Get a Quote

Get a Quote and Find Services to Fit Your Needs 50000+ Satisfied Clients

5000+ Licenses & Registration

15 Branches across India

75 Years + Combined experience

In India, Permanent Account Number (PAN) and Aadhaar Card are two important documents required for financial transactions, filing of taxes, and various other purposes. Recently, the Indian government has made it mandatory to link Aadhaar with PAN before its last date to streamline the tax filing process and eliminate tax evasion. The deadline for linking PAN and Aadhaar is fast approaching, and individuals who fail to link the two documents by the deadline may face penalties and fines. In this blog, we will guide you on linking your Aadhaar number with a PAN card online before the deadline and linking these two important documents.

The Government has granted more time to the taxpayers by extending the date for linking PAN and Aadhaar to 30th June 2023. During this extended period, people can submit their Aadhaar details to the Authority for Aadhaar-PAN linkage. Such a move won't invite any repercussions during the extended period.

If taxpayers do not have their PAN linked with Aadhar even on and before June 30, 2023, then their PAN card will become inoperative. Having an expired PAN card can have the following consequences for the ex-cardholder:

Here, the PAN can be made operative again in 30 days but after the fee payment of one thousand rupees.

Aadhaar is a 12-digit unique identification number issued by the Unique Identification Authority of India (UIDAI) to Indian citizens. On the other hand, PAN is a ten-digit alphanumeric number issued by the Income Tax Department. The Aadhaar-PAN card linkage is essential for various transactions, namely:

The cardholders can easily file their income tax returns by linking their Aadhaar and PAN cards before the last dates. This PAN-Aadhaar linkage enables the government to accurately determine taxpayers' taxable income, making the process more efficient for the general masses.

The online PAN-Aadhaar Link reduces tax fraud possibility by verifying your identity. It also prevents the creation of multiple PAN cards under the same name.

Linking your Aadhaar with a PAN card before its deadline can be beneficial in various ways. The linkage provides access to Government Services requiring Aadhaar authentication, such as the following:

The Government mandates such linkages, and if someone’s Aadhaar card is not linked to his or her PAN, then he or she can be charged up to Rs. 10,000 as per the Income Tax Act.

People can ensure a smooth refund procedure by linking their Aadhaar Card with their PAN card before the last date. Such steps ensure you receive refunds on time and with limited issues.

Section 139AA of the Income Tax Act states that anyone in possession of a Permanent Account Number as of July 1, 2017, and with eligibility for an Aadhaar card procurement must notify their Aadhaar in the prescribed format. It simply means that the individuals must link their PAN card with their Aadhaar before the submission date.

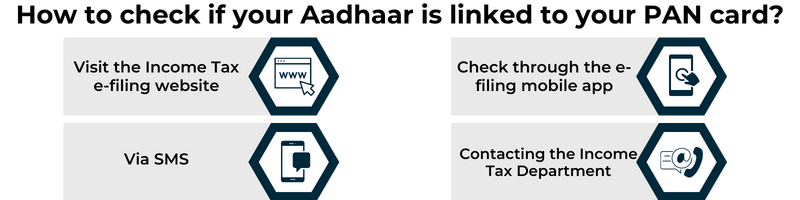

There are multiple ways to verify if your Aadhaar is linked to your PAN card online or not:

Go to the e-filing website of the Income Tax Department, click on the 'Link Aadhaar' option under the 'Quick Links' section, and enter your PAN and Aadhaar details to verify if they are linked.

Send an SMS to 567678 or 56161 with the following message: UIDPAN <SPACE> <12-digit Aadhaar> <SPACE> <10-digit PAN>

Example: UIDPAN 123456789012 RKDLS3241S

Download the e-filing mobile app of the Income Tax Department, log in using your PAN and Aadhaar details, and check the Aadhaar-PAN linking status.

You can call the Income Tax Department toll-free number at 1800-180-1961 or email them at 'ask@incometaxindia.gov.in, to check the status of your Aadhaar and PAN card linking before the last date.

