Get a Quote

Get a Quote and Find Services to Fit Your Needs 50000+ Satisfied Clients

5000+ Licenses & Registration

15 Branches across India

75 Years + Combined experience

Preface: This post was originally published in 2023 and has been updated on September 02, 2025, to provide you with the most current and accurate information.

To provide the loan facility in urban and rural areas, the Government of India has introduced the concept of microfinance institutions. In previous years, the MFI has gained lots of popularity because it is helpful for those people who require small loans for their business, constructing houses, getting better healthcare facilities, etc.

Through these microfinance companies, the people are expanding their present opportunities. Also, women, unemployed people and people with disabilities can benefit from these microfinance institutes. Now when you know the benefits of MFI, you must be wondering how to register a microfinance company. So, the answer to this question is shared below. Check the detailed process to set up a microfinance company in India.

Microfinance Companies also known as MFC provide credit services to underprivileged sections of society who don’t have access to mainstream businesses. It works similarly to the NBFC but provides significantly lower credit than the NBFC. Mostly, microfinance companies provide credit in the bandwidth of Rs. 10,000 to Rs. 20,000 to a person who wants to start a business.

Below are the important microfinance RBI guidelines MFI companies must follow:

Microfinance companies have multiple ways to get funding and several ways are as follows:

Ideally, the Reserve Bank of India has allowed only NBFCs to conduct financial businesses. However, these are some exemptions to register a microfinance company in India. There are two ways to register a microfinancing company and these are as follows:

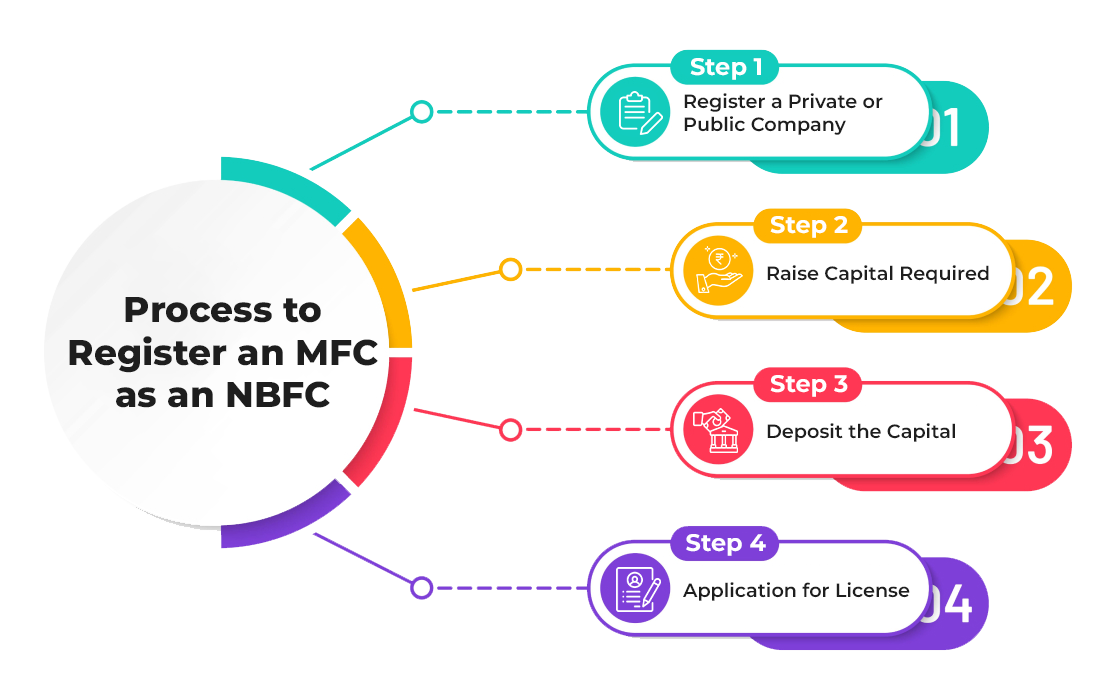

Register a Private or Public Company: To register as an NBFC, first, you must register as a private company or public company. To form a private company, there is no minimum capital requirement but at least 2 members are required for incorporation. For a public company, at least 7 members and Rs 5 lakh are required.

Raise Capital Required: The minimum net owned fund of Rs. 5 crore is required except northeastern region, here the minimum capital required is Rs. 2 crore.

Deposit the Capital: Once the capital is collected it should be deposited in a bank as a fixed deposit and obtain a ‘No lien’ certificate for the same.

Application for License: Last, the application must be filled and submitted online or offline with all the documents required to form NBFC to the Regional Office of the Reserve Bank of India.

