Get a Quote

Get a Quote and Find Services to Fit Your Needs 50000+ Satisfied Clients

5000+ Licenses & Registration

15 Branches across India

75 Years + Combined experience

Want to start a company in India? Contact Registrationwala’s company formation consultants. We will help you to file the company registration application with the Registrar of Companies (RoC) and help you obtain Certificate of Incorporation (COI) easily.

Satisfied Clients

Services

Years Combined Experience

Get Started!

Company Registration Process In India

Starting a company is a dream for many. A lot of people want to be their own boss. Rather than working for someone else, they envision others working for them. To turn this dream into reality, it's crucial to complete the company registration process in India.

This is done through the Registrar of Companies (RoC) under the Ministry of Corporate Affairs (MCA) via the official MCA portal. Connect with Registrationwala for assistance in MCA company registration!

Before understanding what company registration is, it is important to know what a company is. A company refers to a business entity which comprises members/shareholders and directors. It is a legal business unit incorporated as per the provisions of the Companies Act 2013. We can refer to a business as a company only when it is registered with the Registrar of Companies (RoC) in accordance with this Act.

To put it simply, company registration in India is the process of getting your business officially recognized by the RoC as per provisions of the Companies Act 2013 and issued a unique Company Identification Number (CIN). The company registration process in India is a legal process which provides a company its legal identity to operate within the country.

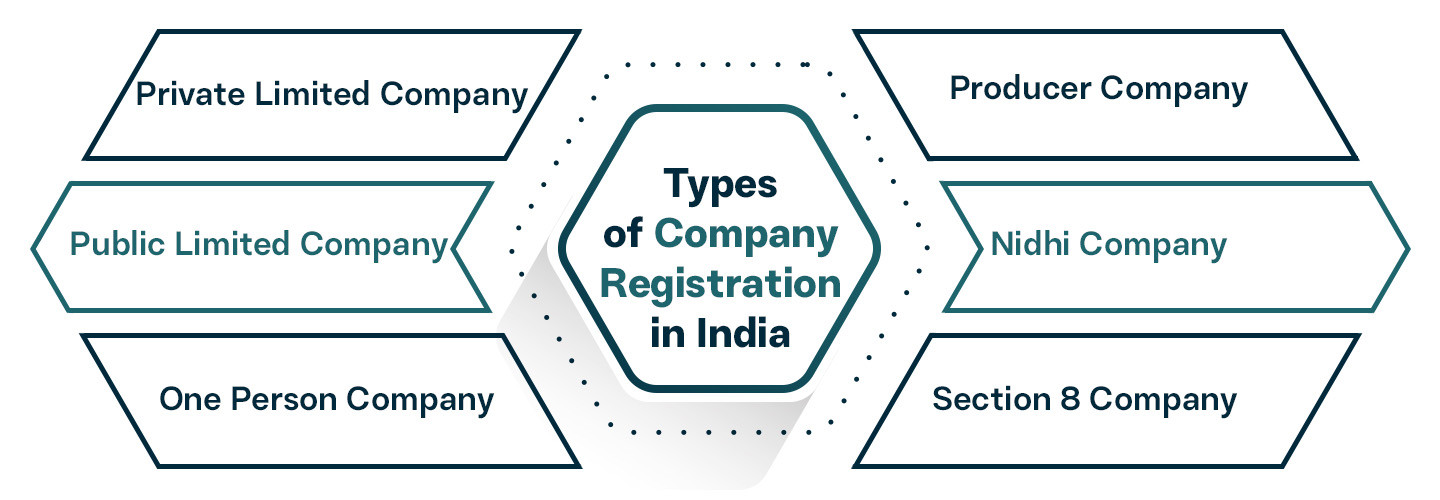

There are several types of companies that individuals can register in India:

Private Limited Company

Public Limited Company

One Person Company

Producer Company

Nidhi Company

Section 8 Company

A Private Ltd Co is perhaps the most popular type of company out of all the companies registered under the Companies Act 2013. It offers limited liability protection to all its members. To form a private limited company, a minimum of two directors are required.

There needs to be a minimum two members/shareholders and a maximum of 200 members/shareholders to form a pvt ltd co. There is no minimum requirement to establish this type of company. It comes with perpetual succession, meaning it continues to exist even after its directors or members change.

A Public Limited Company is recognized as a separate legal entity and enjoys the benefit of share transferability among the general public. It has perpetual succession, meaning the company continues to exist regardless of changes in ownership.

To register a public limited company, a minimum paid-up capital of Rs. 5,00,000 is required. The company name must end with the term “LTD.” At least three directors and a minimum of seven members are needed to form this type of company. Additionally, it is mandatory to issue an annual prospectus.

A One Person Company (OPC) also has a separate legal identity. It requires only one director and a nominee who will take over in case the sole member is unable to continue. Unlike other types, an OPC does not enjoy perpetual succession. There is no minimum capital requirement. This makes it a flexible option for solo entrepreneurs.

Producer Companies are primarily set up with the objective of dealing with agricultural produce and related activities. The company name must include the words "Producer Company." Only equity shares are allowed to be issued, and a minimum of five directors is required. These companies must also set aside a portion of their profits each year to maintain a general reserve.

