E-filing is the process of filing income tax returns electronically. One can easily file their tax returns through www.incometax.gov.in from the comfort of their home.

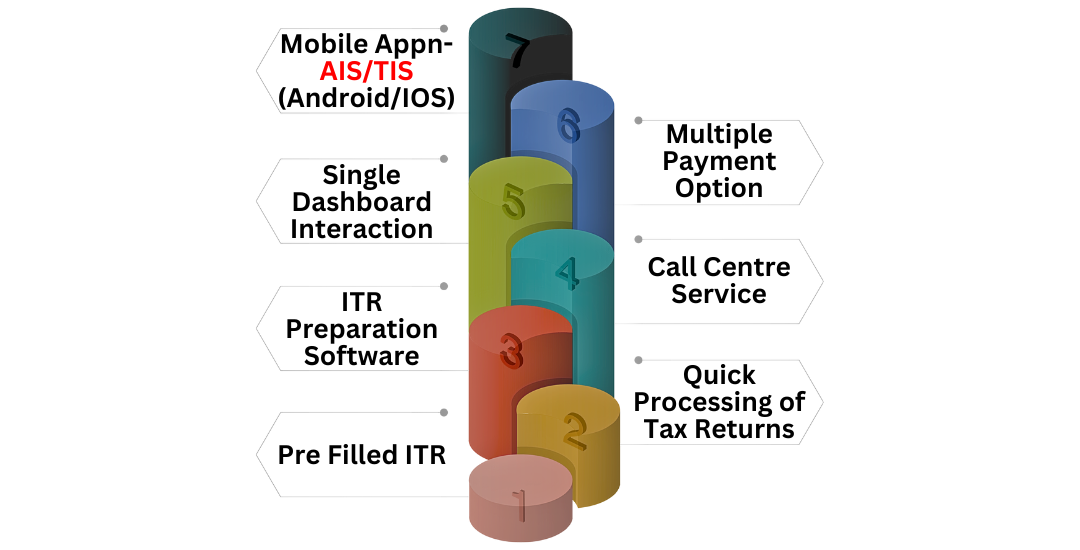

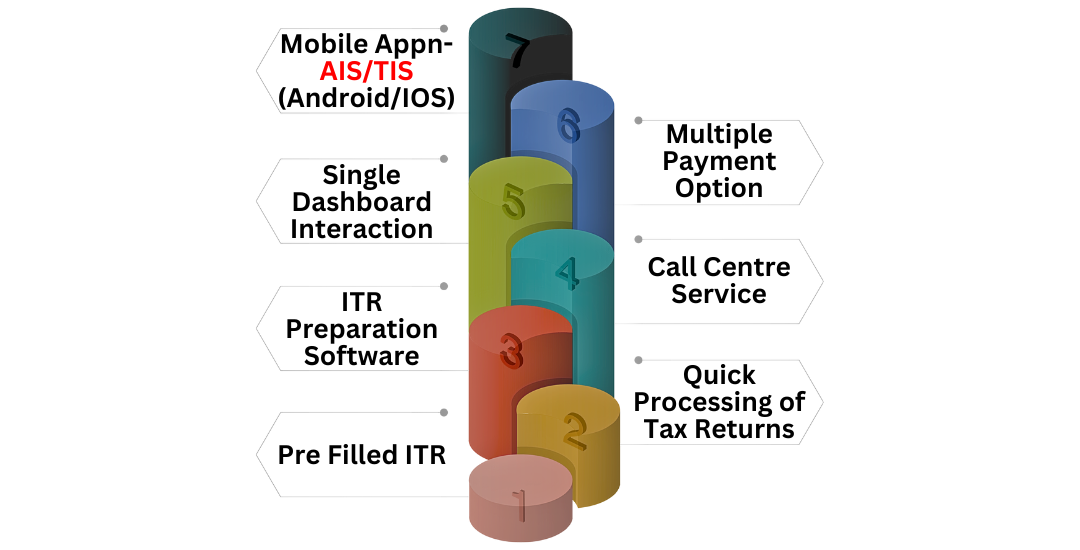

Key Features of the Income Tax E-filing Portal:

- Quick Refunds: The e-filing portal ensures a smooth process when the taxpayer files return. The swift processing of the income tax leads to quicker refunds to the taxpayers.

