Get a Quote

Get a Quote and Find Services to Fit Your Needs 50000+ Satisfied Clients

5000+ Licenses & Registration

15 Branches across India

75 Years + Combined experience

Last Updated on November 28, 2025

The well-being of your family can be disrupted due to any expected situations. For such scenarios, different types of life insurance policies are available in India that offer comprehensive financial protection to you and the ones close to you.

There are various types of life insurance plans to choose from. But without knowing the characteristics of all the life insurance plans, you cannot judge which one is the most appropriate for you. In this article, we will describe the different types of life insurance plans available in India.

A life insurance plan is basically a contract between an insurance company and the policyholder. According to the contract, the insurer promises to pay a sum of money in exchange of a premium, upon the demise of the insured or after a set period (as per the contract).

Generally, when it comes to life insurance, most people associate the plan with an untimely death. However, that’s not all there is to such a plan. There are various kinds of life insurance plans and each one of these plans serve the different needs of individuals and help them to avail 360-degree financial protection.

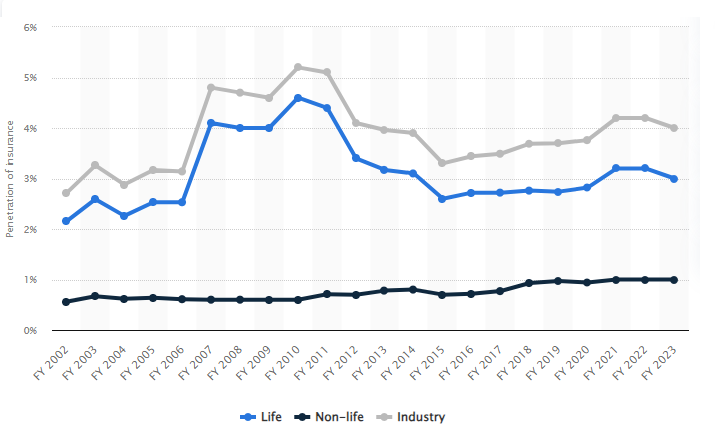

According to Statista, India's insurance penetration stood at 4 percent, with the majority coming from the life insurance sector, in the financial year 2023.

We have described below the major types of Life Insurance Plans along with their examples to help you understand these plans easily.

Term insurance plans protect the financial future of your family in case something happens to you. These plans are simple and affordable plans which provide financial coverage, and are an essential part of financial planning for someone who is the family’s breadwinner.

Term insurance plans are not market-linked, and are pure protection plans. The premiums for these plans are lower as compared to other life insurance plans. Premiums are more affordable for these plans when you purchase them in your early stages of life. Many IRDA-licensed Insurance Agents suggest that the term plan should be an individual’s utmost priority as soon as they start earning.

The financial coverage offered under a term insurance plan can be utilized in many ways. In case of the income’s absence, a family can use the cover for their day-to-day essentials, education fees or expenses related to wedding. In case of any outstanding debts, such as home loan and vehicle loan, the family can pay them off using the financial cover provided as per the term insurance policy.

Some insurance companies provide the insurers the option to add riders in term plans, including critical illness coverage which provides funds for the treatment of specified critical diseases, and accidental death benefit which is paid over and above the sum assured in the unfortunate event of death due to an accident.

These riders can provide you and your family with an extra layer of protection with just a nominal increase in the premiums.

To understand the term insurance, let’s take an example. A 26-year-old man called Ramesh wants a term insurance of Rs. 1 crore till she turns 60. She buys an Insurance Company’s term insurance plan wherein she has to pay an annual premium of Rs. 10,000 for a term of 35 years. In addition to this, she also buys Rs. 50 lakhs accidental death cover for which she pays an additional premium of Rs. 2,000. So, the total premium for this comprehensive package would be 12,000 a year.

Retirement plans are customized to enable individuals to build a corpus for their post-retirement life. These plans assist the individuals to gain financial independence in their non-working days. With the help of a retirement plan, individuals can save and invest for the long-term.

These plans offer the potential to accumulate a significant amount of wealth. Since the retirement insurance plans also provide the benefits of insurance, the policyholders can ensure financial security for their loved ones. These plans give individuals the opportunity for getting better returns.

Let’s understand how a retirement insurance plan works using an example. Radhika, a 46-year-old lady, purchases a retirement insurance plan. She pays a premium of Rs. 10,000 every month.

