Get a Quote

Get a Quote and Find Services to Fit Your Needs 50000+ Satisfied Clients

5000+ Licenses & Registration

15 Branches across India

75 Years + Combined experience

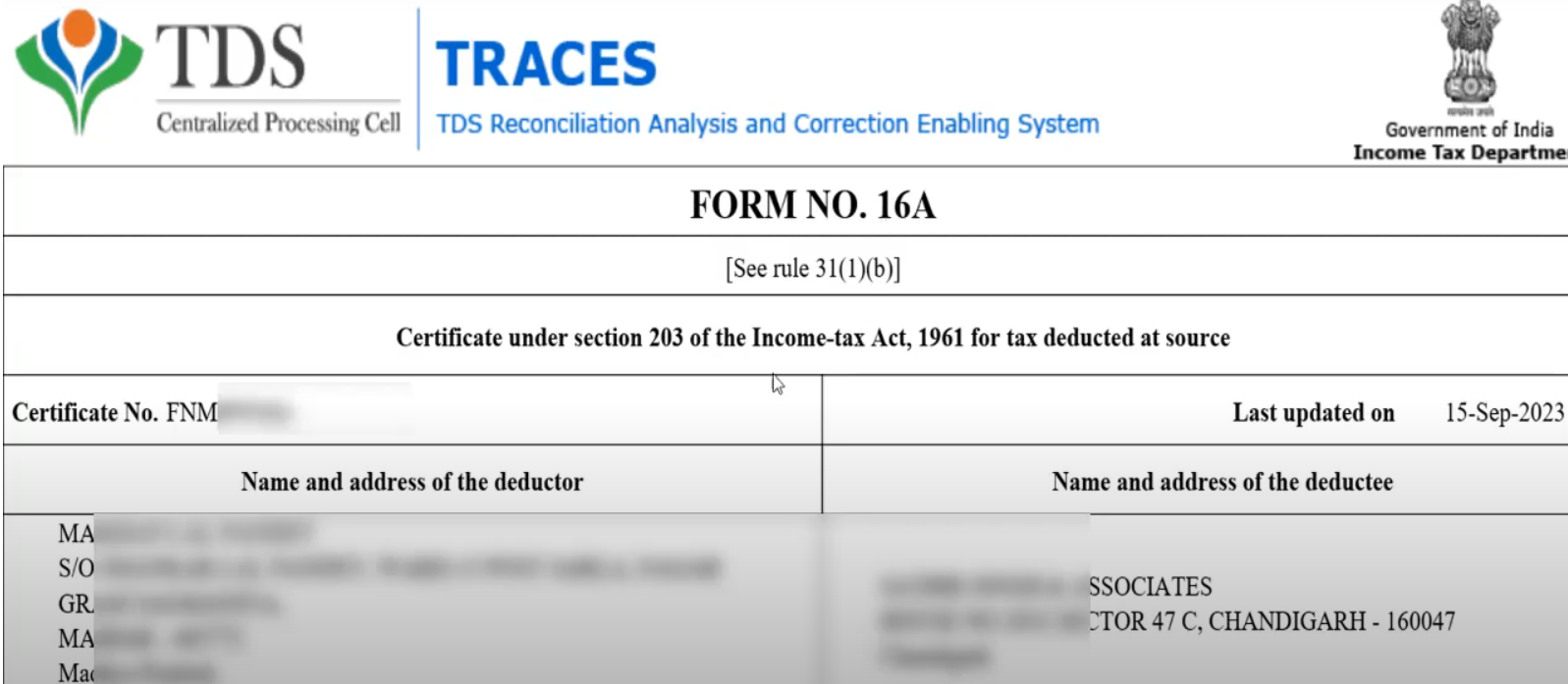

TDS Certificate’s full form is Tax Deducted at Source Certificate. The TDS certificate is a document issued by the deductor that shows the amount of tax that has been deducted from the deductor's salary or other income sources. If you want to know how to download a TDS certificate, then check out this guide!