- Software for preparing ITR: All taxpayers get free access to a software which is useful in preparing ITR.

- Call Centre Service: In case of any complaints or queries, taxpayers can call on the tax helpline numbers & email ids.

- PAN/TAN Updation - +912027218080

- E-filing and Centralized Processing Center - 1800 103 0025, 1800 419 0025, +91-80-46122000, +91-80-61464700

- TDS Centralized Processing Centre (TRACES) - 18001030344, +911204814600, contactus@tdscpc.gov.in

- For clarification related to Income-tax portal - www.incometax.gov.in - 0120-2770483, 2770438 (Fax), webmanager@incometax.gov.in

- Single Dashboard Interaction: All the interactions, uploaded details, and pending actions concerning PAN can be accessed through a single dashboard. This makes it easier for the taxpayers to submit and check the communication from the department and take the next steps accordingly.

- Multiple Payment Options to Choose from: A taxpayer has multiple payment options to choose from for the purpose of paying tax such as, UPI, Net Banking, Credit Card & NEFT. This makes the process of paying taxes easier and promotes digital transactions.

- Mobile Application: Taxpayers can easily check their Annual Information Statement (AIS) and submit their feedback to the tax department through a mobile application called AIS for Taxpayers.

- Android users can download AIS for Taxpayers through this link

- iPhone users can download AIS for Taxpayers through this link

- Pre-filling Details of the ITR: Taxpayers can pre-fill some of the ITR details such as, their income, house property, capital gains and profession/business. TDS and SFT statements of the taxpayers decide the details that can be pre-filled.

Services Available on the Income Tax Portal

The E-filing portal can be availed for the following services:

- E-Verify the Return - This is a pre-login service i.e., you do not have to login to the e-filing portal to avail this facility. There are multiple modes available for e-Verifying your ITR. Furthermore, you can also verify other Income Tax related submissions, services, responses, and requests on the e-Filing portal itself in order to complete the respective processes successfully.

For the purpose of e-verification, you can pick any of the following modes stated below:

-

- Digital Signature Certificate

- Aadhaar OTP

- Electronic Verification Code (using bank account/demat account)

- Electronic Verification Code (using Bank ATM - offline method)

- Net Banking

- Verify PAN - Verify PAN is a service which can be opted by both registered and unregistered users on the e-Filing portal for all users except External Agencies. External Agencies can access this service after log in.

With this service, you can:

-

- Check if the details of PAN, such as Name on the PAN card, Date of Birth etc. are correct/incorrect

- Verify if PAN is active

- Link Aadhaar - The Aadhar PAN linking is automatically done for the new applicants in the application stage itself. As for the PAN holders who were allotted PAN on or before 1st July, 2017, linking the PAN with Aadhar is mandatory as per the Section 139AA of the Income Tax Act, 1961.

- Tax Payment Through Gateway - With this service, you can pay the tax online on the e-filing portal in pre-login as well as post-login mode by using Payment Gateway which enables you to pay the tax using Debit Card, Credit Card, Net Banking, and UPI. The selected Payment Gateway will redirect its own page and you can easily choose your mode of payment. The transaction charges will be deducted as stated in Annexure 1.

- The Income Tax Return Status -

This service can be availed by:

-

- All taxpayers who have filed ITRs against their PAN

- Authorized Signatory, Registered e-Return Intermediary and Representative Assessee for ITRs filed by them in such a role

With the help of this service, the above users can check the following details of ITRs filed:

-

- View and download the ITR-V Acknowledgement, uploaded JSON (from the offline utility), complete ITR form in PDF format, and intimation order

- View the return(s) that is/are pending for verification

- Report Account Misuse - If you think your e-filing account has been accessed by an unauthorized person, you may be a victim of cyber crime. You can report such an incident to the concerned police department or cyber-cell authorities as an initial step. Any complaint of account misuse made before the Income Tax Department should include a copy of FIR/Criminal Complaint and must contain all the details which are relevant to the incident.