A Section 8 Company is a type of non-profit organization established to promote charitable objectives like social welfare, education, or environmental protection. Any profits earned are reinvested to further these causes and are not distributed as dividends among members.

Nidhi Companies are formed to encourage savings and thrift among their members. They provide short-term deposit services and are restricted to doing business only with their registered members. These companies also offer short and long-term loans with minimal documentation requirements.

There are many benefits of registering a company with MCA. Some of them are as follows:

✔Recognized Legal Identity: After you complete the MCA company registration process for registering a company in India, you gain access to a business entity whose existence is recognized by the government bodies. It means that unlike non-separate business entities in India, your Company will exist as per the regulations of the Companies Act, 2013.

✔Enjoy Perpetual Business Continuity: Any limited business entity can exist perpetually. A one-person company, even though it doesn't have a direct perpetual succession benefit, can continue to exist by transferring the shares to the nominee.

✔Limited Liability for Directors and Members: The debts of the directors or members of the Company are limited by the face value of shares they have purchased.

✔Smooth Share Transfer Process: All it takes is one board resolution to authorize the transfer of shares among the members of the Company. And, when it comes to a public limited company, the transferability of the shares is easy even when the public is involved.

✔Right to Own Property in Company’s Name: After completing the company registration procedure in India, it becomes easy for a company to own a property.

✔Legal Standing to Sue or Be Sued: Because a company is a legal entity that has been conferred the status of an "individual" by the government of India, it now has the potential to file court cases against others or get sued all the same.

✔Better Borrowing Potential: Online company registration in India leads to an increase in borrowing capacity. Because you will have a legal business entity, the banks and other institutions will now be more than willing to lend you money.

✔Easier Access to Equity Funding: Company name registration in India leads to forming a business entity that is more trusted in the market and, thus, has the investors' faith. Therefore, it becomes less laborious for you to raise equity for your enterprise.

Due to all the above-mentioned benefits, it is a great idea for any entrepreneur to go through the registration process of a Company in India.

Following is the list of documents required for registering a company in India:

✔PAN card of the Indian directors of the Company

✔Aadhaar Card of the Indian directors of the Company

✔Passport of the foreign directors, if any.

✔Latest Utility Bills

✔Proof of Residence

✔NOC of the registered office address

✔Passport-size photographs

✔Digital Signature Certificate (DSC)

✔Director Identification Number (DIN)

✔Memorandum of Association (MOA)

✔Articles of Association (AOA)

If you have these documents in place, you can go ahead with the company incorporation procedure!

Following is the process for registration of a company:

The first step is to check company name availability in India. To do this, you must refer to either the official MCA portal or our platform. If the company name of your choice already exists, you must choose a different company name that isn’t already taken.

Now, the next step is to furnish all the documents and get them certified by a Chartered Accountant or a Company Secretary. After ensuring you have all the documents, you will become one step closer to getting your company incorporated.

You must file the application for business registration online. For this, you need the DSC. DSC is an electronic signature that is necessary to authenticate the documents you upload on the MCA portal.

Acquire the director identification number (DIN) to access the company registration’s application form. Without a DIN, an individual cannot be a company director.

You must draft the Memorandum of Association to highlight your company objectives. These documents state the rules and regulations that your company must adhere to.

The Spice form is the application for registration of companies in India. It is detailed, intuitive, and provides enough info for a commoner to fill out the application form.

The Registrar of Companies will assess your application form. If you have made no mistake, the RoC will issue your company a certificate of incorporation. This certificate will contain a unique company incorporation number. After this, your company will officially be a legal entity registered with the Ministry of Corporate Affairs.

Once your company is formed, you need to ensure it maintains compliance with legal and regulatory requirements at all times. By doing so, your company will establish a strong foundation for business operations, ensure transparency and avoid penalties. Here are some post-registration compliance requirements for companies registered in India:

Under the Companies Act of 2013, companies are required to submit their annual financial statements and returns to the Ministry of Corporate Affairs (MCA) by the deadlines specified. Within sixty days following the Annual General Meeting (AGM), the Annual Return (Form MGT-7) must be submitted. Information on directorship, shareholding, and business operations is included in this filing.

Within 30 days following the AGM, financial statements (Form AOC-4) must be submitted. It contains profit and loss statements, an audited balance sheet, and additional financial information.

There are deadlines for reporting specific company changes to the MCA. Within 15 days following the AGM, the Auditor Appointment/Reappointment Form (ADT-1) must be submitted. Within 30 days of receiving the Certificate of Incorporation (COI) during the company's first board meeting, newly incorporated corporations must file Form ADT-1. It is necessary when a statutory auditor is appointed or reappointed.

After a director is appointed, resigns, or is removed, the Change in Board of Directors (Form DIR-12) must be submitted within 30 days. Within 15 days following the relocation of a company's registered office, the Change in Registered Office Address (Form INC-22) must be filed. After new shares are issued, the Allotment of New Shares (Form PAS-3) must be submitted within 30 days.

