Get a Quote

Get a Quote and Find Services to Fit Your Needs 50000+ Satisfied Clients

5000+ Licenses & Registration

15 Branches across India

75 Years + Combined experience

Preface: This post was originally published in 2022 and has been updated on July 30, 2025, to provide you with the most current and accurate information.

A Company Secretary (CS) is an individual who is well-versed in corporate governance, and is appointed by a company to ensure compliance with legal and regulatory requirements. They help the company to be in the good books of the government. Supervised by the ICSI, their role is way more than just paperwork. They act as advisors to the owners and board of directors and make sure the company operates within the legal and ethical boundaries.

In this article, we shall explain the role of CS in a company. If you are a student aspiring to become a CS or if you run a company and are considering hiring a CS, this blog post is for you!

A Company Secretary is a key managerial personnel responsible for ensuring effective administration and sound corporate governance. They assist the company in complying with legal and regulatory obligations and maintaining a positive relationship with the government. Under Section 2(l)(c) of the Company Secretaries Act 1980, a company secretary is defined as a person who is a member of the Institute of Company Secretaries of India.

Here are some key points to know about a CS:

In India, an individual must be qualified and registered with the ICSI to be recognized as a CS.

Only an individual can be appointed as the company secretary. Since only an individual can be an ICSI member, not an artificial person. Neither a firm nor a body corporate can be appointed since entities cannot be ICSI members.

A CS should not hold office in more than one company, except in its subsidiary company simultaneously.

A CS should perform all duties which are laid down in the Companies Act.

They should also perform ministerial and administrative duties which may be assigned to them.

A CS must possess the qualifications prescribed by the Central Government from time to time.

A company secretary is an integral part of a company, so they must check whether the company is complying with the legal provisions or not. If the company activities are not as per the legal provisions, the CS shall be held responsible for the misconduct and for that they can be dismissed. Mentioned below are some points that explain the role of a CS:

An essential role of a CS is to incorporate the company and authenticate the documents. Also, they share all the details with the registrar including the application for an increase in capital. Moreover, they keep records of share warrant holders, file annual returns, and sign financial statements and reports for authentication.

It is the duty of CS to check that income tax is deducted at source from the dividends and interests payable and from the salaries of employees. They also check that income tax returns are filed, within the prescribed timeframe, with the income tax authority.

A CS must check that every legal document like letter of allotment, share certificate, transfer form, share warrant, debenture certificate, mortgage and charges, hundis, promissory notes, etc., is affixed with a stamp of the requisite amount, as per the Indian Stamp Act.

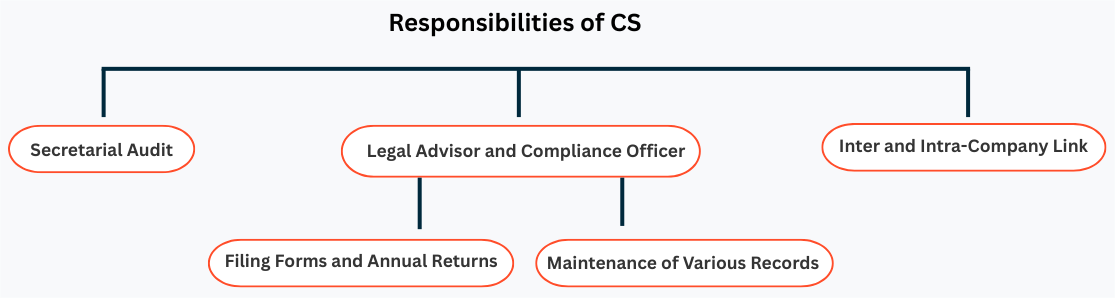

The following are the responsibilities of a company secretary:

In a company secretarial audit, the CS is the one who verifies whether the company is complying with certain guidelines mentioned in the memorandum of the company or not. For the smooth monitoring and functioning of the organization complying with the set standards is required.

This company secretary function falls under Section 204 of the Companies Act, 2013. It's not merely a role; the Act clearly states that it is the duty of the CS to perform such audits of listed and prescribed companies.

A Company Secretary acts as a channel of communication between the Board of Directors, investors, and authorities responsible for regulation and functioning. They are not just a link between various entities in the company, they also serve as guides who advise the directors and the chairman on their roles and powers in the company.

Since a CS is well versed in the laws of the company, they often provide legal advice to the executives. And once the matter goes to a court of law, they guard the rights of the company by seeking legal advice from those who have a command over the subject.

As a compliance officer, a CS expected to adhere to certain legal aspects which include the following:

A CS cross-verifies the legal necessities needed for all the paraphernalia related to share certificates such as their issuance, transfer etc, as they discuss various matters with the chairman and the board of directors. They help and advise the company on how to implement certain guidelines effectively.

A CS also acts as a liaison between various shareholders and the company to achieve mutual benefits. In the company secretarial roles, they oversee the timely flow of dividends in accordance with the laws enshrined in the company's memorandum.

While a CS does mostly legal work and oversees various issues related to it, they also have to maintain records and information of members, directors, shares, investors, etc.

The role of a CS is of utmost importance, particularly for large organizations that require support in ensuring legal compliance and effective corporate governance. Company Secretaries play a crucial role in helping these organizations maintain their compliance and uphold their brand reputation.

Q1. Is it mandatory for a company to appoint a CS?

A. Yes, it is mandatory for a company to appoint a CS if it is a private ltd company with a paid up share capital of Rs. 10 cr. or more, or a public ltd company with a paid up share capital of Rs. 10 cr. or more, or a listed company (regardless of paid up capital).

Q2. Do LLPs need to appoint company secretaries?

A. No, the LLPs do not need to appoint company secretaries.

Q3. Which Act governs the profession of CS in India?

A. The Company Secretaries Act 1980 governs the profession of CS in India.

Q4. Do listed companies need to appoint a whole-time CS?

A. Yes, all the listed companies are required to appoint a whole-time CS as a mandatory obligation under Section 203 of the Companies Act 2013.

Hey there, I'm Dushyant Sharma. With the extensive knowledge I've gained in past 8 years, I have been creating content on various subjects such as banking, insurance, telecom, and all the important registration and licensing processes for various companies. I'm here to help everyone with my expertise in these areas through my articles.

Want to know More ?