The T.D.S Certificate is an essential document for a taxpayer. It serves as a proof that taxes have been deducted from income at source and the payer has remitted them to the government. You can access the Tax Deducted at Source Certificate online by visiting the official TRACES portal.

To download TDS certificate, make sure you fulfill all the key prerequisites:

You must have a stable internet connection for completing the T.D.S certificate download process.

You must have an account on the official TRACES portal. If you do not have an account, then make sure to create one. Without an account, you can initiate the download process.

Make sure that the TDS deducted has been paid to the government, as this is necessary for the issuance of T.D.S certificate.

It is crucial to have specific details such as assessment year, TAN, and the relevant quarter of deduction to access/download the certificate.

In the TDS return, the PAN number of both the deductor (the entity that is deducting TDS) and the deductee (the person or entity receiving the payment) must be mentioned correctly.

Having a valid PAN and TAN are essential. Without them, you cannot download the certificate of TDS.

After ensuring that you meet all the requirements, you can go ahead and download the certificate of TDS!

For downloading the T.D.S certificate online, you must visit the TRACES portal. The portal allows you to download the certificate for TDS if you have a valid PAN. Here are the steps you need to follow:

Step 1: Visit the TRACES portal.

Step 2: Now, on the homepage, you must locate the Login option and click on it.

Step 3: On the next page, enter your User ID, password, TAN/PAN and password. Now, click on Login.

Step 4: Thereafter, go to the ‘Downloads’ section and use the dropdown menu, choose Form 16A.

Step 5: Select the FY (Financial Year) and Q (Quarter) for which you want TDS certificate, the form type and PAN. Then, click on ‘Go’.

Step 6: Check all the details that appear on your screen and in Form 16A. After checking, click on ‘submit’.

