What are Small Scale Industries

- May 05, 2025

- Registrationwala

- Home

- /

- Knowledge Base

- /

- Business Registrations

- /

- MSME

- /

- What are Small Scale Industries

What are Small Scale Industries

Preface: This post was originally published in 2023 and has been updated on May 05, 2025, to provide you with the most current and accurate information.

SSI full form is Small Scale Industries. These are industries which produce, manufacture or provide services on smaller levels. The Small Scale Industry comes under the Micro, Small, and Medium Enterprises Act of 2006. Examples of small-scale industries are manufacturing business, bakeries, school stationery, beauty parlours, paper bag industry, and others.

The small scale industries registration is voluntary, so many businesses don’t get SSI registration certificates. However, the registration of small scale industries is recommended due to benefits associated with it. Some benefits include tax benefits, government subsidies and lower interest rates on loans.

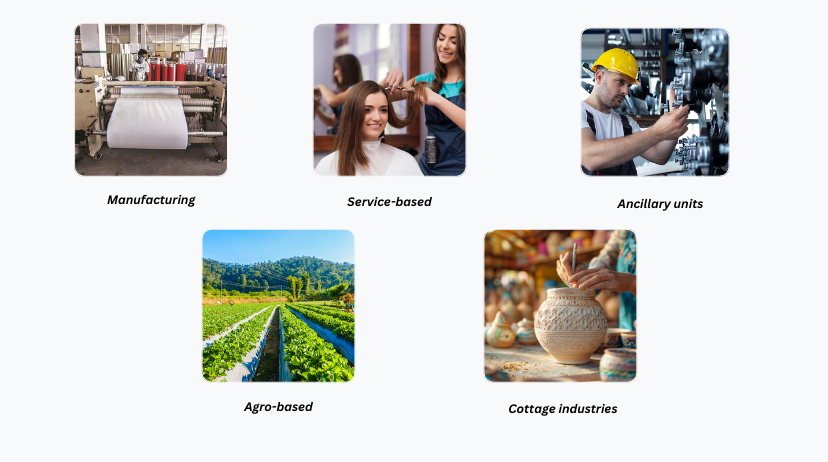

Types of Small Scale Industries

There are various small scale industries in India, such as:

-

Manufacturing: Involves producing various goods such as textiles, electronics, food items, and other consumer products. The cost of equipment and materials can differ significantly based on the specific industry.

-

Service-based: Comprises businesses that deliver services, including repair work, beauty salons, small consultancy setups, and IT solutions. Initial costs usually cover office setup, equipment, and marketing.

-

Ancillary units: These enterprises support larger industries by supplying parts or offering services such as equipment maintenance and repair. Investment needs vary depending on the nature and extent of services or production involved.

-

Agro-based: Focuses on sectors like food processing, dairy, poultry farming, and organic agriculture. Expenses generally include land acquisition, tools, seeds, fertilizers, and livestock care.

-

Cottage industries: Small-scale, home-operated ventures centered around traditional crafts and handmade products. Typical costs involve purchasing raw materials, tools, and covering promotional activities.

MSME Criteria for Investment and Annual Turnover

Here is the MSME criteria for investment and annual turnover:

Micro Enterprises

For micro enterprises, here is the MSME criteria:

-

Investment in Plant and Machinery/Equipment: Not more than Rs. 2.5 crore.

-

Annual Turnover: Not more than Rs. 10 crore.

Small Enterprises

For small enterprises, the MSME criteria is as follows:

-

Investment in Plant and Machinery/Equipment: Not more than Rs. 25 crore.

-

Annual Turnover: Not more than Rs. 100 crore.

Medium Enterprises

Let’s see the MSME criteria for medium enterprises:

-

Investment in Plant and Machinery/Equipment: Not more than Rs. 125 crore.

-

Annual Turnover: Not more than Rs. 500 crore.

Role of Small-Scale Industries in the Growth of the Economy in India

In the growth of the economy the small-scale industries play a crucial role. Let’s check below:

-

The total SSI sector comprises more than 1,05,21,190 units, spreading all over the country and 55% of units located only in rural India.