The deadline for PAN-Aadhaar linking has been extended several times and has been extended to June 30, 2023, from its earlier deadline of March 31, 2023. However, those who missed the original deadline will now face a penalty of Rs.1,000 when linking PAN and Aadhaar.

Moreover, the government has also warned individuals that PAN cards that are not linked with Aadhaar may become inoperative and may cause difficulties while carrying out financial transactions.

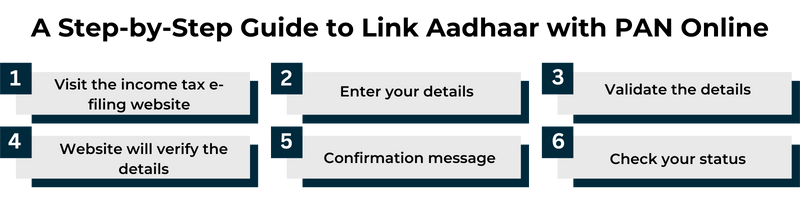

Linking Aadhaar with PAN is simple; individuals can link the two documents online. Here are the steps to link an Aadhaar card with a PAN card online before the last date:

Step 1: Visit the Income Tax e-Filing portal at www.incometaxindiaefiling.gov.in

Step 2: Click on the "Link Aadhaar" option on the homepage.

Step 3: Enter your PAN number, Aadhaar number, and name as per Aadhaar.

Step 4: If your Aadhaar card has only the year of birth mentioned, then tick the box "I have only the year of birth on the Aadhaar card."

Step 5: Enter the captcha code and click on the "Link Aadhaar" button.

Once the Aadhaar and PAN are linked, a confirmation message will be displayed on the screen. If the Aadhaar and PAN details do not match, individuals must update their details in the Aadhaar or PAN database.

If you do not link your Aadhaar Card with your PAN Card before the deadline, it may become challenging to file an Income Tax Return (ITR), as the Aadhaar Card number must be included in the ITR. Such a move can face rejection for filing the ITRs by the Income Tax Department. It further prevents the individual from filing their ITR as well as hinders their reception of a tax refund.

If one fails to link their PAN Card with Aadhaar Card, it can become difficult for them to access government services, such as the following:

Each such service requires the submission of both these imperative cards.

Any failure by the cardholder to link the PAN Card and the Aadhaar Card before the deadline can attract a penalty of Rs. 10,000 as per the IT Act regulations. If you don’t apply for card linkage by June 30, 2023, the IT Department will render your PAN Card inoperable. Therefore, linking your PAN Card and Aadhaar Card before the deadline is essential for any case.

After linking your Aadhaar number with your PAN card, you can easily file your income tax returns online. Here is the procedure for e-filing your income tax returns:

Step 1: Visit the Income Tax Department website (https://www.incometaxindiaefiling.gov.in/home) and log in using your PAN number and password.

Step 2: Click on the "Income Tax Return" option.

Step 3: Select the assessment year you want to file your return.

Step 4: Fill in the necessary details and click on the "Submit" button.

Step 5: After submitting your return, you will receive an acknowledgment from the Income Tax Department.

While linking an Aadhaar number with a PAN card is straightforward, some individuals may face challenges due to discrepancies in their Aadhaar or PAN data. In such cases, individuals must rectify the errors before proceeding with the linking process. The deadline for linking the Aadhaar number with a PAN card is approaching. By linking your Aadhaar number with a PAN card before the last date, you can enjoy the benefits of easy e-filing of income tax returns, eliminating the need to submit multiple documents and curbing tax evasion. If you're facing any challenges in the linking process, Registrationwala can help you. Don't wait any longer; now, link your Aadhaar number with your PAN card.

Hey there, I'm Dushyant Sharma. With the extensive knowledge I've gained in past 8 years, I have been creating content on various subjects such as banking, insurance, telecom, and all the important registration and licensing processes for various companies. I'm here to help everyone with my expertise in these areas through my articles.

Want to know More ?