Get a Quote

Get a Quote and Find Services to Fit Your Needs 50000+ Satisfied Clients

5000+ Licenses & Registration

15 Branches across India

75 Years + Combined experience

Preface: This post was originally published in 2019 and has been updated on June 24, 2025, to provide you with the most current and accurate information.

MSME Form-1 is related to Micro and Small Enterprises (not Medium). However, it is not the MSEs themselves who are required to file this form. Instead, it must be filed by companies that have received goods or services from Micro or Small Enterprises and have outstanding payments due to them for more than 45 days. In this blog post, we shall discuss everything you need to know about MSME Form-1.

MSME Form-1 is a half-yearly return issued by the Ministry of Corporate Affairs (MCA). The MCA mandates that companies are required to file this form to disclose their outstanding payments to MSME suppliers if the payments exceed 45 days from the date of acceptance or deemed acceptance of goods/services.

MCA introduced the MSME 1 Form on 22 January 2019 with the intention of strengthening the provisions of MSME Development Act 2006. This MSME form's main goals are to monitor businesses who owe MSMEs money and make sure MSME suppliers are paid on time.

MSME Form-1 is applicable to certain companies to report any pending payments to Micro and Small Enterprises (MSEs) that have been due for more than 45 days. It’s not about all companies or all payments and only those where the supplier is registered under the MSME Act 2006, and the payment has crossed the allowed time frame.

Before filing, companies are expected to check whether their suppliers fall under the MSME category as per the Act. If a registered MSME has supplied goods or services and hasn’t been paid within 45 days, the buyer company is required to file MSME Form-1 with the Registrar of Companies (ROC), Ministry of Corporate Affairs (MCA).

This requirement stems from the MSME Development Act 2006, which aims to protect small businesses from delayed payments by setting limits on credit periods and allowing for penalties on late payments. According to Section 15 of the Act, buyers must pay suppliers either by the mutually agreed date or if no such date exists, then within 15 days from the date the goods/services were accepted. In any scenario, the payment period must not exceed beyond 45 days from the acceptance date.

It’s important to note that companies are only required to file MSME Form-1 when there are dues that are pending beyond the 45 days timeline. If there are no such outstanding payments, companies are not required to file any ‘Nil’ return.

The following are the MSME 1 Form filing details that you must fill accurately before you file the form with the Registrar of Companies (ROC):

Corporate Identification Number (CIN) of the company.

Permanent Account Number (PAN) of the company.

Name, registered address and e-mail ID of the company.

Name and Permanent Account Number (PAN) of the suppliers.

Total outstanding amount payable for the supply of goods/services.

Date from which the payment has been due.

Reason for the delay in making the payment.

Here is how you need to fill the MSME Form-1:

Step 1: Start filling the form by entering key company details like the Corporate Identification Number (CIN), Global Location Number (GLN) and Permanent Account Number (PAN).

Step 2: Now, you need to fill in certain basic company information, including its name, registered address and email ID.

1.png)

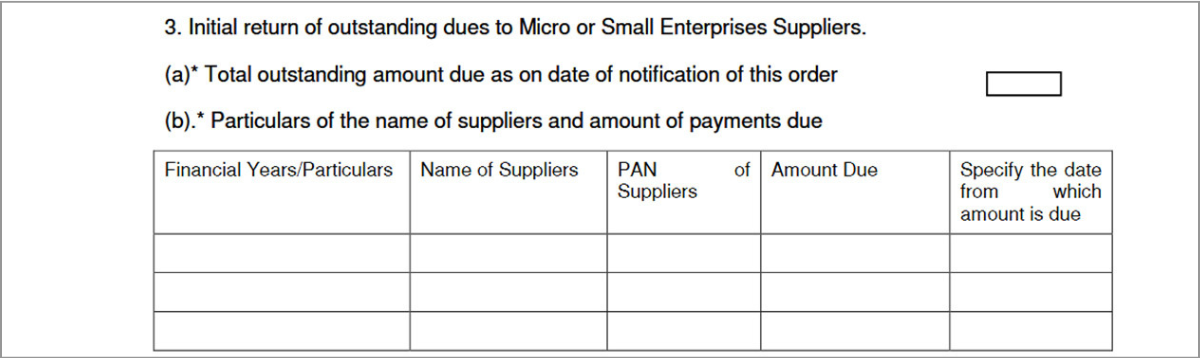

Step 3: Thereafter, you must provide details of any initial returns related to outstanding payments to MSE (Micro and Small Enterprise) suppliers.

Step 4: Enter regular return data showing pending dues to MSE suppliers.

.jpg)

Step 5: Mention the reasons for any delay in clearing the payments.

.png)

Step 6: Now, upload any supporting documents for verification if the same is deemed necessary.

.png)

Step 7: Finally, the director of the company must digitally sign the declaration with Digital Signature Certificate to complete filling the form.

.png)

After following all the above-mentioned steps, your form will be considered as ‘complete’.

If your company fails to file MSME-Form 1, it may be liable to pay a penalty of Rs. 20,000. Additionally, a fine of Rs. 1,000 per day of default can be imposed on the company and its responsible officers, up to a maximum limit of Rs. 3 lakh.

The MSME Form 1 is an MCA form that certain companies must file with the Ministry of Corporate Affairs (MCA) if payments due to micro and small enterprises remain outstanding for more than 45 days from the date of acceptance i.e., date on which goods are delivered or services are rendered by MSME supplier and accepted by the buyer (company). This form applies to all companies registered under the Companies Act, 2013, including private limited companies, public limited companies, and one-person companies.

If you need assistance with filing MSME Form 1, connect with Registrationwala’s MCA compliance consultants. We’ll help you file the form on time and avoid penalties.

Q1. What is MSME 1 Form?

A. MSME 1 Form is a half-yearly return that companies must file with MCA to report any outstanding payments due to Micro and Small Enterprises (MSEs) that exceed 45 days from the date of acceptance.

Q2. Who is required to file MSME Form-1?

A. All companies registered under the Companies Act, 2013 are required to file this form if they have outstanding dues to MSE suppliers beyond 45 days. This includes Private Limited Companies, One Person Companies, Public Limited Companies and others.

Q3. Do MSMEs need to file MSME Form 1?

A. No, contrary to popular belief, it is not the MSMEs who need to file this form. Instead, it is the companies that have outstanding dues toward registered MSEs that are required to file MSME-Form-1.

Q4. What is the penalty for non-filing of Form MSME-1?

A. If a company fails to file MSME Form-1, it can face a penalty of Rs. 20,000. Additionally, a fine of Rs. 1,000 per day of continued default may apply, with the total penalty capped at Rs. 3 lakh.

Q5. Is it mandatory to have a Digital Signature Certificate to file Form MSME-1?

A. Yes, a valid Digital Signature Certificate of the authorized director is mandatory for filing MSME Form-1 via MCA portal.

Hey there, I'm Dushyant Sharma. With the extensive knowledge I've gained in past 8 years, I have been creating content on various subjects such as banking, insurance, telecom, and all the important registration and licensing processes for various companies. I'm here to help everyone with my expertise in these areas through my articles.

Want to know More ?