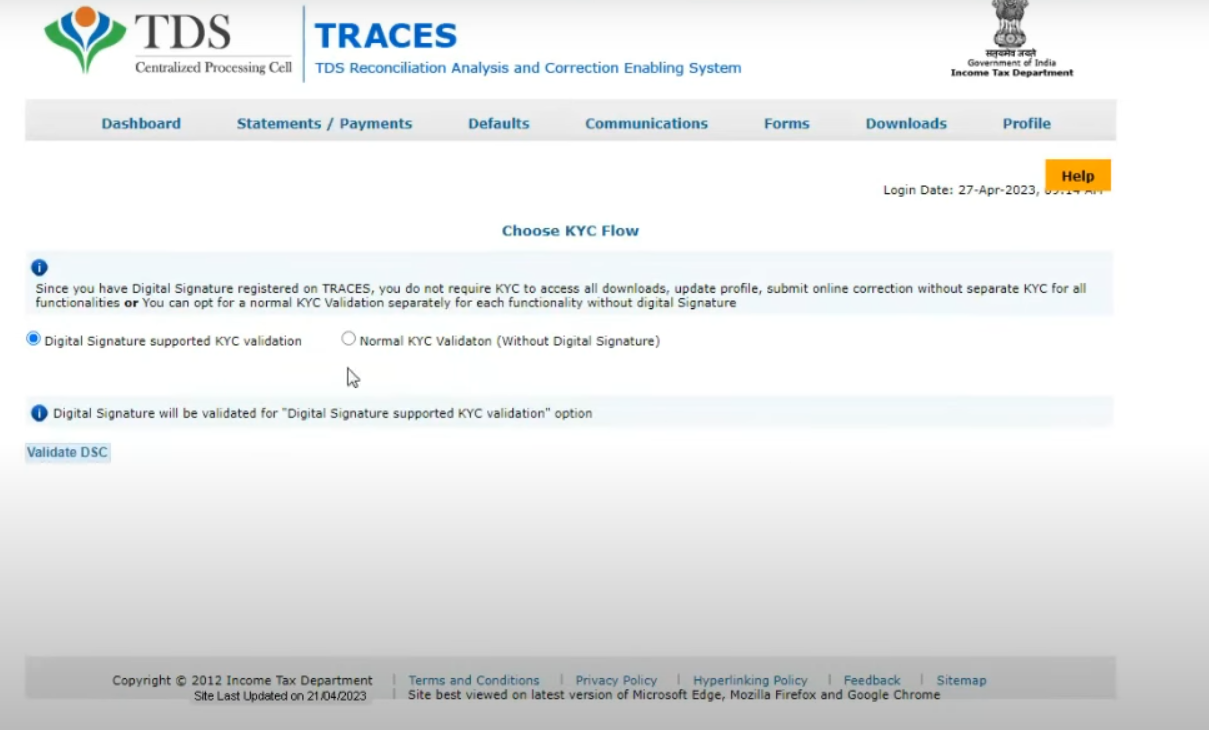

Step 7: Now, you need KYC validation. There are two ways to do this. Using DSC, and without using DSC. If you want to use DSC, click on the ‘validate’ option, enter the DSC password, and click on ‘sign’. If you do not have DSC, then enter details such as Token number of ITR filed, challan details, PAN and TDS amount deposited. After this, click on proceed.