This policy offers life insurance coverage as well as a cash value component. As Radhika continues the premium payment, the policy’s cash value increases. By the time she reaches the retirement age of 60, the accumulated cash value could provide her with a significant amount of funds through which she can support her post-retirement lifestyle. Additionally, in the unfortunate event of her demise, the plan would pay out a death benefit to the nominee(s).

A united linked insurance plan, or ULIP, is a plan which combines the benefits of insurance and investment. This plan provides life cover that offers financial protection to your close family. Moreover, it also gives you the potential for generating wealth through market-linked returns from systematic investments. ULIP provides the individuals the opportunity to invest their savings in different fund options as per their risk tolerance.

It is necessary to mention that ULIPs have a lock-in period of 5 years. The funds can be invested in equities, bonds, hybrid funds, and so on. For those who are looking for safer options, bonds would be a good option. Whereas, for individuals with a higher risk appetite, hybrid funds and equities can be a better option since they have the potential to offer higher returns.

ULIPs allow individuals to be flexible in their investments, since every individual has different requirements, objectives and budget. With age, your risk appetite might increase or decrease and your taste in investments might also change. ULIPs enable individuals to take these factors into account and accordingly, alter their investment strategy. In addition to this advantage, ULIPs also provide flexibility when it comes to partial withdrawals and fund-switching.

These plans come with multiple benefits such as loyalty additions and wealth boosters which allow you to generate more wealth with time.

Let’s understand how ULIP works using an example. Rajeshwari is a 30-year-old female who purchased a ULIP policy for a term of 20 years. She decided to pay Rs. 5,000 every month as a premium for a period of 20 years. The life cover for this plan was Rs. 3.6 lakhs. On maturity, she will get returns based on the performance of funds she had invested in.

This means that the maturity benefit at a 4% return would be Rs. 9.05 lakhs and at an 8% would be Rs. 13.9 lakhs. In case of the unfortunate event of Rameshwari’s death, her nominee would receive the death benefit as a lump sum payout.

Child insurance plans allow the parents, grandparents or guardians to build a corpus for the future of their little ones. With the help of these plans, you can build a significant sum for your child’s future education and wedding expenditure.

A child plan provides maturity benefits as a one-time payout after the child turns 18 or in the form of annual installments. For the parent, there is an in-built coverage in this plan. Child insurance plans offer immediate payment, if the insured parents passes away due to an unfortunate event, to cover the expenses of the child.

This plan allows the parent to choose how and where the money gets invested. You get to choose where your premium is invested (from options such as equity, debt and balanced funds). Child plans also offer loyalty additions and wealth boosters which add up to your overall savings.

In addition to this, you are given the choice to either pay regular premiums or a single premium, depending on your capacity. Child insurance plans enable you to get wider coverage with critical illnesses and accidental death benefits.

Let’s take an example to understand how a child insurance plan works. Rina is a 35-year-old married woman, who recently became a mother. She decided to invest in a child insurance plan for her child. She opted for premium payment of Rs. 5,000 on a monthly basis, for a policy period for 18 years. At an expected return of 4%, she would be eligible for getting Rs. 15.83 lakhs after the maturity of the policy i.e., after 18 years.

An endowment plan is ideal for an individual that wants guaranteed returns along with the protection provided by a life insurance. An endowment plan is a life insurance plan which offers life coverage as well as the opportunity for regular savings.

As part of this plan, the policyholder receives a lump sum amount upon the plan’s maturity. In case of the unfortunate demise of the policyholder during the policy term, the nominee receives a death benefit.

Endowment plans are flexible in nature. You can select the appropriate method and time frame for the premium payment. These plans offer bonuses which are paid additionally over and above the sum assured on your policy.

Let’s understand how an endowment insurance plan works using an example. Rakeshwar is a 32-year-old fellow who has purchased an Endowment Insurance Plan for a policy term of 20 years, and a premium paying term for 10 years. He pays the premium on an annual basis which costs him Rs. 30,000, and carries a sum assured of Rs. 3 lakh. At a 4% return, his estimated maturity benefit would be approx. Rs. 4.5 lakhs, inclusive of guaranteed additions and terminal bonuses.

When it comes to money back plans, this kind of life insurance policy provides the insured a percentage of sum insured at steady intervals. As you save regularly, this plan rewards you regularly. Simply put, a money back plan is basically an endowment plan which offers the benefit of increased liquidity with systematic payouts.

