Get a Quote

Get a Quote and Find Services to Fit Your Needs 50000+ Satisfied Clients

5000+ Licenses & Registration

15 Branches across India

75 Years + Combined experience

Satisfied Clients

Services

Years Combined Experience

Get Started!

Limited Liability Partnership Registration Process

LLP Registration is the process to incorporate a Limited Liability Partnership. It is a business entity governed under the Limited Liability Partnership Act, 2008. A minimum of two partners are requirements for its incorporation in India.

If you intend to do business safely, you need to protect your personal assets. However, if you choose the traditional limited company to keep your assets away from your business, you lost the aspects of a partnership firm. So, is there a way to retain the benefits of a limited company while existing as a partners firm? Yes, there is.

Let us explain limited liability partnership to you.

Limited Liability Partnership is a form of business entity that is seen as a partnership.

However, it does have the limited liability perk protecting the assets of the LLP owners. Introduced by the Limited Liability Partnership act of 2008, it is the most popular form of business infrastructure after a company. In order to establish it, you need to go through LLP registration in India.

Being Limited Liable is not the only way that an LLP differs from a partnership. In a partnership firm, if one partner does something wrong, both the partners are held accountable. However, one of the major benefits of LLP registration in India is that one partner’s misconduct isn’t going to affect the other partner.

The other features of LLP are as follows:

.jpg)

2.jpg)

Incorporating a Limited Liability Partnership in India has the following perks:

Following are the LLP registration requirements you must meet before applying for the certificate of incorporation.

3.jpg)

The following are the documents required for LLP incorporation.

Note:- Your registered office need not be a commercial space; it can be your residence too.

For LLP registration, these documents required are an integral part. Therefore, proceed with the incorporation process only after you have put these attachments together.

The Limited Liability Partnership Registration process in India is quite easy. As a result, several business individuals find it easier to establish their businesses as an LLP. The process is as follows:

The LLP Agreement entails the details of powers wielded by the partners of the LLP. After submission of the agreement, you will get the Limited Liability partnership certificate.

Note: The Central Government can, by notification in the Official Gazette, exempt any class or classes of LLP registration.

The LLP Incorporation document, names of partners and changes, if any, made in the Statement of Account and Solvency, and annual return filed by each Limited Liability Partnership with the Registrar must be available for inspection by any person appointed by the Authority to conduct an inspection.

If in any return, statement or other document required by the Registrar for the inspection purposes, makes a statement:

a) which is false or is knowing it to be false,

b) which omits any material fact knowing it to be material

Then he will be punished with imprisonment for a term which may extend to two years. Also, he can be liable to pay a fine which may extend to five lakh rupees but not less than one lakh rupees.

If any registered LLP is in default of complying with:

Suppose the LLP incorporation fails to make good the default. In that case, the Tribunal can, on application by the Registrar, make an order directing that LLP registration or it's designated partners to make good the default within the specified time.

We, at Registrationwala, provide end-to-end solutions for Limited Liability Partnership registration in India. Our services include:

Thus, if you are looking for services for the formation of a Limited liability partnership without paying high professional costs, call Registrationwala.

Yes, there exists an online LLP registration process that allows you to fill the online application form to obtain a certificate of incorporation for your LLP.

No, while a Limited Liability Partnership possesses the same traits as that of a company including the perks of Limited Liability, Separate legal entities, it is not a company.

