Company Registration in London

London, the heart of the former British Empire, has been a trading giant for the past three centuries. London is a city where it never ceases to rain, just as the business opportunities it offers. London has, over a period of time, built over the riches from all over the world. It has always been an attraction for businesses worldwide. We can attribute such accomplishments to its business-oriented infrastructure, world-level facilities, quality governance, and respect for rules and regulations among the general masses.

London is a major financial centre of the western world. Also, as one of the top technologically advanced cities on the planet, London attracts some of the best talents across the globe. Such magnetism for a skilled workforce fuels London's corporate workforce with trained and skilled personnel. Furthermore, most nations have adopted the British Legal System, especially commonwealth nations. This makes it easier for foreign entrepreneurs to set up their businesses in British city.

Benefits of Company Registration in London

Now for some serious talks, let us look at some of the benefits of Company Registration in London. London has a lot to offer to budding entrepreneurs. The entrepreneur must not necessarily reside in the city. You can also avail yourself of the benefits of registering your Business in London from a foreign country.

The benefits of company registration in London are as follows:

London offers tax benefits to its registered Businesses

London boasts of being the most extensive network of double tax avoidance treaties. Their Corporate Authority offers various incentives for registering companies in the British City. The London Legislation offers several tax incentives for Tech startups and Fintech Firms.

- The annual Corporate Tax payable by the Company in London is 25% if they generate a revenue of over 250,000 pounds.

- The only exception to this rule is Ring Fence Companies.

- If you are a company making profits in the range starting from £50,000 up to £250,000 annually, then you must pay 19% corporate tax. These current rates will be applicable in London from April 1, 2023.

London has the most vibrant marketplace in all of Europe

London city boasts of being one of Europe's largest and most vibrant marketplaces. Acting as a gateway to other corners of the world, London offers its foreign investors the following advantages:

Ease of Doing Business

- London ranks high in the 'Ease of Doing Business' report card released by the World Bank.

- The company registration in London takes only 24 hours.

- The London Authority puts no minimum capital requirement for company registration.

- Registration requires only one shareholder and one Director.

- The Corporate Authority does not necessitate the appointment of a company secretary compulsory for private limited registration.

British Legal System

There are potent similarities between the legal system adopted worldwide with the Westminster legal system, making it easier for companies to adapt to such systems.

Robust Business Ecosystem

London offers a robust business ecosystem to budding entrepreneurs to build their businesses and sustain themselves in the long term.

Quality Personnel from all around the world

London magnets world-class talent towards itself. It can offer a pool of employees ready to be employed in business administration. This is because London has knitted world-class academic institutions and businesses close together.

Advantageous Location

London ripes the benefit of being strategically located between the East and West worlds. The British city offers a central time zone position to budding businesses. Therefore, they can operate round the clock if the business situation demands to push for maximum output.

As one of the world's major financial centers, London also offers an ideal environment for research and development work for business development.

London's Corporate Legislation is friendly to International Holding Companies

The London Legal System facilitates an ideal environment for International Holding Companies. It offers the following benefits to the Holding Companies:

Tax Exemptions on Dividends

London tax laws exempt taxing dividends received by Foreign Companies. But there is a catch. The London companies are exempted on certain conditions, such as the company's size, whether the company is small, medium, or large.

Also, the Corporate Authority imposes no withholding tax on the dividends distribution paid to the shareholders. The exemption is irrespective of the residential status of the company's shareholders.

Paid-up & Share Capital and Stamp Duty

- Furthermore, London levies no custom duties imposed on the paid-up capital or issued share capital.

- The London Legislation puts the stamp duty at a mere rate of 0.5%.

London tax exempts Capital Gains of registered Businesses

London tax regime keeps from imposing Capital Gains tax on the disposal of a substantial shareholding in any of the following entities:

- Registered Company

- Holding Company of a Trading Company

- Other Companies

Note: Here, substantial shareholding means shareholding in which at least 10% of the ordinary shares are stored in another company for one year in the previous six years preceding the sale.

The Corporate Authority also relieves the disposal of shares in companies owned QIIs, i.e., the Qualified Institutional Investors.