Additional compliance reports must be submitted by certain businesses. Private limited companies that accept deposits are required to submit the Deposits Reporting (Form DPT-3). It needs to be submitted within ninety days of the fiscal year's conclusion.

Companies that owe money to Micro or Small Enterprises suppliers are required to submit the Micro & Small Enterprises Payments (Form MSME-1) report. To report delayed payments, it must be sent by October 31 and April 30 of each year.

Within 30 days of securing a loan or modifying charges on company assets, Creation/Modification of Charges (Form CHG-1) needs to be filed. If an auditor resigns or is not ratified, auditor Resignation/Non-Ratification (Form ADT-3) must be filed within 90 days.

For board resolutions and specific agreements, the approval of the resolutions of the board and shareholders (form MGT-14) must be submitted within 30 days.

Registrationwala’s experts provide you end to end company registration services in India by assisting you in the following manner:

✔Collecting and organizing the documents.

✔Applying for the Digital Signature Certificate.

✔Digitally certifying the documents.

✔Precisely drafting the Memorandum and Articles of Association.

✔Filing the application for business registration online.

✔Obtaining and forwarding the Certificate of Incorporation.

We ensure that your requirements for online company incorporation services are always met on time. Our professionals understand the complexities that come with the online company incorporation process. That’s why we have simplified and accelerated the procedure to help you incorporate your company at an affordable and competitive price.

Connect with our experts today and take the first step towards becoming your own boss by starting your own company!

Q1. Which Act governs the registration of companies in India?

A. The Companies Act 2013 governs how the companies are registered in India.

Q2. What is the Company Incorporation Number in India?

A. A Company Incorporation Number (CIN) refers to the company’s unique identification number.

Q3. What are company registration fees in India?

A. The company registration fees depend on several factors like type of company, its authorized capital and professional fees for Chartered Accountants or Company Secretaries. Connect with us to learn about the exact fees if you avail our company incorporation services.

Q4. How to check company name availability in India?

A. To check the availability of a company name in India, you can visit the MCA (Ministry of Corporate Affairs) portal and use the “Check Company Name” service. You can also use platforms like Registrationwala’s company name search tool for a preliminary check.

Q5. How to check company registration in India?

A. To check a company’s registration status, you can use the “View Company or LLP Master Data” feature on the official MCA portal. Some private service providers also offer similar search tools for convenience.

Q6. Who provides the registration certificate to a company?

A. Ministry of Corporate Affairs (MCA) issues the Certificate of Incorporation through its online registration system after successful processing of incorporation documents.

Q7. What is DSC in company incorporation?

A. DSC stands for Digital Signature Certificate. It is crucial for signing electronic documents during the company incorporation process, especially when filing forms online through the MCA portal.

Q8. How many members are necessary for registration of a public company?

A. A minimum of seven members are mandatory to incorporate a public company in India. However, there’s no limit on the maximum number of members in a public ltd co.

Q9. How to check a company’s registration status on Registrationwala?

A. To check the company’s registration status, you simply need to enter the company’s name in Registrationwala’s company search tool to view basic registration details.

Q10. What is OPC company registration?

A. OPC (One Person Company) registration refers to the incorporation of a company that has only one person as its member and director, ideal for solo entrepreneurs looking for a corporate structure.

Q11. What is private limited company registration in India?

A. Private limited company registration refers to the process of incorporating a privately held business entity. A pvt ltd co is governed by the Companies Act, 2013 and comes with limited liability and a separate legal identity.

★ ★ ★ ★ ★

I very much appreciate the fact that you guys possess tremendous knowhow of private limited company incorporation. You have exhibited professional and respectful manner towards my query and I would seriously recommend you guys to all the folks looking for outstanding business services.

★ ★ ★ ★ ★

Thanks to their support, I got my trademark successfully. I highly recommend their services for anyone needing help with their intellectual property. The person assigned to me was very cooperative and helpful.

★ ★ ★ ★ ★

Thanks to their support ragistrationwala team, I got my IP-1 license successfully and special thanks to Miss.Kanishka for your great and timing support !!!!!! I have archived my goal one step forward... Thanks for the entire team....

★ ★ ★ ★ ★

Really helped a lot in getting my both VNO licenses. Great experience working with the team and very humble team, thanks for providing the vno license on time.

★ ★ ★ ★ ★

I had a good time working with Registrationwala. Good team. I would recommend their services to others.

★ ★ ★ ★ ★

It was extremely great service of Registrationwala consulting firm, and this firm is providing the best services and worry about the client's required services along the client's satisfaction.

★ ★ ★ ★ ★

Superb Experince! Within no time the trademark registration was on.Highly professional team. I am very much Impressed with the prompt response and efficiency.Thank you.

★ ★ ★ ★ ★

We had taken ISP license from registration wala and the supporting person is very helpful to taken that license his communication and his work is satisfactory and thanks for those services

★ ★ ★ ★ ★

I sincerely appreciate your prompt support in helping me get the access license so quickly. Your professionalism and efficiency are truly commendable. Thank you for going above and beyond to assist me. Keep up the great work!