-

Maharashtra, Tamil Nadu, and Uttar Pradesh collectively contribute nearly 40 per cent of all registered MSMEs in the country, according to a CBRE-CREDAI report.

-

The service sector emerges as a dominant sector in the total SSI sector.

-

For the Make in India initiative, the SSI sector is best, as it focuses on manufacturing products in the country and selling them worldwide. More supply of products creates more demand and boosts the economy.

How You Can Create a Small-Scale Industry?

The entrepreneurs of SSI should pass all the stages shared below to establish an SSI:

-

Choose SSI Ownership Structure: The very first step of establishing an SSI is to choose the ownership structure. There are different types of SSIs, such as manufacturing industries, ancillary units, service industries, cottage units, and agro-based industries.

-

Location: The area of the factory must be decided on the basis of plot, area, market, structure of the land and open area. After selecting the location, establish the SSI unit to start the business operations. The registered address of the unit becomes the address of the location.

-

Machinery and Equipment: The machinery and equipment required for the manufacturing units must be under the set cost. The latest technology machinery should be procured and installed in the SSI unit.

-

Recruitment of Manpower: For installed machinery, manpower is needed. After getting all the permission, hire manpower to run the installed machinery. The small-scale industries provide employment to most labourers in the country.

-

Quality of Product: Once the SSI gets the raw material, they can start the production of the units. Sold the produced products in the market after manufacturing the desired units of the products. But before selling the products, obtain the quality certificate from the concerned authorities such as AGMARK, FSSAI, etc.

Government Schemes for Small Scale Industries

To promote the Micro, Small and Medium Enterprises (MSME) sector in India, the government has come up with different initiatives and schemes to support the sector and increase their contribution to the Make in India initiative. Check these schemes below:

Collateral Free Loans

The SSI is a priority sector for providing advances and 40% of scheduled commercial banks must be on priority for these sectors. As per the rule of RBI, banks can provide composite loans up to Rs. 1 crore to MSME entrepreneurs for working capital and term loan requirements. The priority for loans is provided to small-scale industries in the finance sector.

The collateral-free loans work as a major source of support to small industries. In support of this, the Ministry of MSME has launched a Credit Guarantee Scheme (CGS) to create a smooth flow of credit. The scheme covers loans up to Rs. 10 crore for small enterprises.

Equity Support and Lower Interest Rates

Equity support has been provided to entrepreneurs for starting new projects in the MSME sector. The support is only provided to those companies which fulfil the specified eligibility criteria.

Entrepreneurs can need equity to expand their business, upgrade the technology and machines, and diversify the products from existing companies. For all these reasons, SSI requires equity. The SSI that looks for loans from the banks has the benefit of lower interest rates. As you have a small-scale industry unit, you will be provided a loan on special concession rates.

Assistance for Technology Development

The Small Industries Development Bank of India (SIDBI) has set up a Technology Development & Modernisation Fund (TDMF) scheme for direct assistance to SSI to scale their industrial units in the sector. Under the scheme, for the following reasons assistance provided:

-

Encourage existing industrial units.

-

Meeting the expenditure on the purchase of capital equipment.

-

Upgradation of technology.

-

Improve product quality and packaging cost.

-

Acquisition of ISO-9000 series certification.

Conclusion

Lastly, it can be stated that industries have expanded from organised large and medium industries to modern Small Scale Industries and unorganised traditional industries. Along with this, there are some government tenders that are only open to SSI. So, if you want to register as an SSI, visit the Udyam Registration Portal. Also, you can reach out to Registrationwala to obtain the SSI Certificate a.k.a MSME Registration License.

Frequently Asked Questions (FAQs)

Q1. What is SSI certificate full form?

A. SSI certificate full form is Small Scale Industries certificate.

Q2. Is the SSI certificate and MSME certificate the same?

A. Yes, the SSI (Small Scale Industry) certificate and the MSME (Micro, Small, and Medium Enterprises) certificate essentially refer to the same certification.

Q3. How to register an MSME in India?

A. To register an MSME in India, you need to visit the Udyam Registration Portal.

Q4. What is Small Industries Development Bank of India (SIDBI)?

A. SIDBI is an independent financial institution. Its aim is to support growth and development of MSMEs in India.

- 5160 views