Which is the Regulatory Authority for Company Registration in London?

The regulatory Authority for business registration in London is the Companies Register of London. It is commonly known as the Companies House in Britain.

Eligible Criteria for Company Registration in London

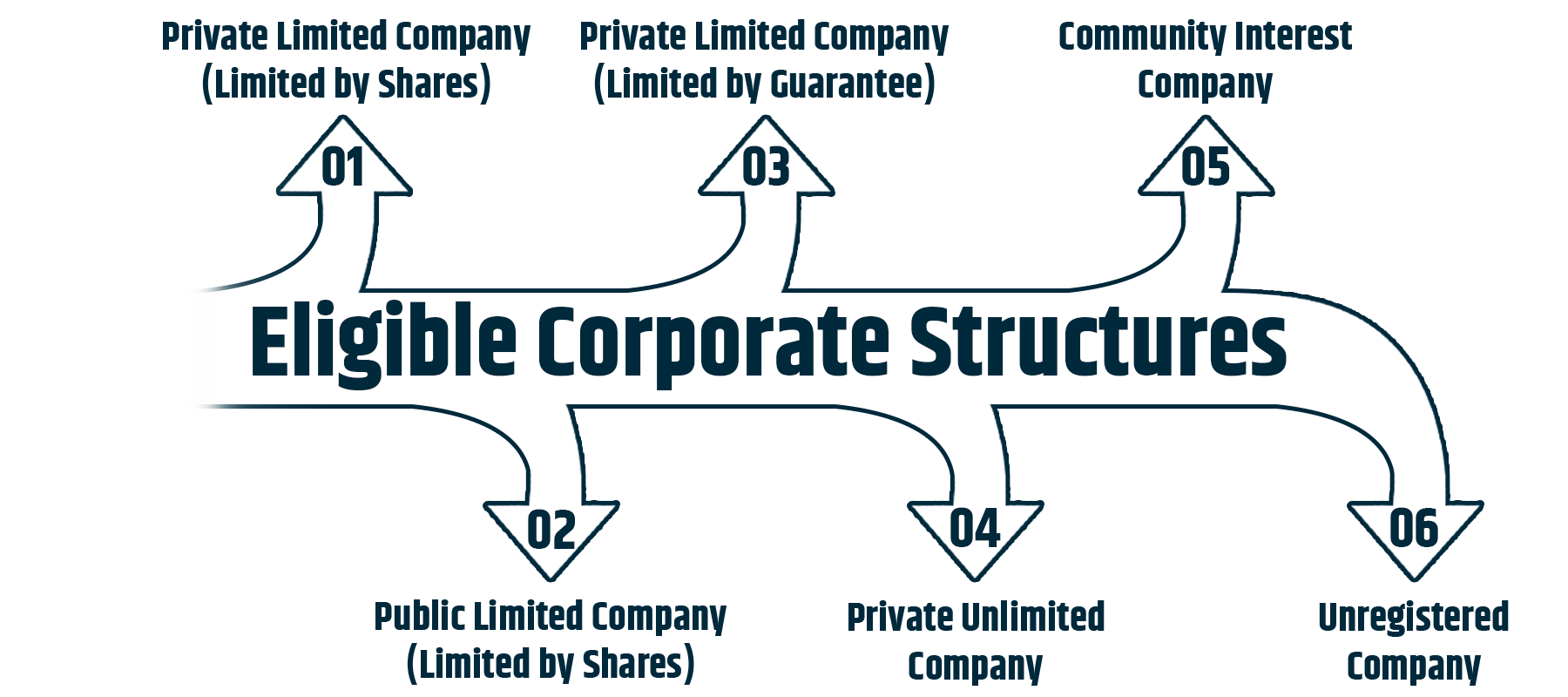

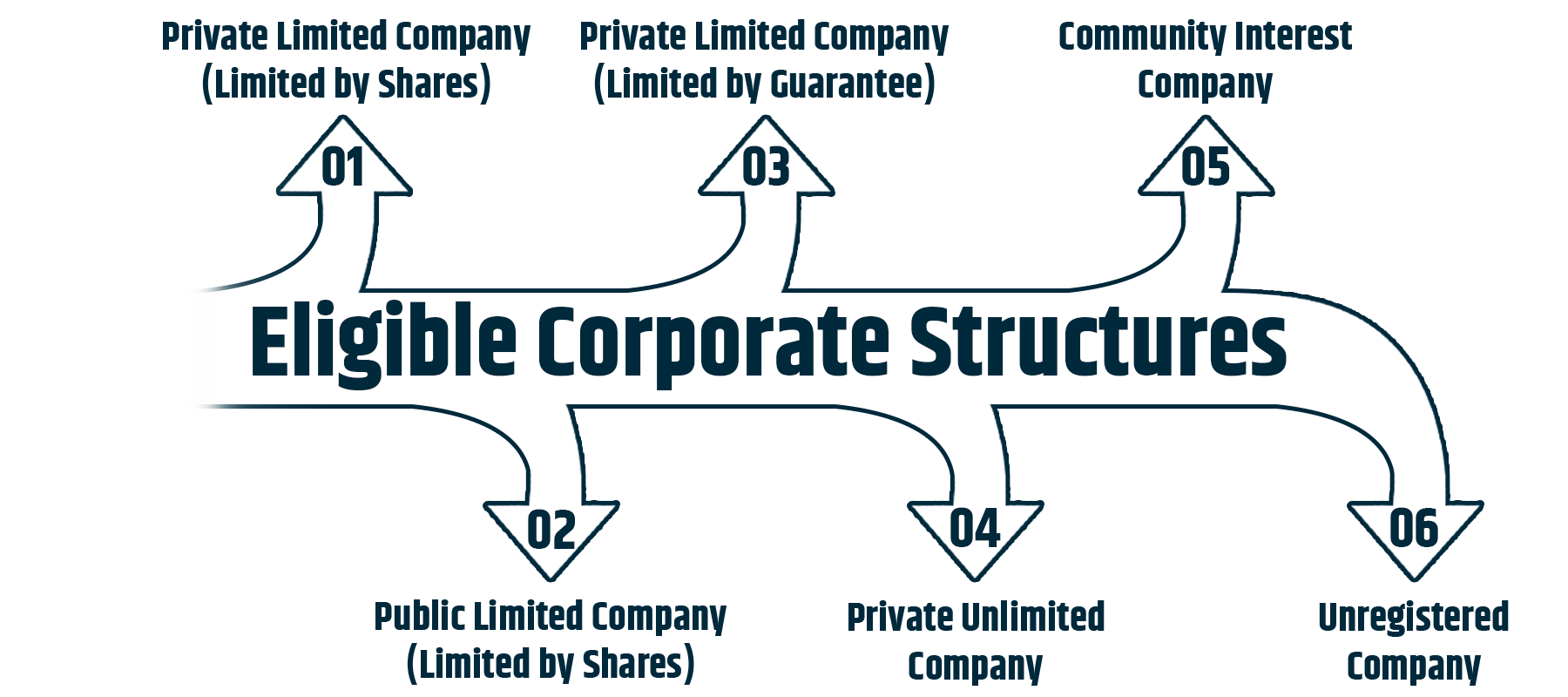

The Companies Act of 2006 of London recognizes many business structures as companies, such as:

- Limited and Unlimited Companies

- Private and Public Companies

- Companies limited by shares and guarantee

- Community Interest Companies.

Of these, there are majorly five types of companies commonly adopted by budding businesses in London to start their commercial operations.

Each of these business structures has its own eligibility requirements. They are:

- Private Limited Company (Limited by shares)

- Public Limited Company (Limited by shares)

- Private Limited Company (Limited by guarantee)

- Private Unlimited Company

Some of the less common forms of Business Structures in London are:

- Community Interest Company

- Unregistered Company

Now let us look at such corporate structures one by one in detail.

Private Limited Company: Limited by Shares

- This Private Limited Company is the most common business entity in London.

- Almost 95% of companies registered in London are Private Limited Companies (Limited by shares).

- Every Private Limited Company or Pvt Ltd must suffix the word 'Limited' or 'Ltd.' to their name.