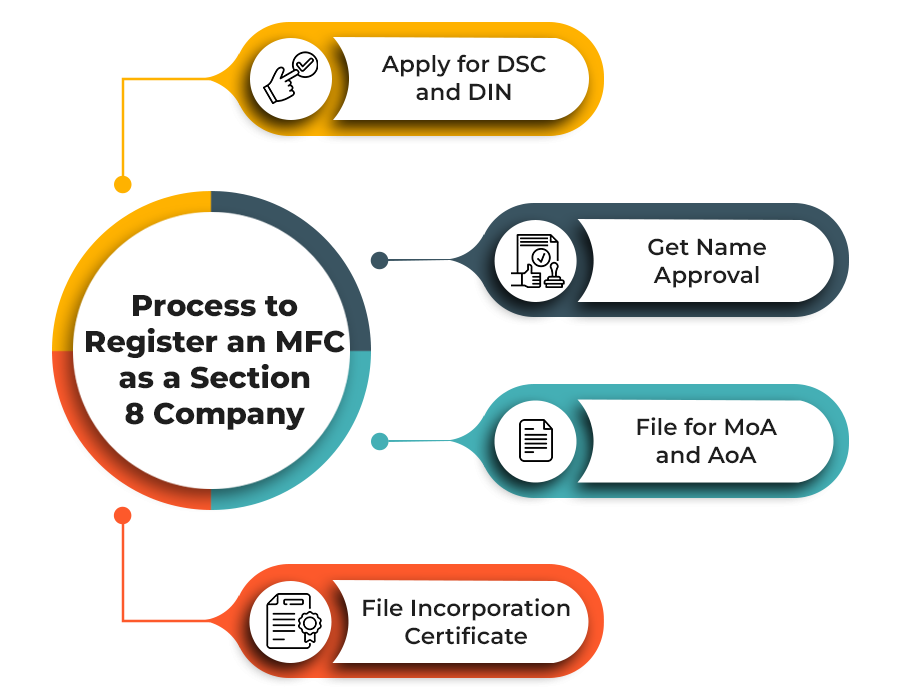

Apply for DSC and DIN: To form a Section 8 micro finance company the first step is to get a Digital Signature Certificate to sign the digital documents, it shows the credibility of the document. Also, the Director Identification Number for every director of the company.

Get Name Approval: Fill out the form INC-1 to get approval for the name and follow the guidelines to set a name. As per ICSI, the name must include words like - Foundation, Forum, Association, Federation, Chambers, Confederation, council, Electoral Trust and the like etc.

File for MoA and AoA: After name approval, the company have to draft a Memorandum of Association and Article of Association.

File Incorporation Certificate: File an incorporation certificate with the relevant documents and Form INC-12 to obtain a license. The basic documents required are as follows:

It has been seen by the authorities that certain microfinancing companies fail to work as per the set guidelines for the disbursement of the loan. Some other issues are as follows:

Charge a higher rate of interest from the poor people.

Provide credit to newly formed entities within 15 days of formation.

Work without proper scrutiny with all the related authorities at the time of disposal including the credit facilities.

The state government is taking strict measures to ensure the microfinancing companies work under the prescribed guidelines. The NBFCs who want to take advantage of various funding options from the banks must obtain the NBFC status.

To conclude, microfinance companies are an important part of the finance industry. So anyone who is looking to start an MFI will play a significant role in this industry. To complete a microfinance company registration, one must look for professional advice. At Registrationwala, we assist you in the process, from application, and documents, to finally obtaining the microfinance company license.

Q1. How to start a microfinance company?

A. To start a microfinance company in India, you need to choose between for-profit NBFC MFI and non-profit Section 8 company. Once you decide on the entity, you must incorporate the company and fulfill capital requirements. For NBFC MFI, you need to secure a license from RBI. However, a microfinance section 8 company does not require this license.

Q2. What are the documents required for microfinance company registration?

A. Documents required for microfinance company registration include memorandum of association, articles of association and certificate of incorporation among other documents.

Q3. Which authority issues micro finance license in India?

A. The Reserve Bank of India (RBI) issues micro finance license in India.

Q4. What is microfinance section 8 company?

A. It refers to a micro finance company that is registered as a non-profit section 8 company. It provides small loans to underserved low-income populations.

Q5. What are the benefits of microfinance?

A. Benefits of microfinance are access to credit, better rates for loan repayment, empowerment of women, financial inclusion and poverty reduction.

Q6. What are the features of microfinance?

A. The features of microfinance include small loans for low-income households, minimal or no collateral requirements and short loan tenures.

Hey there, I'm Dushyant Sharma. With the extensive knowledge I've gained in past 8 years, I have been creating content on various subjects such as banking, insurance, telecom, and all the important registration and licensing processes for various companies. I'm here to help everyone with my expertise in these areas through my articles.

Want to know More ?