Get a Quote

Get a Quote and Find Services to Fit Your Needs 50000+ Satisfied Clients

5000+ Licenses & Registration

15 Branches across India

75 Years + Combined experience

Satisfied Clients

Services

Years Combined Experience

Get Started!

Process of Company Registration in Malaysia

Malaysia is a south-east Asian island nation surrounded by the South China sea from all sides. After independence from British Colonial Rule in 1957, Malaysia gained independence. Since then, the Island Nation has grown continuously at a growth rate of 6.3% and above. It is one of the most industrialized and technologically-advanced nations in all of South East Asia. With the economy seeing an upward trend, the number of investments has gone up in Malaysia. With a multi-ethnical and multi-cultural liberalized market, it offers many business opportunities to foreign investors.

The procedure of company registration in Malaysia is seamlessly straightforward. In Malaysia, companies registered as Public Limited must end their name with the suffix- Berhad or Bhd. For a company registered as Private Limited, it must end its name with the suffix- Sendirian Berhad or Sdn Bhd. Also, to go through the company registration process in Malaysia, the applicant must conform to the eligibility and documentation requirements and the prescribed procedure.

As per the company registration procedure of Malaysia, the applicant must also ensure the requirements prescribed by the Malaysian Local Law. In Malaysia, the primary Corporate Legislation for company regulations is its Companies Act of 2016. Let us look at them in detail.