- The Corporate Authority does not mandate minimum share capital for such Pvt Ltd.

- Any person, UK national or foreigner, can start a Pvt Ltd with capital as one pound.

- The liability of the shareholders of Pvt Ltd is limited to the unpaid shares held by them.

- The Company Register in London mandates no prescription on the amount paid up on the issue of shares.

- In a Pvt Ltd, shares cannot be offered to the general public.

- Every Pvt Ltd must have at least one Director.

- The Common Houses does not necessitate a Pvt Ltd to appoint a company secretary.

- Pvt Ltd is not heavily regulated as are Public Limited Company (limited by shares).

Public Limited Company: Limited by Share

- A Public Limited Company is also termed a PLC in London.

- Usually, big businesses adopt such a business entity.

- A PLC can make its shares available to the general public.

- Shares are sold on the stock market so that Company can raise capital for business growth and operations.

- The financial liability of the shareholders of a PLC is limited to the unpaid shares held by them.

- The Corporate Law mandates a minimum share capital of £50,000 to incorporate a PLC in London.

- Furthermore, every PLC incorporation applicant must maintain a minimum of 25% of the nominal value.

- They must also pay the premium payable on the issued shares at the time of share allotment.

- Each Public Limited Company must appoint at least two directors for its incorporation.

- The appointment of a Company Secretary is necessary to incorporate a PLC. The CS must be appointed at the time of registration.

Private Limited Company: Limited by Guarantee

- In such a Company, the Company is liable to pay its debtors a pre-agreed amount if it shuts down from bankruptcy or insolvency.

- Non-Profit Organizations adopt this business structure for charitable purposes, such as:

- Charitable Organization

- Educational Institution

- Social Clubbing

- Trade Unions

- These companies do not have shareholders, and there exists no share capital.

- This Company members become the shareholders.

- The guaranteed amount can be as little as one pound for such PLCs.

Private Unlimited Company

- The distinctive feature of a Private Unlimited Company is that there is no extent of liability accrued to its members in case the PUC shuts down from bankruptcy.

- The PUC structure is valid for only those companies if there is a surety of no insolvency.

- Furthermore, PUCs are not legally bound to submit annual filings to the Companies House.

Branch Office: London-based Establishment

- A Branch Office is a registered London Establishment of overseas or foreign companies.

- Branch Office is no separate legal identity.

- For a Branch Office, the affairs are governed by the directors as well as shareholders of the overseas Company.

- A Branch Office can be thought of as an entity alternative to a separate company in London.

- But Branch Office as a London Establishment must be registered with Companies House in London.

- The Branch Office must make the identities of the directors and their authorized representatives publicly available.

- Branch Office is a local representation of an Overseas Company in London.

- The applicant must apply for registration with the Companies House within one month of opening the Branch Office in London.

- The cost of Branch registration depends on the country of registration of the overseas Company.

- The reporting requirement of a Branch Office is similar to that of a private limited company's.

- The registration of a Branch Office requires a physical address in London.

- The liability of a Branch Office is subject to the requirements of the parent overseas Company.

- However, the Authority mandates the Branch Office to pay taxes only to the extent earned by its establishment in Britain.

Community Interest Companies

- A Community Interest Company or a CIC is a type of Private Limited Company limited by shares.

- A CIC is set up to carry out benefits for the general community.

- A CIC is a not-for-profit entity.

- But A CIC must earn profits to remain solvent

- They must apply the profit for the benefit of the community as a whole and not for personal gain.

Unregistered Companies

- Unregistered companies are not registered under the Companies Act of 2006.

- Such companies are created through Private Acts of Parliament or a specialized Royal Charter.