- Submit information - Tax Evasion or Benami Property - If you have any information about someone with a benami property (i.e., a property bought in name of someone who isn't the true beneficiary) or a case of tax evasion, you may register a complaint by visiting the TEP e-filing portal at following link:

- Tax Calendar - You can check the Tax calendar to check important dates related to taxes. For the February calendar, here are the important dates:

|

7 February 2024

|

Due date for deposit of Tax deducted/collected for the month of January, 2024. However, all the sum deducted/collected by an office of the government shall be paid to the credit of the Central Government on the same day where tax is paid without production of an Income-tax Challan.

|

|

14 February 2024

|

Due date for issue of TDS Certificate for tax deducted under section 194-IA, 194-IB, 194M & 194S (by specified person) in the month of December, 2023.

|

|

15 February 2024

|

Due date for furnishing of Form 24G by an office of the Government where TDS/TCS for the month of January, 2024 has been paid without the production of a challan.

Quarterly TDS certificate (in respect of tax deducted for payments other than salary) for the quarter ending December 31, 2023

|

- Calculate TDS on cash withdrawal - You can instantly calculate your TDS amount with the help of the TDS calculator.

- Comply to Notice - This is a pre-login service given to the assessee to submit their response to the notices issued.

- To Know your AO - You do not need to login to the e-filing portal to avail this service, but it requires you to have a valid PAN. You can use this service to view the details of the Jurisdictional Assessing Officer (AO) for a particular PAN.

- Instant E-PAN - This facility is available to those who have not been allotted a PAN but possess Aadhaar details. This is a pre-login facility which enables users to:

- Obtain digitally signed PAN in electronic format, free of cost, with the help of Aadhaar and your mobile number linked with Aadhaar,

- Update PAN details as per Aadhaar e-KYC,

- Create e-filing account based on e-KYC details after allotment/updation of PAN, and

- Check status of pending e-PAN request/Download e-PAN either before or after logging in to the e-filing portal.

- Authenticate Notice/order by ITD - This service can be availed by both registered and unregistered users to verify the authenticity of a Notice, Order, Summons, Letter or any correspondence issued by Income Tax Authorities.

- Tax Information and Services - With the help of this service, one can view their tax credit, locate TIN facilitation center, check penalties and prosecution, etc. All the information about the taxes and the portal’s services are mentioned on this single page.

- Know TAN details - This service can be used by both registered and unregistered users to view the TAN Details (Basic details and AO details) of a tax deductor and collector for a TAN.

- Know Tax Payment/Refund Status - The status of the refund can be easily checked by accessing the income tax e-filing portal or the NSDL website.

Basic Requirements for E-filing Income Taxes

- The user is required to have a valid user ID and password on the e-filing portal.

- The PAN provided should be in use and also linked to the Aadhar card.

- For e-verification, a valid mobile number must be linked to the Aadhar/E-filing Portal/Bank.

Things to Keep in Mind Before E-Filing Income Tax

- Don’t forget to quote your Aadhar while filing ITR. It is mandatory as per the Finance Act, 2017.

- If you have multiple bank accounts, make sure you mention all of them in your ITR form.

- Understand all the ITR forms and their relevance before filling them.

- If you have an additional source of income apart from your salary, such as rent or capital gains, make sure you mention their details.

- Keep checking for recent updates before filing ITR, as the tax laws keep changing from time to time.

- Try to fill ITR prior to the last day, as sometimes the portal can face technical glitches. In case you miss filing your ITR by the due date, you can file the belated return by 31st December, 2024. However, you will be required to pay a penalty for the late filing. The maximum penalty of Rs 5,000 will be imposed if you file your ITR after the due date of 31st July but before 31st December, 2024.