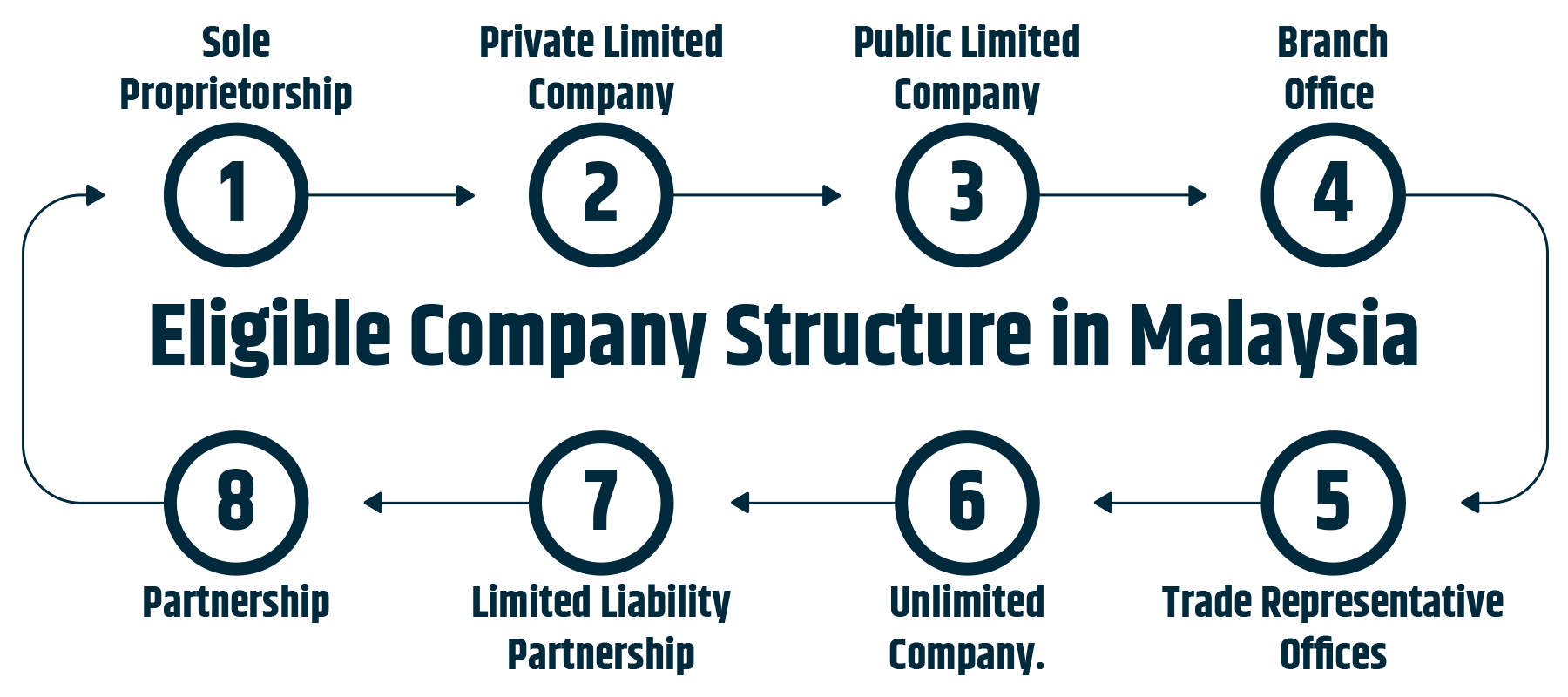

The Malaysian Corporate Legislation guarantees an array of corporate legal structures to its nationals as well as foreigners. The business person can choose the suitable corporate system for himself per his business requirements. Let us look at them in detail one by one.

There are multiple economic sectors thriving in Malaysia. The Malaysian Government offers various incentives to Foreign Establishments to set up their businesses in Malaysia:

The Regulatory Authority for Corporate Registration of the Malaysian Federation is the SSM, i.e., Suruhanjaya Syarikat Malaysia. It is the nodal agency for corporate registrations in Malaysia, also known as the CCM or Companies Commission of Malaysia. As mentioned earlier, the corporate Legislation which regulates corporate entities in Malaysia is the Companies Act of 2016.

There are various benefits of company registration in Malaysia, such as:

The cost to register and run a company in Malaysia is relatively low in comparison to other Asian countries.

You can easily avail of cheap office space on a rent or lease basis in Malaysia. Office spaces are well structured and available in prime business locations in Malaysia.

Companies can hire skilled and professional employees in Malaysia on comparatively lower wages or Cost-to-Companies. It is lesser than the average wages compared with other countries.

The Malaysian Government is a signatory to a number of double taxation treaties with other trading countries. Therefore, there is no issue with paying the Double Taxes on revenue generated by Companies in Malaysia. Also, the Malaysian Corporate Authority levies no withholding taxes on dividends paid outside the country.

Malaysian Authority puts no restrictions on its Corporations upon Repatriation of any of the following:

The Government offers strong incentives and subsidies to registered Corporations in Malaysia to encourage business registration and capital investment.

Many Foreign Investors and Establishments prefer Malaysia as their business destination because their local Legislation guarantees a high level of investor protection.

Before applying for Company Registration in Malaysia, every applicant must ascertain and conform to the required eligibilities, as per the Malaysian Corporate Legislation, needed for the company registration procedure:

Every incorporated entity in Malaysia must have a dedicated office space on a rent or lease basis. This office space must be registered with the Malay Authority. The applicant must provide proof of the office facility at the time of company registration.

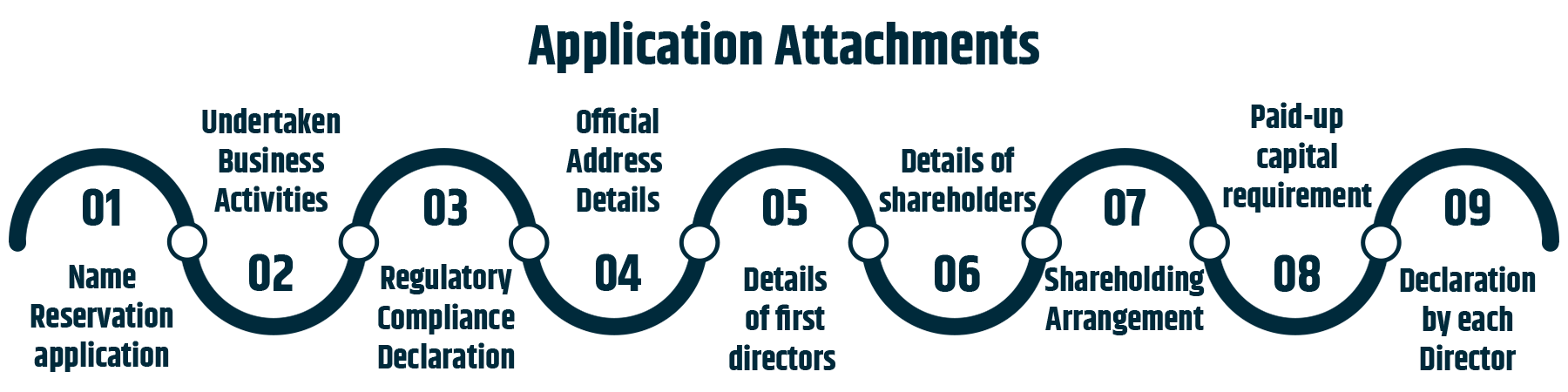

Every company registration applicant in Malaysia must submit the following document to the Authority to further their candidature for company formation in the Asian country:

The registration applicant must provide the declaration for business registration in Malaysia. The declaration must state the information provided in the incorporation application is absolutely true to the applicant's knowledge.