The short-term goals of an individual can be met through money back plans. The feature of ‘money back’ can add to your monthly or annual income. Money back plans also offer maturity benefits, which means that the individuals get a lump sum payout at maturity which can be helpful in securing the future of these individuals and their families.

The insurance element of these kinds of plans allow individuals to lead a peaceful life, without any stress. Money back plans help to secure the financial future of the breadwinner’s family, in their absence. Therefore, the individuals get all-round protection for themselves and their families.

The lump sum amount will be received by the individual’s family in case of the unfortunate event of death. If the individual survives the term of the money back plan, they are eligible for regular payouts along with lump sum benefits. Money back plans offer flexibility and the subscribers can choose how they pay the premium depending on their suitability.

Let’s take an example to learn how the money plan works. Raghu is a 34-year-old employee who was recently blessed with a child. He understands the responsibilities toward his child’s education and wants to protect him against any unforeseen tragedies. Hence, he chooses to purchase a money back plan for which he pays a premium of Rs. 50,000 annually for a paying term of 10 years. His policy includes a maturity benefit of Rs. 2.64 lakh, and additional bonuses of Rs. 1.08 lakhs at 4% return which can be used for his child’s education. For the next 20 years, Raghu can also benefit from the life cover of Rs. 5 lakhs for himself.

Whole life insurance plans offer life coverage up to 99 or 100 years. Unlike other life insurance policies which have a shorter term of 10-30 years, whole life insurance plans’ long coverage period ensures protection for your family for an extended time period.

Due to the coverage for a long period of time, whole life insurance plans are ideal for those who are in their old age but still have financially dependent family members. Not only does this kind of insurance plan provide lifelong protection to the insured, it also provides a simple way to leave behind a legacy for the ones closest to them i.e., their children.

Under these plans, a lot of stability is offered to the policyholders. Upon the premium payment for 5 years, they’re eligible for a guaranteed income on maturity. In case of the policyholder’s death, the nominee(s) receive the benefits of the policy, which include a bonus for the total premiums paid.

To understand how a whole life insurance plan works, let’s take an example. A 45-year-old man Radheshyam buys Rs. 1 crore policy by paying Rs. 80,000 every year. Over the next 20 years, the cash value might go up to Rs. 25 lakhs. Radheshyam can borrow against this for his daughter’s education or wedding expenditure. Later, when he passes away at age of 79, his wife Rita receives the full Rs. 1 crore amount as per the policy. The cash value growth essentially offsets years of premiums while leaving a lasting legacy.

Life insurance plans combine the benefits of savings and protection. We have mentioned the benefits of life insurance plans, so that you can understand why they are necessary for your financial portfolio:

Choosing life insurance is a delicate act, and the individuals interested in purchasing policies need all the help they can. When an individual purchases a life insurance plan for the first time, it is important for them to get proper guidance about all the best plans available for them. Such guidance can be provided by an entity with an Insurance Broker License. Interested in obtaining this license for your business? Get in touch with Registrationwala.

Q1. What is a life insurance plan?

A. A life insurance plan is an agreement where the insurance company pays a sum of money to your family in return for the premium you pay. This payout happens either after your death or after the policy term ends.

Q2. Why do I need a life insurance plan?

A. Life insurance helps protect your family financially in case something happens to you. It also helps you save for future goals like retirement, your child’s education, or buying a house.

Q3. What is a term insurance plan?

A. A term plan gives financial protection to your family if you pass away during the policy term. It is the most affordable and simplest form of life insurance.

Q4. What is a retirement insurance plan?

A. Retirement plans help you save gradually for your post-retirement life. They offer life cover plus a fund that you can use after retirement.

Q5. What is a ULIP?

A. A ULIP gives both life insurance and investment benefits. Your premium is partly used for life cover and partly invested in funds like equity, debt, or hybrid funds.

Q6. What is a child insurance plan?

A. A child plan helps you save for your child's future needs such as education or marriage. It also ensures financial support for your child if something happens to you.

Disclaimer: This article is meant for educational purposes only, and the author does not recommend any insurance plans/policies. It is completely up to the readers to decide the plans/policies they want to opt for. Additionally, the examples mentioned for various

Hey there, I'm Dushyant Sharma. With the extensive knowledge I've gained in past 8 years, I have been creating content on various subjects such as banking, insurance, telecom, and all the important registration and licensing processes for various companies. I'm here to help everyone with my expertise in these areas through my articles.

Want to know More ?