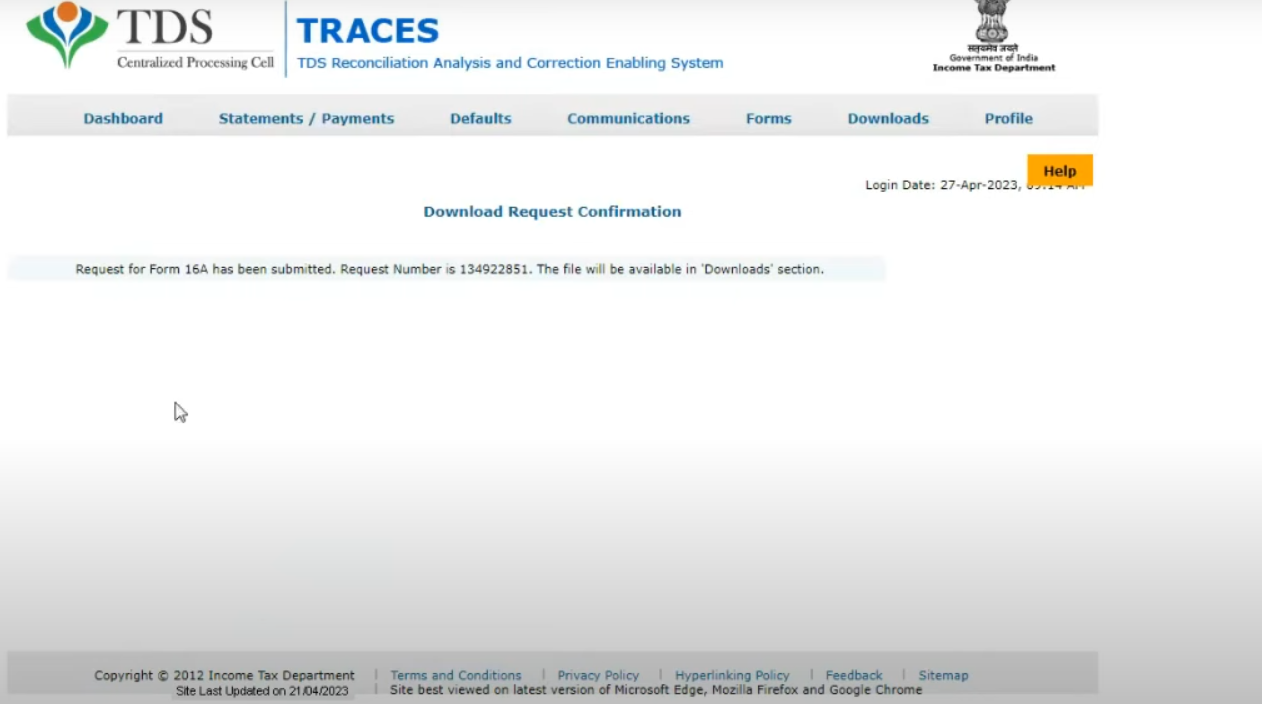

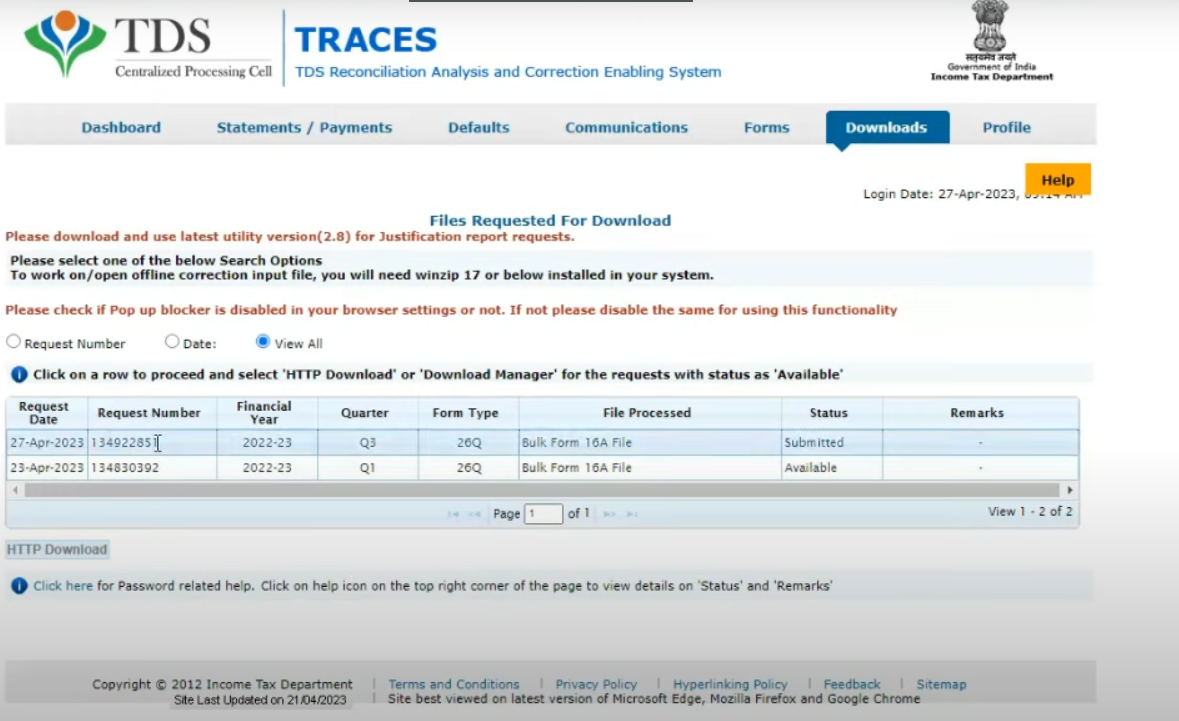

Step 8: After successful validation of KYC details, a message and a request number will appear on the screen. After the request status is ‘submitted’, wait for 24-48 hours. When the status is ‘available’, you can access and download the T.D.S certificate (Form 16A) from the ‘Download’ section.

Step 9: Now, you need to enter the request number or request date and then choose ‘view all’. Click on the download option if the status is ‘Available’.