Documents required for Company Registration in London

You can register your company in London electronically through the e-Business portal at the official Company Register website. If you want to submit your registration application offline, then you can avail of the physical registration option with a notary's assistance. You can hire a notary to help you in the preparation of the following documentation for company registration in London:

- Memorandum of Association of the applicant business

- Articles of Association of the applicant business

- Company Incorporation Form IN-01

- In the applicant's Business is an overseas company, then the Form OS IN-01

- Applicant Company's Founders Agreement

- Applicant Company's Co-Founder's Agreement

- Details of the shareholders as well as guarantors, such as:

- Birth Place

- Mother's middle name

- Father's first name

- Contact Number

- National Insurance Number

- Passport Number

The promoters of the applicant company can adopt other means for company registration, such as:

- Post

- Registration Agent

- Third-Party Software

If the promoter chooses to register the Company via post, he must use the incorporation form IN-01.

Also, every newly incorporated Company must register for the applicable Corporation Tax within three months of kickstarting your Business. Usually, people prefer to register for applicable Corporation Tax at the time of company registration with the Companies House. Suppose the promoter is unable to register the Company with the Authority. In such cases, they can register the company separately with the HMRC, i.e., the HM Revenue and Customs, after the applicant business has been registered with the Companies House.

Documents required for Overseas Company Registration

- Name of the overseas Company

- Details of the accounts related to the Overseas company

- Required constitutional documents of the Company

- Principal place of Business with the Authority

- Registered Office Address of the Company

- Objects of the Applicant Company

- Amount issued as the share capital by the Overseas Company

- Details of the Officers/Management personnel of the Overseas Company

Documents required for Branch Office Registration