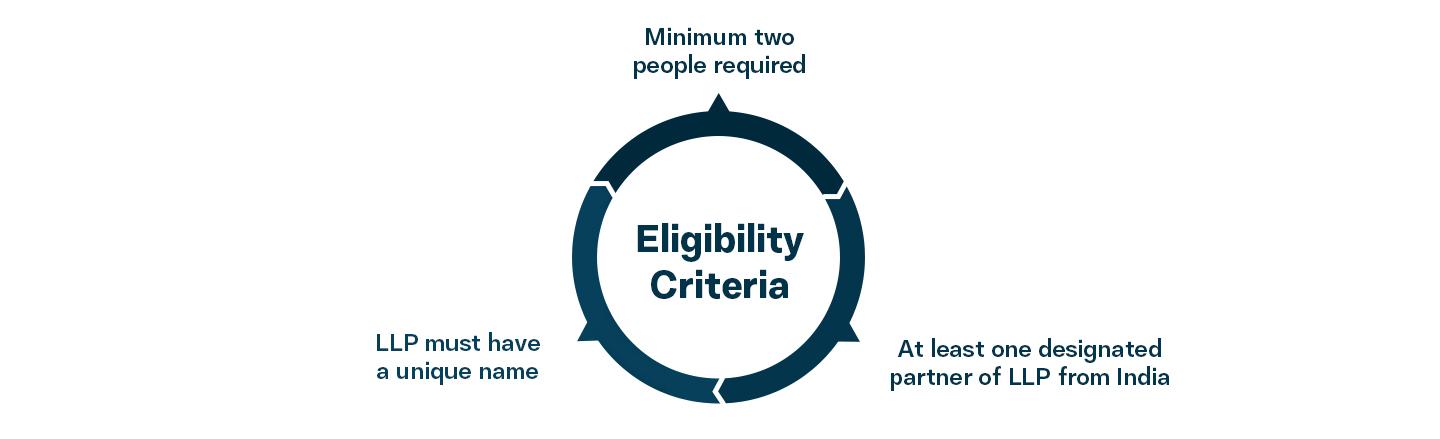

To form an LLP, the eligibility requirements are:

Yes. It is possible to convert an existing partnership firm to LLP. You can learn more about it here.

Yes. It is possible to convert an existing company into a Limited Liability Partnership by adhering to the provisions of clause 58 of Schedule III and IV for the LLP Act. To initiate the conversion, the applicant must fill Form 18 and Form 2

Before applying for LLP incorporation, you must reserve the name of an LLP. You can do so by filing LLP FORM No.1 (Application form to reserve or change the name of an LLP)

Yes. As per the LLP Act, you must suffix the term “LLP” at the end of the name of your Limited Liability Partnership firm.

The LLP Company Registration cost is NIL. The only government fee you have to bear will be decided based on the capital you wish to choose for your Limited Liability partnership.

★ ★ ★ ★ ★

I very much appreciate the fact that you guys possess tremendous knowhow of private limited company incorporation. You have exhibited professional and respectful manner towards my query and I would seriously recommend you guys to all the folks looking for outstanding business services.

★ ★ ★ ★ ★

Thanks to their support, I got my trademark successfully. I highly recommend their services for anyone needing help with their intellectual property. The person assigned to me was very cooperative and helpful.

★ ★ ★ ★ ★

Thanks to their support ragistrationwala team, I got my IP-1 license successfully and special thanks to Miss.Kanishka for your great and timing support !!!!!! I have archived my goal one step forward... Thanks for the entire team....

★ ★ ★ ★ ★

Really helped a lot in getting my both VNO licenses. Great experience working with the team and very humble team, thanks for providing the vno license on time.

★ ★ ★ ★ ★

I had a good time working with Registrationwala. Good team. I would recommend their services to others.

★ ★ ★ ★ ★

It was extremely great service of Registrationwala consulting firm, and this firm is providing the best services and worry about the client's required services along the client's satisfaction.

★ ★ ★ ★ ★

Superb Experince! Within no time the trademark registration was on.Highly professional team. I am very much Impressed with the prompt response and efficiency.Thank you.

★ ★ ★ ★ ★

We had taken ISP license from registration wala and the supporting person is very helpful to taken that license his communication and his work is satisfactory and thanks for those services

★ ★ ★ ★ ★

I sincerely appreciate your prompt support in helping me get the access license so quickly. Your professionalism and efficiency are truly commendable. Thank you for going above and beyond to assist me. Keep up the great work!