporting person is very helpful to taken that license his communication and his work is satisfactory and thanks for those services

★ ★ ★ ★ ★

I sincerely appreciate your prompt support in helping me get the access license so quickly. Your professionalism and efficiency are truly commendable. Thank you for going above and beyond to assist me. Keep up the great work!