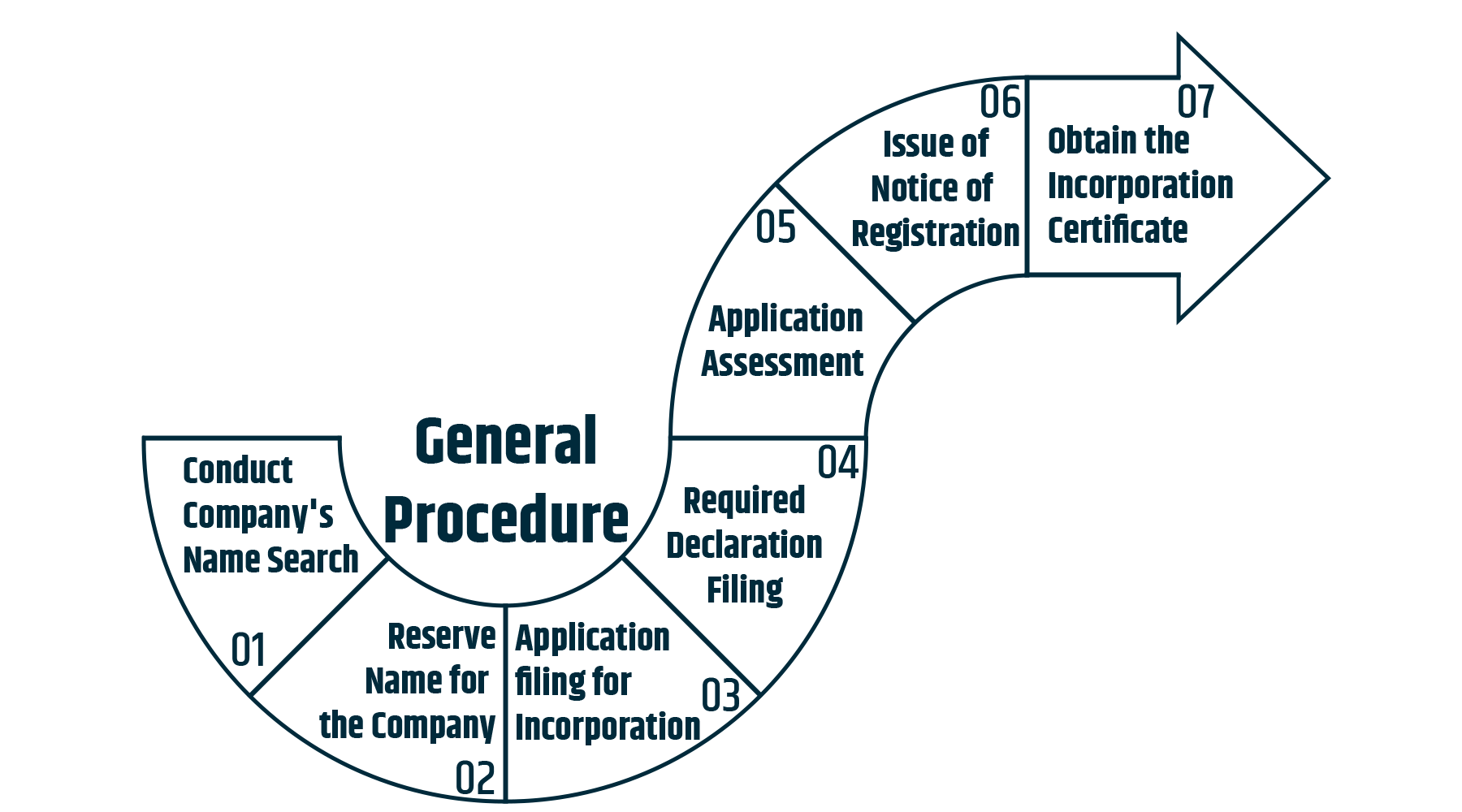

After the application submission, the SSM will review and check the application for any inconsistencies. If no problems are encountered by the SSM related to the application, then it will send a registration notice to the applicant.