- Name of the proposed Branch office

- Official Address of the Branch office

- Business Activity to be undertaken by the Branch Office

- Permanent Representative of the Branch Office as a London Establishment

- Details of the Representative accepting service on behalf of the Branch Office

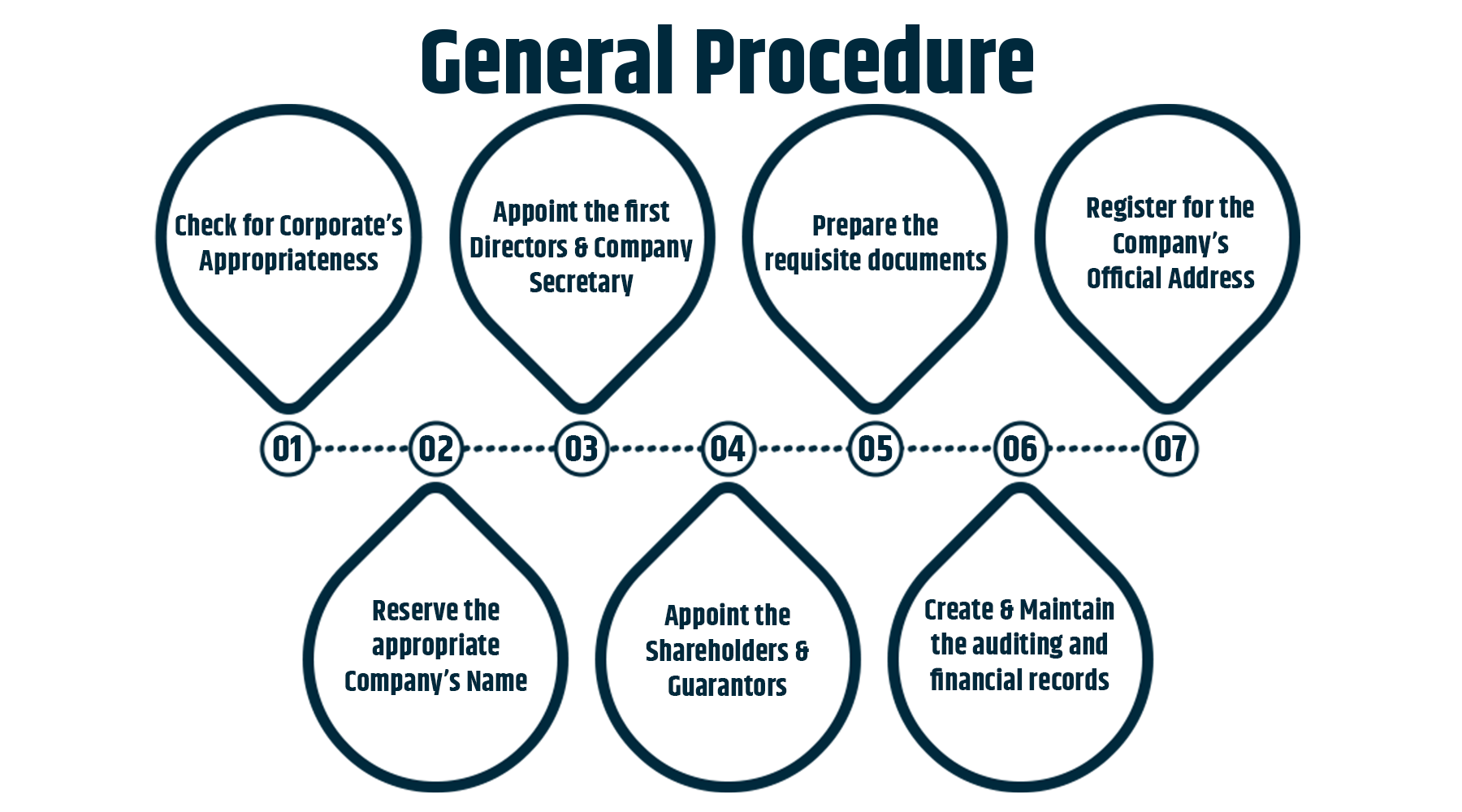

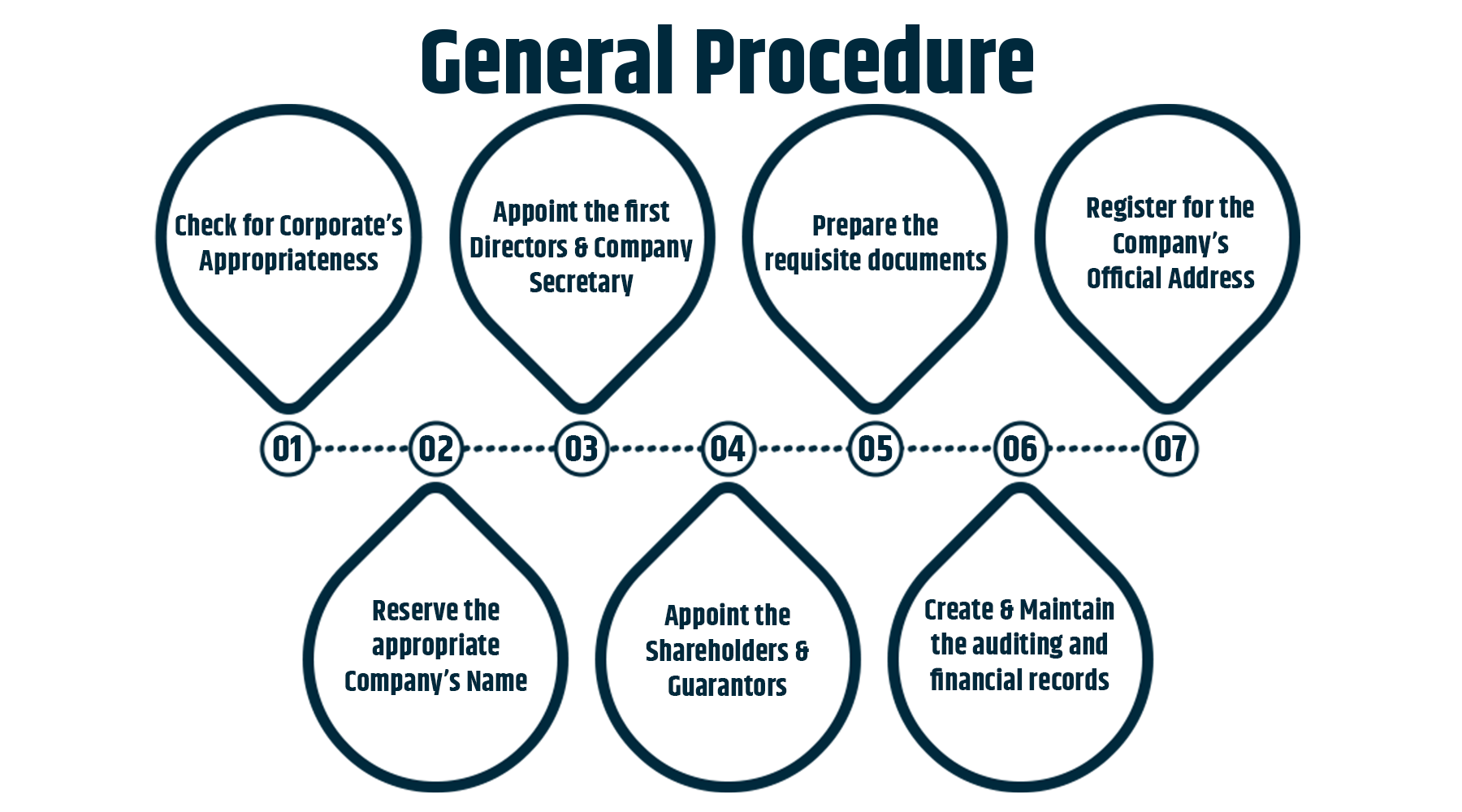

Procedure for Company Registration in the London

Every Company registration applicant must go through the process of Company Registration enlisted in the following steps to get registered as a Corporate entity in London:

- Check the appropriateness of the Company structure for your Business

- Choose and Reserve the appropriate name for the Company

- Appoint the first Directors and Company Secretary for the applicant Company

- Appoint the Shareholders or Guarantors of the applicant's Business

- Preparing the required documents to run the Company

- Create & maintain the auditing and financial records of the Company

- Register for the Official Address of the Company

Check the appropriateness of the Business Structure for your Company

The first step in registering your company in London is ascertaining whether the chosen company structure is suitable for the commercial activities to be undertaken by the applicant company owner. For such purposes, the applicant must understand the taxation structure of the chosen business entity.

As a foreign investor, if you want to set up a branch office in London, you have the following two options:

Overseas Company: In this case, the Foreign Company operates from its native state. In addition, it bears all the responsibilities of the debts of its branch office in London.

Open a Subsidiary: You can open a subsidiary as a Private Limited Company. Here, the Subsidiary is a separate legal entity and will bear the required responsibilities.

Choose and Reserve the appropriate name for the Company

After choosing the appropriate business structure, the applicant company must choose and reserve the trade name for itself. Here, the promoters are assigned the task of choosing an appropriate name. .

- The chosen name must not be the same as the name of an already registered company.

- The applicant Company's name must end with either Limited or Ltd.

