Get a Quote

Get a Quote and Find Services to Fit Your Needs 50000+ Satisfied Clients

5000+ Licenses & Registration

15 Branches across India

75 Years + Combined experience

GST Registration definition is, “the process of obtaining a unique identification number for a business required to pay goods and services tax (GST).” Any business in India having an annual turnover exceeding Rs. 40 lakh (or Rs. 20 lakh for special category states) is required to register as a normal taxable entity. Once a business has obtained GST Registration, the GST portal provides it with an Application Reference Number (ARN). This number can be used to check GST registration status online.

In this blog post titled ‘how to check GST registration status’, we will explain all the required steps involved in checking the status of GST registration verification.

GST Registration is an essential procedure for companies in India. Obtaining it ensures adherence to the tax framework set by the Government of India. Any business dealing in supply of goods and services must register for GST according to the CGST Act 2017. GST registration helps businesses to establish their brands as trustworthy and allows them to operate legally.

Now, let's check what is an Application Reference Number in context of GST Registration.

Application Reference Number (ARN) is a code issued during the GST registration process. ARN consists of 15 digits, and is allotted to each GST registration application. Until the GSTIN is issued, ARN serves as an identification and reference number throughout the entire application process.

ARN format is AA999999999999Z. As you can tell, it consists of a combination of letters and numbers. Once your GST registration application has been submitted on the GST portal, the ARN will be sent to your registered mobile number and email address so that you can access it easily.

Want to find out how to check GST status? It’s pretty easy. You do not even need to log in on the GST portal. Just follow the simple steps mentioned below for a quick GST Registration status check of your business.

Step 1: Access the official GST portal. Now, the home page will be displayed on your screen.

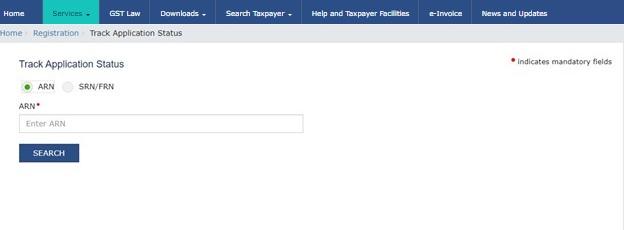

Step 2: On the home page, click on the services tab and then choose the track application status option.

Step 3: On the track application status, select the registration option using the module drop-down list.

Step 4: Now, enter the ARN you received during the GST registration process. You can check your mailbox or phone messages for this number.

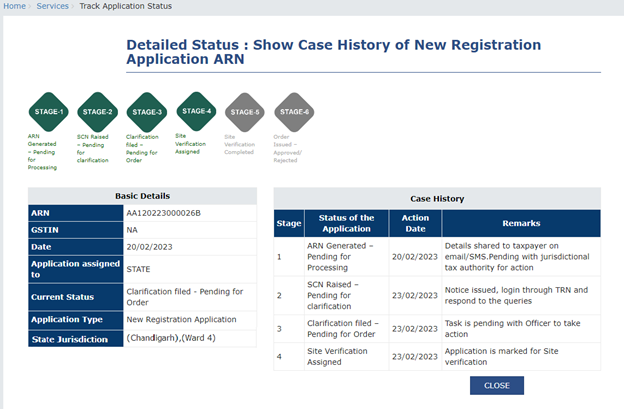

Step 5: Click on the search button and the GST registration status will be displayed on your screen. The status can be pending, approved, rejected, etc.

Step 6: Based on the GST status, you can take the required action. If approved, then you can download the GST registration certificate by clicking on the link for “download”. If rejected/pending, you can follow the instructions provided to address the issue or provide additional GST registration details if required.

Whenever you check the GST application status online with the help of ARN number, one of the following status types may be displayed on your screen:

This GST status indicates that the new registration application for Goods and Services Tax has been filed successfully and is awaiting to be processed by the tax officer.

This status means that the registration application has been denied by the tax officer.

The applicant has voluntarily withdrawn their application for GST registration, according to this status.

‘Pending for clarification’ status is reflected when the tax officer requires further details from the applicant. A notice is issued to the applicant seeking the clarification.

The status shows that application has been successfully submitted and is awaiting the Tax Officer's decision after the applicant has given the desired clarification.

The status will be marked as pending for the officer's order if the applicant fails to submit the necessary clarification within the allotted period.

This status indicates that the application has been accepted by the tax officer. The GST Registration ID and password will be emailed to you in this case.

If this status is displayed on your screen, it means that a site visit is scheduled for the applicant and the verification is assigned to the site verification officer.

This is reflected when the site verification officer is done with the visit and the report has been submitted to the tax officer.

Once an applicant has successfully filed the application for GST registration, they can track the status of registration. For this, ARN number must be used. Using this number, you can check whether your GST registration status is approved, pending or rejected.

If you want to apply for GST registration for your company without any hassle, connect with Registrationwala. We’ll help you to obtain a GST registration certificate as soon as possible.

Q1. What is the full form of ARN in GST?

A. ARN stands for Application Reference Number. It is a unique 15-digit number generated after submitting the GST registration application on the GST portal.

Q2. Which portal is used for GST status check India?

A. The official GST portal www.gst.gov.in/ is used for GST registration lookup in India.

Q3. How to verify GST Registration status?

A. For this, visit the GST portal, and then click on services tab and then on track application status. Now, enter all the required information asked on the page and click on the search button.

Q4. Can I download the GST registration certificate after approval?

A. Yes, once your application is approved, you can download the GST registration certificate directly from the GST portal using your login credentials.

Q5. Can I reapply if my GST registration is rejected?

A. Yes, you can fix the issues mentioned and apply again.

Hey there, I'm Dushyant Sharma. With the extensive knowledge I've gained in past 8 years, I have been creating content on various subjects such as banking, insurance, telecom, and all the important registration and licensing processes for various companies. I'm here to help everyone with my expertise in these areas through my articles.

Want to know More ?