If the applicant's filed registration application is in compliance with the registration procedures and submission of the duly attested documents along with the prescribed licensing fee, the SSM will issue the Certificate of Incorporation to the applicant company.

After the Company's incorporation, the newly registered Company must obtain the required licenses from the relevant authorities before starting its business activities as specified in its Memorandum of Association.

Our Incorporation experts provide you end to end company incorporation services in Malaysia by assisting you in the following manner:

We ensure that your company incorporation services requirements for Malaysia are always on time. Our professionals understand the intricacies of company incorporation procedures in Malaysia. Thus, we have expedited the process – helping you incorporate your Company at an affordable price.

So, reach out to our Incorporation Experts and realize your dream of starting your own Company in Malaysia.

Q. What is the procedure for Company Registration in Malaysia?

A. The process for registering your Company in Malaysia is enlisted in the following points:

Q. What are the eligibility requirements for the directors for Company Incorporation in Malaysia?

A. The eligibility requirements for the directors for Company Incorporation in Malaysia are as follows:

Q. What are the documentation requirements for Company Formation in Malaysia?

A. Every company registration applicant in Malaysia must submit the following document to the Authority to further their candidature for company formation in the Asian country:

Q. What are the requirements for gaining company name approval for business registration in Malaysia?

A. The requirements are as follows:

Q. What are the competent economic sectors to register a business in Malaysia?

A. There are multiple economic sectors thriving in Malaysia. The Malaysian Government offers various incentives to Foreign Establishments to set up their businesses in Malaysia:

Q. What are the benefits for foreigners in company registration in Malaysia?

A. There are various benefits of company registration in Malaysia, such as:

For more, refer to the introductory section of this web page.

Q. What are the Double Taxation benefits that the Malaysian Government offers?

A. The Malaysian Government is a signatory to a number of double taxation treaties with other trading countries. Therefore, there is no issue with paying the Double Taxes on revenue generated by Companies in Malaysia. Also, the Malaysian Corporate Authority levies no withholding taxes on dividends paid outside the country.

Q. Who regulates Corporate Bodies in Malaysia?

A. The Regulatory Authority for Corporate Registration of the Malaysian Federation is the SSM, i.e., Suruhanjaya Syarikat Malaysia. It is the nodal agency for corporate registrations in Malaysia, also known as the CCM or Companies Commission of Malaysia. As mentioned earlier, the corporate Legislation which regulates corporate entities in Malaysia is the Companies Act of 2016.

Q. What must be the object of the Corporation for company formation in Malaysia?

A. The objects of the Corporation must be along the following lines:

Q. What are the paid-up capital requirements for business registration in Jakarta?

A. The paid-up capital is decided based on the business activity of the Corporation, such as:

★ ★ ★ ★ ★

I very much appreciate the fact that you guys possess tremendous knowhow of private limited company incorporation. You have exhibited professional and respectful manner towards my query and I would seriously recommend you guys to all the folks looking for outstanding business services.

★ ★ ★ ★ ★

Thanks to their support, I got my trademark successfully. I highly recommend their services for anyone needing help with their intellectual property. The person assigned to me was very cooperative and helpful.

★ ★ ★ ★ ★

Thanks to their support ragistrationwala team, I got my IP-1 license successfully and special thanks to Miss.Kanishka for your great and timing support !!!!!! I have archived my goal one step forward... Thanks for the entire team....

★ ★ ★ ★ ★

Really helped a lot in getting my both VNO licenses. Great experience working with the team and very humble team, thanks for providing the vno license on time.

★ ★ ★ ★ ★

I had a good time working with Registrationwala. Good team. I would recommend their services to others.

★ ★ ★ ★ ★

It was extremely great service of Registrationwala consulting firm, and this firm is providing the best services and worry about the client's required services along the client's satisfaction.

★ ★ ★ ★ ★

Superb Experince! Within no time the trademark registration was on.Highly professional team. I am very much Impressed with the prompt response and efficiency.Thank you.

★ ★ ★ ★ ★

We had taken ISP license from registration wala and the supporting person is very helpful to taken that license his communication and his work is satisfactory and thanks for those services

★ ★ ★ ★ ★

I sincerely appreciate your prompt support in helping me get the access license so quickly. Your professionalism and efficiency are truly commendable. Thank you for going above and beyond to assist me. Keep up the great work!