- The chosen name cannot be offensive to the public.

- The chosen name must not contain any sensitive word or expression.

- The chosen name must not indicate any connection with the Government or Local Authorities.

- The applicant must obtain special permission from the government to choose the authority name in the Company's title.

- The applicant must choose a trading name that is different from its registered name.

- A trade name can also be termed a Business Name.

- The business name of a company must not include any of the following terms:

- Limited

- Ltd

- LLP

- Limited Liability Company

- Public Limited Company

- PLC

- To use a sensitive expression or word in the trade name, the applicant must seek permission from the concerned authorities.

- If the chosen name is similar to the trademark of some other company, then the applicant must not use such a name.

- In any of the following conditions, the applicant must not use the Limited suffix with its name:

- Company is registered for charity

- Company limited by guarantee

- Articles of association reflect that the applicant Company has been registered to promote the following:

- Art

- Religion

- Commerce

- Education

- Charity

Appoint the first Directors and Company Secretary for the applicant Company

The Company Law of London makes it mandatory for the business applicant to appoint at least one Director for company registration. However, the Law does not mandate the company to appoint a Company Secretary at its incorporation.

Directors

- The appointed directors must be legally responsible for running its affairs

- They must ensure that the company accounts are properly prepared.

- To qualify as a Director, the appointee must be above 16 years of age

- The Director must not be disqualified from being a director in another company under any Law.

- The Authority exerts no statutory compulsion for a director to be a London resident.

- But the registered Address of the Company's office must be in London.

- The applicant must publicly display the details of its first directors from Companies House.

- Every appointee must provide a service address, which the applicant company must make publicly available.