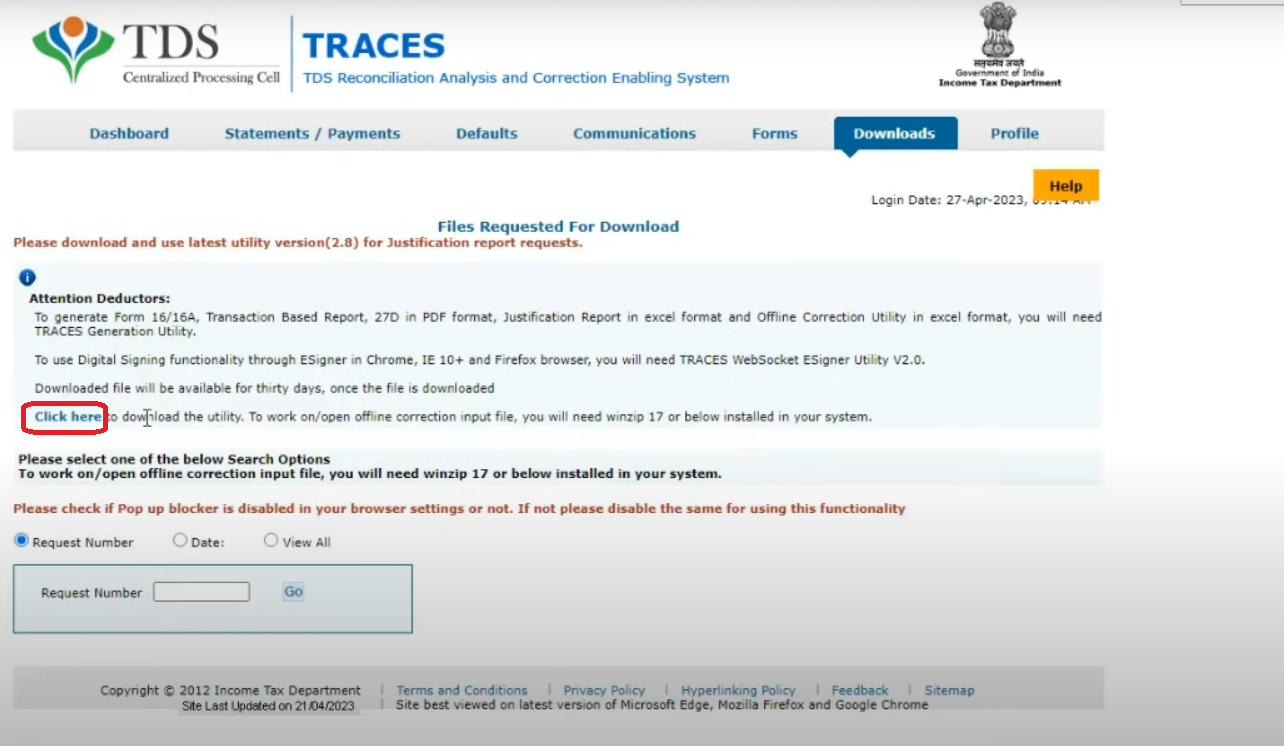

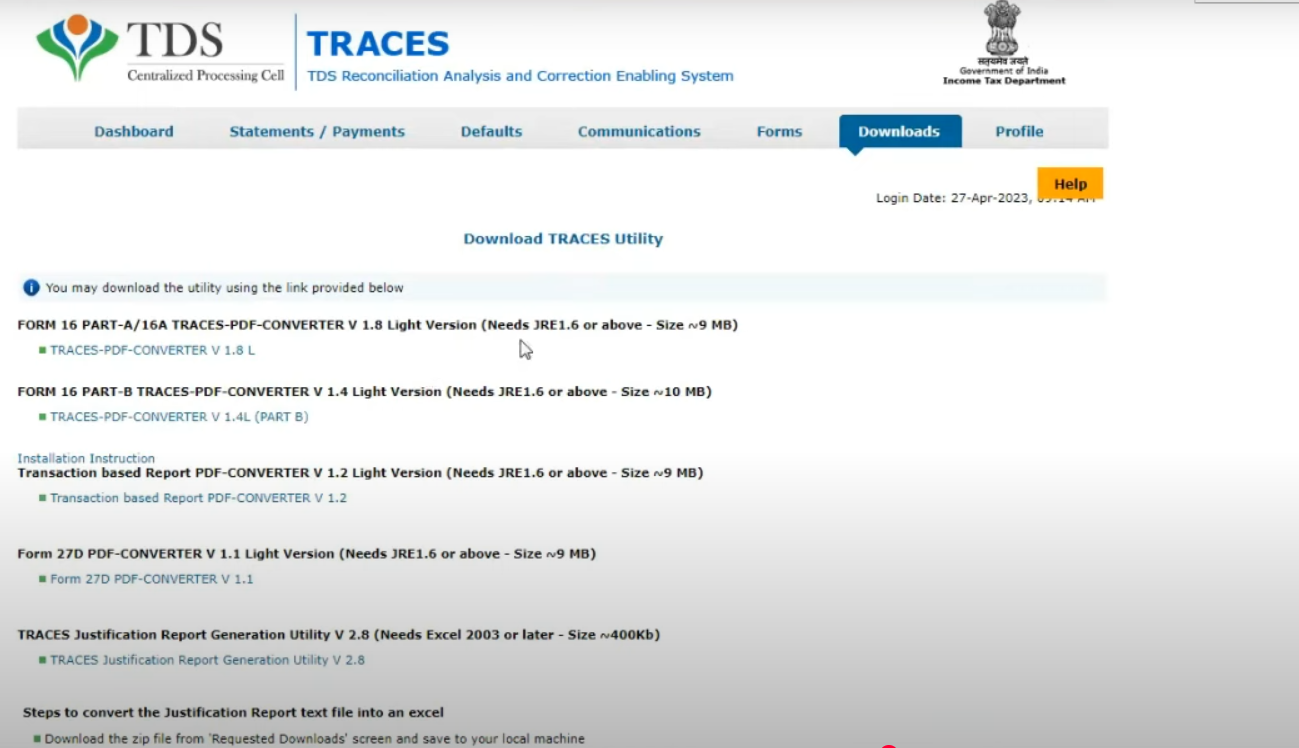

Step 10: Now, you must download TRACES Utility. Go to downloads, then choose ‘files requested for download’, then select ‘click here’. After this, enter the captcha code on the next page.

Step 11: Now, you have to click on TRACES PDF Converter V 1.5 Light Version to download the utility for converting T.D.S certificate (Form 16A) to PDF.

Step 12: Open the utility, browse and select the zip folder, then enter TAN as the password for the input file. Now, select the folder where you want to save the T D S certificate. Click on Proceed to download TDS certificate PDF in the selected folder.

By completing all the above steps, you can easily download your Tax Deducted at Source Certificate online.

Tax Deducted at Source Certificate is an important document for the taxpayers. It reflects the amount of tax that has been deducted from the deductor's salary or other income sources. Downloading a T.D.S certificate through the TRACES portal is pretty easy. Just follow the steps we explained in this post. Also, make sure you have all the necessary details, such as TAN, PAN, login credentials on TRACES portal, etc.

Need assistance in TDS return filing? Connect with Registrationwala’s tax experts!

Q1. Who is responsible for granting the T.D.S certificate?

A. The deductor (like employer, bank, or any entity deducting TDS) is responsible for providing the T.D.S certificate to the deductee (like employee, vendor, or taxpayer).

Q2. Can I download my TDS certificate without a TRACES account?

A. No, you need to have an account on the TRACES portal to download your T D S certificate. If you don’t have one, you need to register first. You can only download the certificate after logging in.

Q3. How long does it take for the TDS certificate to be available for download?

A. Once the request is submitted, it generally takes 24 - 48 hours for the T D S certificate to be available for downloading. You can check the request status on the TRACES portal. Once the status is ‘available’, you can download the certificate.

Q4. What should I do if my T D S certificate download fails?

A. While downloading the certificate, you need to make sure that your internet connection is stable and verify your KYC details. Also, check if the request status on TRACES is marked as ‘available.’ If you still face issues, you should contact TRACES customer support.

Q5. What are the consequences of not issuing a TDS certificate on time?

A. If a deductor fails to issue the TDS certificate within the prescribed deadline, a penalty of Rs. 100 per day per certificate will be levied. However, the total penalty cannot exceed the TDS amount deducted for that quarter.

🚀 Try Our Free TDS Calculator Tool

I’m Manish Kumar, a content management specialist. I simplify complex financial and regulatory topics into clear, insightful content. As a regular contributor to the Registrationwala portal, I provide updates on finance, Tax, government schemes, compliance, and other incorporation information. My goal is to keep you informed about key industry developments and their impact.

Want to know More ?