Company Secretary

- The Corporate Authority does not necessitate the company to appoint a Company Secretary.

- Some companies, as per their choice, can appoint to take on the responsibilities of the Company's Director.

- A company secretary can become a Company's Director but not an auditor.

- The secretary must not be an undischarged bankrupt unless he sought special court permission.

- Even after a company secretary's appointment, the directors will remain legally responsible for every aspect of the applicant company

Appoint the Shareholders or Guarantors of the applicant's Business

- After the appointment of directors, the applicant company must appoint the shareholders and guarantors themselves.

- Companies, in most cases, are limited by shares.

- Shareholders with certain rights also own them.

- They issue ordinary shares where the directors get one vote per share

- The directors also receive dividend payments.

- Every limited company by shares must maintain at least one shareholder or a guarantor. He can be the Company's Director.

- If the appointed person is the only shareholder, he can completely own the company.

- Corporate Law in London imposes no limit on the maximum number of shareholders that a Company can keep.

- If the Company is going to shut down, its shareholders must pay their shares.

- Every applicant, at the time of the company registration, must provide the following information about shares:

- Number of shares within the Company

- Types of shares along with their total value: Share Capital

- Details of every shareholder, such as name and address

Create & maintain the auditing and financial records of the Company

For every Company Registration in London, the applicant must maintain specific records regarding the affairs of the Company. In such cases, the Authority has delegated the HM Revenue and Customs to check the compliances of the Company. HMRC also checks the right amount of Tax being paid by the Company. The records to be presented to the HMRC are as follows:

The applicant must maintain the following details about the Company at all times:

- Shareholders details

- Company Secretary details

- Director details

- Votes of shareholders

- Resolutions of a Company

- Promises to repay loans in the future

- Recipient of loan repayment and debentures

- Promises for payment to the recipient if some fault occurs on the part of the Company: Indemnities

- Transaction Records of the shares bought by the Company

- Loans and Mortgages secured against the Company's assets

- Register of People with significant control: It must include the following details:

- These people must have 25% voting rights in the Company

- They can remove or appoint a majority of directors in the Company

- They can influence and control the Company

It must be noted that the above-mentioned record must be maintained anyway if there are no people with significant control.

Register for the Official Address of the Company

Finally, the company must register for a physical address. They must also select the SIC code that identifies which the newly incorporated company will undertake commercial activities.

Physical Address

- The purpose of official address registration is to receive all written communications to that address.

- The office must be located in London or the country where it is registered.

- The applicant can use a Post Office Box as a physical address and a postcode.

- This official address of the Company must be publicly available. You must post it on the online register.

- If you don't want to reveal the official address, you can keep the address private. Keep a different address and appoint an agent to give you an address. The Legislation mandates the company to have a physical address before company registration.

SIC Code

- The applicant must always use the SIC code for company registration.

- It is available on the condensed list from the Office of National Statistics.

- The ONS list classifies business establishments by their activity type.

- The applicant must provide the correct SIC code to the Companies House.

- If case the code applied is incorrect, the Company House will reject the application.

Grant of Registration Certificate

On the successful registration of the company, the Authority will issue the Certificate of Incorporation to the applicant. With the certificate issue, the company enters the corporate existence. The Certificate of Incorporation puts the company on the legal map. The certificate enlists the company's number and its date of formation.

Our Assistance for Company Registration in London

Our Incorporation experts provide you end to end company incorporation services in London by assisting you in the following manner:

- Collecting and Organizing the requisite Documents

- Compiling the necessary documents for registration

- Reserving the chosen name with the British Authority

- File the certification application for Company's Incorporation on your behalf

- Appoint a Directors and Company Secretary for your Firm

- Prepare the requisite Memorandum and Articles for the Corporation

- Assist in the appointment of the directors and shareholders in the Company

- Choosing the appropriate office location for the Company

- Obtain the required business licenses for running the Company in London

We ensure that your company incorporation services requirements for London are always on time. Our professionals understand the intricacies of company incorporation procedures in London. Thus, we have expedited the process – helping you incorporate your Company at an affordable price.

So, reach out to our Incorporation Experts and realize your dream of starting your own Company in London.